Have you ever needed to borrow or lend money to someone you know? Maybe it’s a friend who needs a little help to cover an unexpected bill, or perhaps you’re assisting a family member with a down payment. In these situations, it’s essential to have a clear, written agreement outlining the terms of the loan. This protects both the lender and the borrower and helps avoid misunderstandings down the road. That’s where a simple interest loan agreement template comes in handy.

A simple interest loan agreement template is a pre-designed document that you can customize to fit your specific lending needs. It outlines the amount of the loan, the interest rate, the repayment schedule, and other important details. Think of it as a roadmap for the loan, ensuring everyone is on the same page from the very beginning. Using a template saves you time and money because you don’t have to hire a lawyer to draft a completely new document.

This article will guide you through the key components of a simple interest loan agreement template and explain why it’s a crucial tool for anyone involved in lending or borrowing money. We’ll cover everything from the basic information you need to include to how to customize the template to fit your unique circumstances. Let’s dive in and learn how to create a loan agreement that protects your interests and fosters a positive lending relationship.

Key Components of a Simple Interest Loan Agreement

A well-crafted simple interest loan agreement is more than just a formality; it’s a legally binding document that clearly defines the responsibilities and rights of both the lender and the borrower. It’s important to understand the essential components to ensure the agreement is comprehensive and protects everyone involved. Let’s break down the key elements you’ll typically find in a simple interest loan agreement template.

