Ever felt that knot in your stomach when you’re relying on a verbal agreement for a substantial payment? We all have. In the fast-paced world of business and freelancing, a handshake and a promise sometimes just aren’t enough to provide true peace of mind. A written agreement for payment acts like a safety net, clearly outlining the terms of the financial transaction and protecting both parties involved. Think of it as building a solid foundation for a healthy business relationship, one built on trust and clarity.

Using a written agreement template for payment is a smart move. It eliminates ambiguity, reduces the risk of misunderstandings, and provides a legally sound document to refer back to if any disputes arise. No more he-said, she-said scenarios! This template acts as a detailed roadmap, guiding both the payer and the payee towards a smooth and successful transaction. It can be used for almost any situation where a clear outline for payment is needed.

But where do you even begin? Creating a comprehensive payment agreement from scratch can feel daunting. That’s why having a readily available template can be a lifesaver. It provides a framework, ensuring you cover all the essential aspects of the payment arrangement. Let’s dive into the key elements you should always include in your written agreement template for payment to make sure your business stays protected and your cash flow is smooth.

Why You Absolutely Need a Written Agreement Template for Payment

Think about it: in our daily lives, we have written agreements for so many things. From renting an apartment to subscribing to a streaming service, documents lay out expectations and consequences. The same logic applies to any agreement involving a payment. A written agreement template for payment offers clarity and security that verbal agreements simply cannot match. It protects both the person making the payment and the person receiving it, ensuring that everyone is on the same page and understands their obligations.

Imagine agreeing to pay someone for a service, like designing a website. Without a written agreement, there’s potential for disputes over the scope of work, deadlines, or even the final price. What if the designer delivers something completely different from what you envisioned? Or what if you’re a designer and the client refuses to pay after you’ve poured hours into the project? A clear, concise written agreement template for payment can prevent these headaches by clearly defining the project scope, deliverables, payment schedule, and dispute resolution process.

But the benefits extend beyond just avoiding arguments. A well-drafted agreement fosters trust and strengthens the business relationship. When everything is laid out in writing, it demonstrates professionalism and shows that you value the other party’s time and resources. It also streamlines the process, making it easier to track payments, manage invoices, and maintain accurate financial records.

Let’s face it, memory isn’t perfect. Even with the best intentions, people can forget details or misremember conversations. A written agreement serves as a reliable record of what was agreed upon, eliminating the risk of misunderstandings based on faulty recollections. This is especially important in long-term projects or ongoing service arrangements.

In the unfortunate event that a dispute does arise, a written agreement provides solid legal footing. It serves as evidence of the terms of the agreement, making it easier to resolve the issue through negotiation, mediation, or even legal action if necessary. Without a written agreement, it can be incredibly difficult to prove what was agreed upon, leaving you vulnerable to financial loss or legal complications. A written agreement template for payment will save you from so much problems down the road.

Key Elements to Include in Your Written Agreement Template for Payment

A solid written agreement isn’t just a formality; it’s a comprehensive document that addresses all the critical aspects of the payment arrangement. While every agreement will vary based on the specific situation, certain elements are essential to include to ensure clarity, protect your interests, and minimize the risk of disputes. These are the core elements that make up a truly robust agreement.

