Ever been in a situation where you’re lending money to a friend, providing services to a client, or selling something valuable? While trust is important, a little paperwork can go a long way in protecting everyone involved. That’s where a simple payment agreement template between two parties comes in handy. It’s not about distrust; it’s about clearly outlining the terms of a payment, ensuring everyone is on the same page, and preventing potential misunderstandings down the road. Think of it as a roadmap for a smooth financial transaction.

A simple payment agreement acts as a legally sound record of your agreement. It’s a clear declaration of intent, detailing who owes what to whom, when the payment is due, and how it will be made. This written confirmation can be a lifesaver should disagreements arise later. It’s far easier to refer back to a signed document than to rely on potentially fuzzy memories of verbal agreements. Plus, it adds a layer of professionalism to your dealings, whether you’re a freelancer, small business owner, or just helping out a friend.

In the following sections, we’ll break down what a simple payment agreement template should include, why it’s important, and how you can tailor it to suit your specific needs. We’ll walk you through the essential elements, making it easy to create a document that protects your interests and promotes clear communication with the other party. Get ready to navigate the world of payment agreements with confidence!

Why You Absolutely Need a Payment Agreement

Let’s face it: money matters can be tricky. Even the best of relationships can be strained by financial misunderstandings. A written payment agreement serves as a neutral referee, preventing disputes before they even begin. It’s much easier to agree on terms beforehand than to argue about them later. The core benefit of using a simple payment agreement template between two parties is creating clarity and a shared understanding. It minimizes the risk of one party claiming they were unaware of certain payment conditions or deadlines.

Consider this scenario: you’re a freelance web designer working on a website for a new client. You discuss the project scope and payment terms verbally, but nothing is written down. Halfway through the project, the client claims they didn’t realize the price included revisions, leading to a disagreement and potential delays. A payment agreement, clearly outlining the scope of work, payment schedule, and revision policy, would have prevented this situation entirely. It transforms a vague agreement into a concrete, enforceable contract.

Moreover, a payment agreement offers legal protection. While a handshake deal might seem sufficient for small transactions, it lacks the legal weight needed to resolve disputes in court. A well-written agreement can be used as evidence in case of non-payment or breach of contract. It provides a clear record of the agreed-upon terms, making it easier to pursue legal action if necessary. This protection is particularly crucial for businesses, freelancers, and anyone regularly involved in financial transactions.

Beyond legal protection, a payment agreement also promotes professionalism and accountability. It demonstrates that you’re serious about your business dealings and committed to fulfilling your obligations. It also holds the other party accountable for their end of the bargain, ensuring they understand the importance of timely and complete payments. This fosters a sense of mutual respect and trust, strengthening the relationship between the parties involved.

Finally, a payment agreement can help you manage your finances more effectively. By clearly outlining payment schedules and amounts, you can better track your income and expenses, plan your budget, and avoid cash flow problems. It allows you to anticipate future payments and make informed financial decisions. For businesses, this is particularly important for forecasting revenue and managing working capital. Essentially, it puts you in control of your financial future.

