Transferring shares in a company might seem like a complex legal process, but it doesn’t have to be. Whether you’re a seasoned investor or a small business owner, understanding the fundamentals of share transfers is crucial. This article will guide you through the process, highlighting the importance of a well-drafted agreement and offering insights into how a simple share transfer agreement template can simplify the procedure.

Think of a share transfer agreement as the roadmap for transferring ownership. It outlines the terms and conditions under which shares are being moved from one party to another. Without a clear agreement, you could face disputes, legal complications, and potential misunderstandings down the line. Therefore, a robust agreement is essential for protecting your interests and ensuring a smooth transaction.

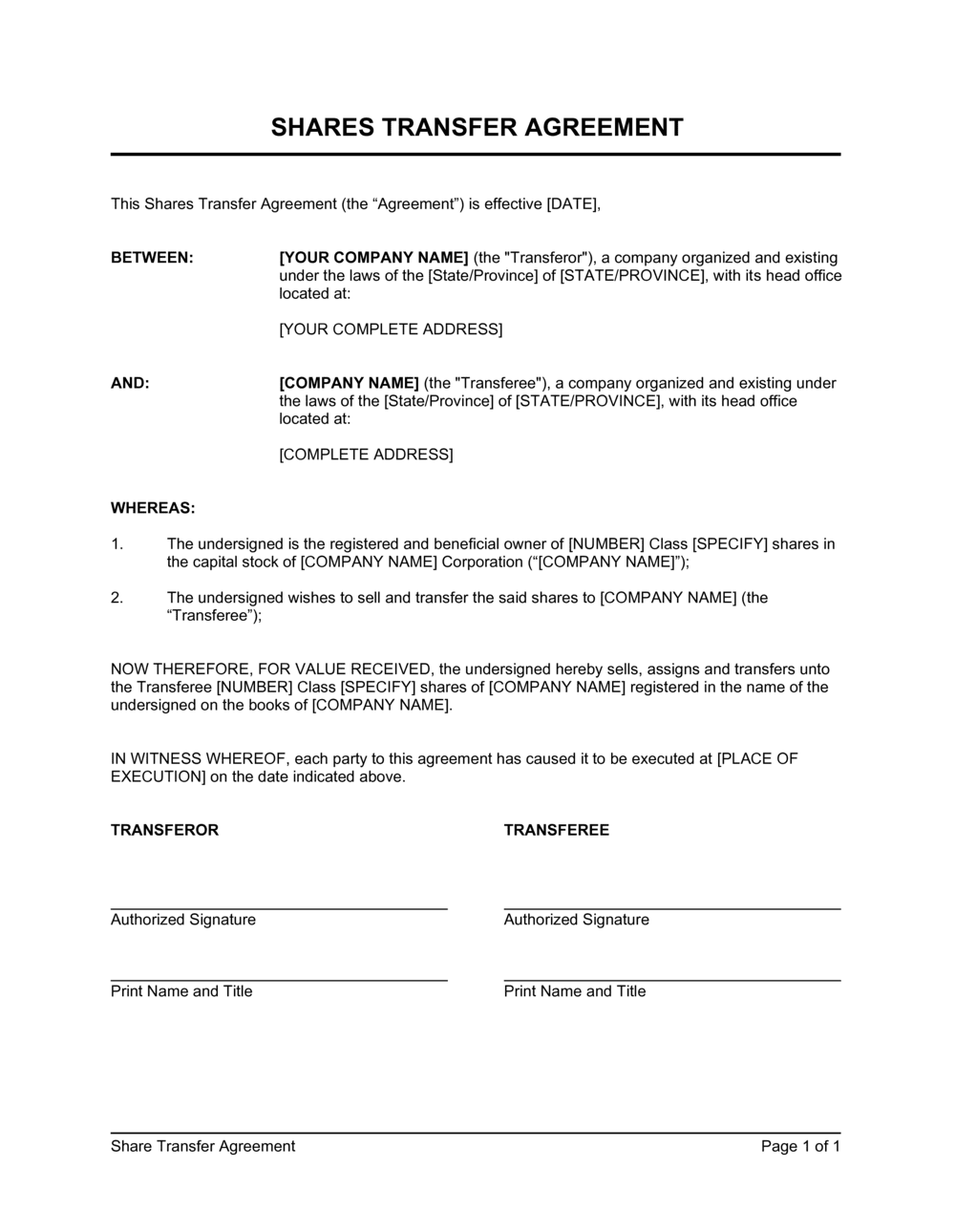

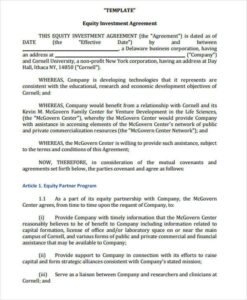

Fortunately, you don’t need to be a legal expert to create a solid share transfer agreement. A simple share transfer agreement template can be an invaluable resource. It provides a framework, covering essential elements such as the parties involved, the number of shares being transferred, the price, and the date of the transfer. Using a template can save you time and money while minimizing the risk of errors. Let’s delve deeper into the world of share transfer agreements and explore how you can use a template effectively.