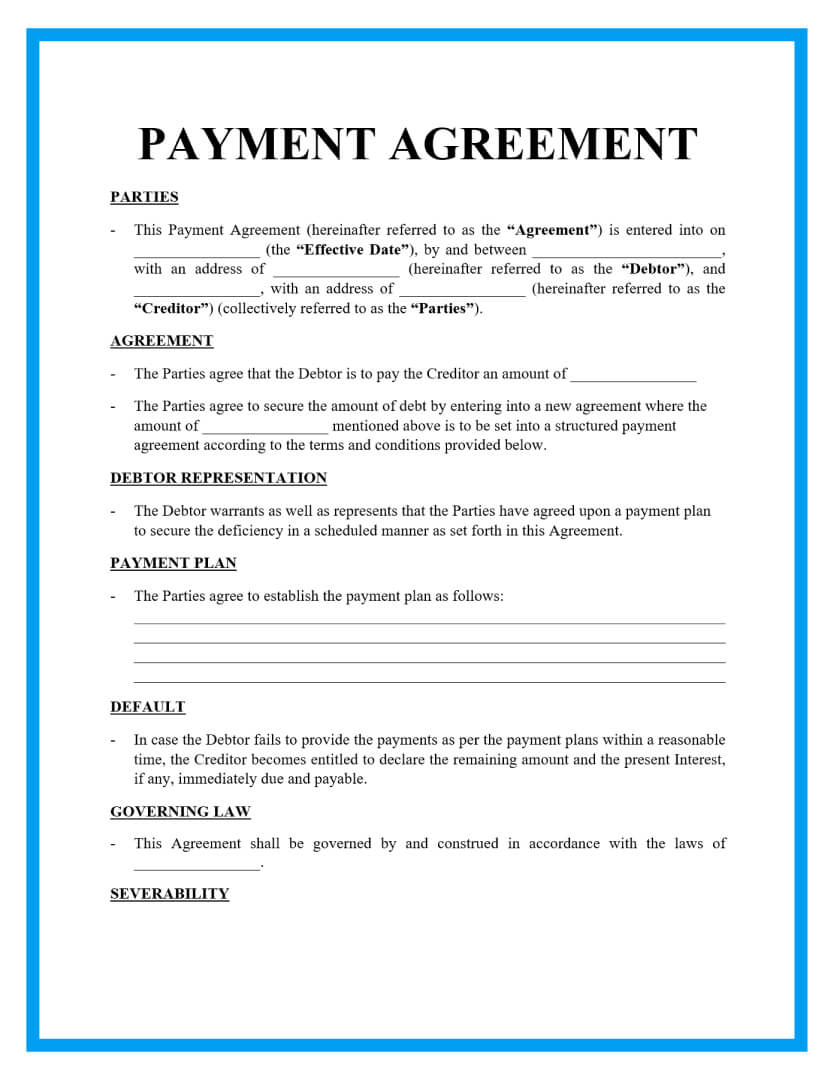

First and foremost, clearly identify the parties involved. Include the full legal names and addresses of both the payer and the payee. This may seem obvious, but it’s a crucial step in establishing the validity of the agreement. Next, describe the services or goods being provided in detail. Be specific and avoid vague language. The more clarity you provide here, the less room there is for misinterpretation. For example, instead of saying “website design,” specify the number of pages, features, and functionalities included in the design.

The most crucial element, of course, is the payment terms. Clearly state the total amount due, the currency, and the payment schedule. Outline when payments are due (e.g., upon completion, in installments, or on a specific date). Specify the accepted methods of payment (e.g., check, credit card, electronic transfer). It is also important to include information on late payment fees and any penalties for non-payment. Being upfront about these consequences can incentivize timely payments and prevent future issues.

Furthermore, address intellectual property rights if applicable. If the agreement involves the creation of original content or designs, clearly define who owns the intellectual property rights. This is particularly important for freelancers, designers, and other creatives who want to protect their work. You should also include a clause addressing confidentiality, especially if the agreement involves the sharing of sensitive information. This clause should outline the obligations of both parties to keep the information confidential and protect it from unauthorized disclosure.

Finally, include a clause outlining the process for dispute resolution. This should specify how disputes will be resolved, such as through negotiation, mediation, or arbitration. Having a clearly defined dispute resolution process can save time, money, and stress in the event of a disagreement. Remember to review and update your template regularly to ensure it complies with the latest laws and regulations.

Remember, a well-crafted written agreement template for payment is an investment in your peace of mind. It protects your interests, promotes clear communication, and strengthens your business relationships. Taking the time to create a comprehensive agreement upfront can save you from countless headaches down the road.

It’s about building trust and solidifying partnerships. When all parties are on the same page, it creates a better working environment.