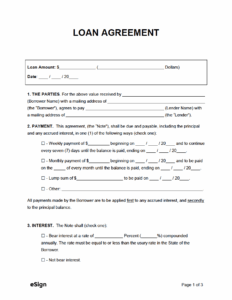

Essential Elements of a Simple Payment Agreement

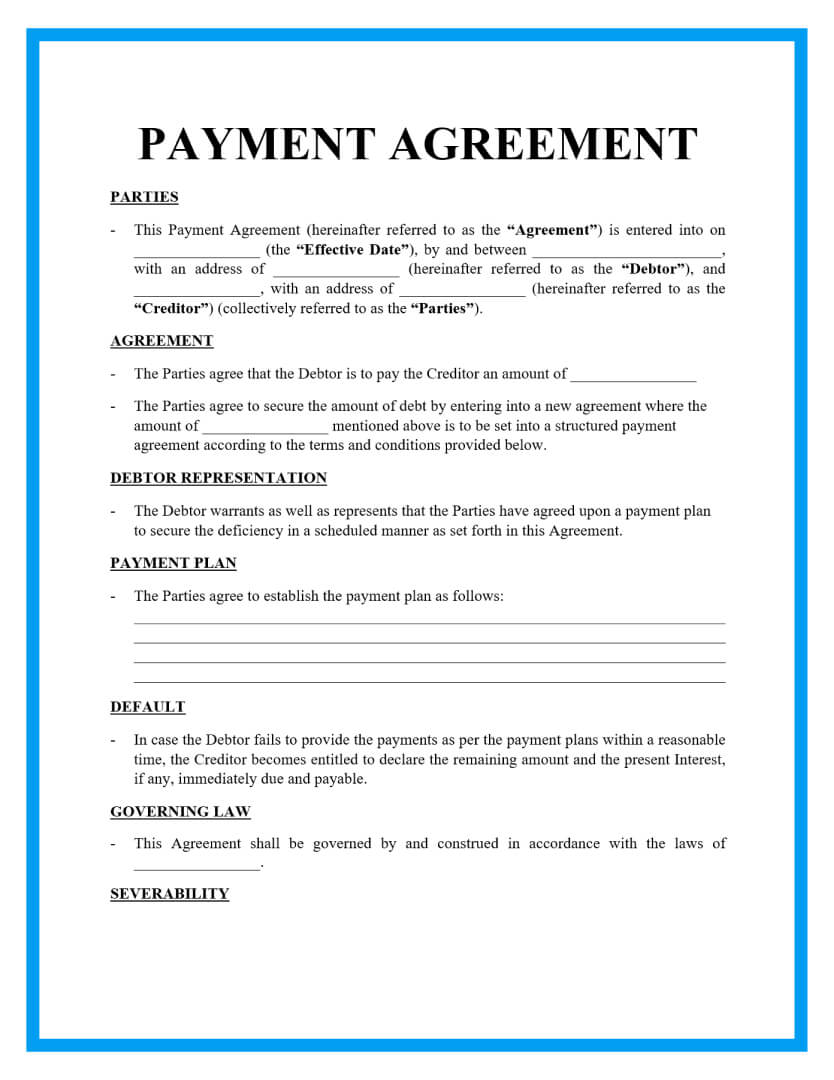

Creating an effective payment agreement doesn’t have to be complicated. Here are the key elements you should always include to make the template comprehensive and legally sound:

Identification of Parties: Clearly state the full legal names and addresses of both parties involved in the agreement. This avoids any confusion about who is obligated to pay and who is entitled to receive payment.

Description of Goods or Services: Provide a detailed description of the goods or services being provided. Be as specific as possible to avoid misunderstandings about the scope of work or the nature of the goods being sold. This should include quantities, specifications, and any relevant details.

Payment Amount: Specify the total amount due, including any applicable taxes or fees. Clearly state the currency being used and any accepted methods of payment (e.g., cash, check, credit card, electronic transfer).

Payment Schedule: Outline the payment schedule, including due dates for each installment (if applicable). Specify whether payments are due in advance, upon completion of the project, or according to a specific timetable. You might also include information about late payment fees.

Late Payment Terms: Define the consequences of late payments. This could include late fees, interest charges, or a suspension of services. Clearly stating these terms incentivizes timely payments and protects your interests.

Termination Clause: Include a clause outlining the conditions under which the agreement can be terminated by either party. This might include non-payment, breach of contract, or other unforeseen circumstances.

Governing Law: Specify the jurisdiction whose laws will govern the agreement. This is important for resolving disputes and ensuring the agreement is enforceable in a particular location.

Signatures: Include signature lines for both parties, along with the date of signing. This signifies that both parties have read and understood the agreement and agree to be bound by its terms.

While this information provides a solid foundation, remember that every agreement is unique. Adapt the template to fit your specific circumstances and consider seeking legal advice if you have any doubts or concerns. A well-crafted payment agreement protects you and fosters a positive business relationship.

Taking the time to create and utilize a simple payment agreement template between two parties is an investment in clear communication and mutual understanding. It can significantly reduce the risk of misunderstandings and financial disputes, leading to more positive and productive relationships.

Ultimately, the goal is to establish a transparent and equitable arrangement that benefits all parties involved. A simple payment agreement isn’t just about legal protection; it’s about building trust and fostering long-term relationships based on mutual respect and accountability.