Understanding the Essential Elements of a Share Transfer Agreement

A share transfer agreement, at its core, is a legally binding contract that documents the transfer of shares from a seller (the transferor) to a buyer (the transferee). It’s more than just a formality; it’s a comprehensive record that protects both parties involved. Understanding the key components of this agreement is crucial for a successful and legally sound transaction. A well-constructed agreement minimizes potential disputes and provides clarity for all stakeholders.

One of the most important elements is clearly identifying the parties involved. This includes the full legal names and addresses of both the transferor and the transferee. Additionally, the agreement must accurately describe the shares being transferred. This involves specifying the number of shares, the class of shares (e.g., common or preferred), and the company issuing the shares. Ambiguity in these details can lead to legal challenges later on. Always double-check the information to ensure its accuracy.

Furthermore, the agreement must stipulate the consideration, which is the price the transferee is paying for the shares. This should be a specific monetary amount or another agreed-upon form of compensation. Payment terms, such as the method of payment and the payment schedule, should also be clearly outlined. This leaves no room for misinterpretation and ensures both parties understand their obligations.

The transfer date is another crucial component. This is the date on which the transfer of ownership officially takes place. The agreement should also address any warranties or representations made by the transferor about the shares. For example, the transferor might warrant that they have the full right and authority to transfer the shares and that the shares are free from any encumbrances or liens. These warranties provide the transferee with assurance and recourse in case of any misrepresentation.

Finally, the agreement should include provisions for governing law and dispute resolution. This specifies the jurisdiction whose laws will govern the agreement and the method for resolving any disputes that may arise, such as through arbitration or litigation. By addressing these essential elements, a share transfer agreement provides a solid foundation for a smooth and legally sound transfer of shares. Using a simple share transfer agreement template can significantly aid in ensuring all these critical elements are covered.

Key Considerations When Using a Simple Share Transfer Agreement Template

While a simple share transfer agreement template provides a great starting point, it’s important to understand that it’s not a one-size-fits-all solution. Each share transfer is unique, and your agreement should be tailored to the specific circumstances of the transaction. Think of the template as a framework that you can customize to fit your needs. Failing to do so can lead to overlooking crucial details and potentially jeopardizing the validity of the agreement.

Firstly, carefully review the template and ensure that all sections are applicable to your situation. Some templates may include clauses that are not relevant to your transaction, while others may omit important considerations specific to your company or the type of shares being transferred. It’s crucial to identify these gaps and make the necessary adjustments.

Secondly, pay close attention to the details. Even minor inaccuracies can have significant legal consequences. Double-check all names, addresses, share details, and financial information to ensure their accuracy. If you’re unsure about any aspect of the agreement, consult with a legal professional. They can provide guidance and help you ensure that the agreement accurately reflects your intentions.

Consider any specific clauses that may be necessary for your transaction. For example, if there are any restrictions on the transfer of shares outlined in the company’s articles of association, these should be reflected in the agreement. Similarly, if there are any conditions precedent to the transfer, such as obtaining consent from other shareholders or regulatory bodies, these should be clearly stated. A comprehensive agreement anticipates potential issues and addresses them proactively.

Finally, remember that the agreement should be signed by both the transferor and the transferee in the presence of a witness. This adds an extra layer of security and ensures that both parties are aware of the terms of the agreement. A properly executed agreement is essential for its enforceability. By carefully considering these factors, you can ensure that your share transfer agreement is both effective and legally sound, providing peace of mind for all parties involved.

Transferring shares doesn’t have to be daunting. With a basic understanding and the help of a readily available tool, you can confidently navigate the process. Take your time, seek advice when needed, and ensure that your agreement accurately reflects the intentions of all parties involved.

By taking a careful and considered approach, you can ensure that your transfer proceeds smoothly and without any unexpected complications. A little planning and attention to detail can make all the difference in safeguarding your interests and achieving a successful outcome.