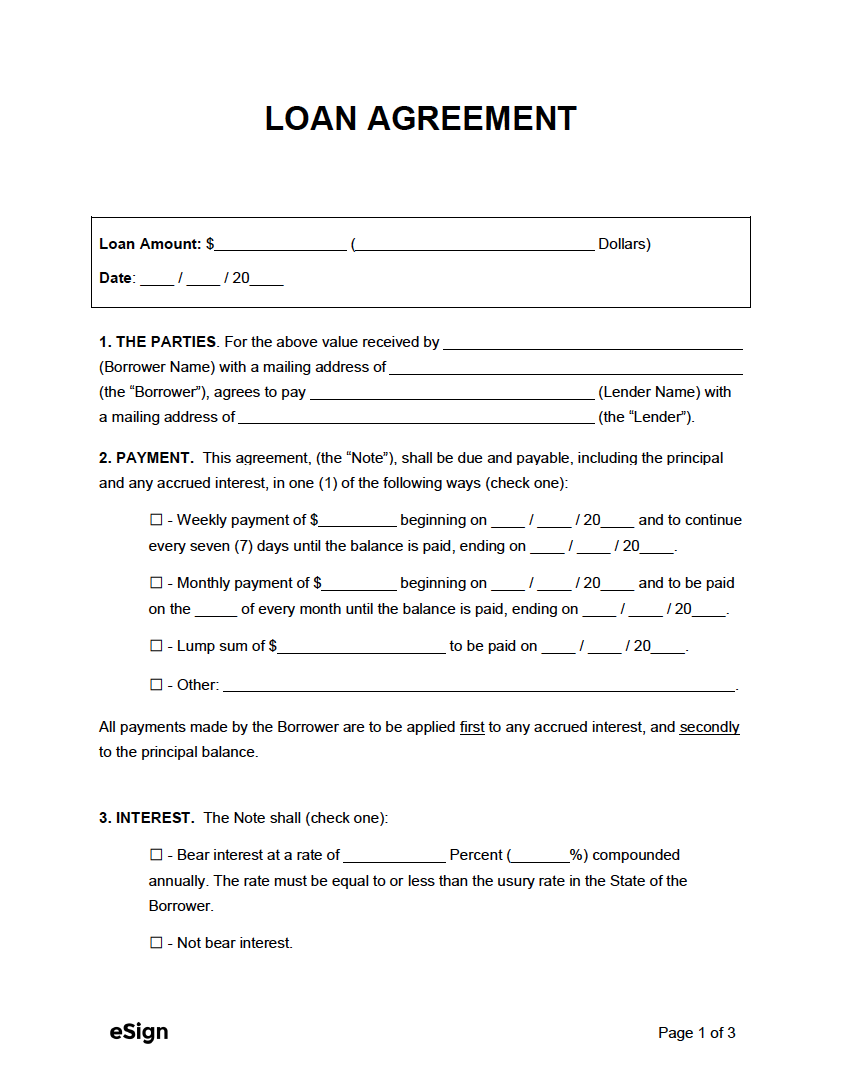

First and foremost, the agreement must identify the parties involved. This includes the full legal names and addresses of both the lender (the person or entity providing the loan) and the borrower (the person or entity receiving the loan). Be precise with this information to avoid any confusion later on. Think of it as setting the stage for the entire agreement, clearly establishing who is responsible for what.

Next, the agreement must clearly state the principal loan amount. This is the total amount of money being lent to the borrower. Specify the exact amount in both numerical and written form to avoid any potential discrepancies. For example, write “$10,000.00 (Ten Thousand US Dollars).” This leaves no room for interpretation and ensures both parties are in agreement about the amount of money being exchanged.

The interest rate is another crucial element. This is the percentage charged on the principal loan amount and represents the lender’s compensation for providing the loan. In a simple interest loan, the interest is calculated only on the principal balance. The agreement should clearly state the annual interest rate and how it will be calculated. Including an example calculation can be helpful for clarity. This helps the borrower understand the true cost of the loan.

Finally, the repayment schedule is essential. This section outlines how the borrower will repay the loan, including the frequency of payments (e.g., monthly, quarterly), the amount of each payment, and the due date for each payment. The agreement should also specify the method of payment accepted by the lender (e.g., check, electronic transfer). A detailed repayment schedule is vital for both the lender and the borrower to track payments and ensure timely repayment of the loan. Failing to define this can cause huge problems down the road. It is recommended to include what happens if payments are missed, as well.

Benefits of Using a Simple Interest Loan Agreement Template

Why should you bother with a simple interest loan agreement template? It boils down to protection, clarity, and efficiency. When lending or borrowing money, especially within personal relationships, emotions can sometimes cloud judgment. A well-drafted loan agreement template provides a neutral framework to ensure both parties are treated fairly and understand their obligations.

One of the primary benefits is risk mitigation. A loan agreement template clearly outlines the terms of the loan, including the repayment schedule, interest rate, and any consequences for default. This helps protect the lender from financial loss and provides the borrower with a clear understanding of their repayment responsibilities. By having everything in writing, you minimize the risk of misunderstandings and disputes later on.

Using a template also saves time and money. Creating a loan agreement from scratch can be a complex and time-consuming process, potentially requiring legal assistance. A simple interest loan agreement template provides a pre-designed framework that you can easily customize to fit your specific needs. This saves you the cost of hiring a lawyer and the time spent drafting the document yourself.

Furthermore, a template promotes transparency and accountability. When both parties have a clear understanding of the loan terms, it fosters a more trustworthy and reliable lending relationship. The borrower is more likely to adhere to the repayment schedule when they understand the consequences of default, and the lender is more likely to be patient and understanding when unforeseen circumstances arise. The use of a simple interest loan agreement template helps in this area.

Beyond protection and clarity, using a simple interest loan agreement template demonstrates professionalism. It shows that you’re taking the loan seriously and are committed to establishing a clear and legally sound agreement. This can be particularly important when lending to or borrowing from individuals with whom you have a personal relationship, as it sets a professional tone and helps maintain a healthy dynamic.

It’s hard to overstate the importance of a clear agreement, especially when dealing with finances. Using a simple interest loan agreement template allows both the lender and borrower to begin the transaction with the correct expectations and protections.

In conclusion, remember that while a simple interest loan agreement template is a great starting point, it’s crucial to tailor it to your specific situation and, if necessary, seek legal advice to ensure it fully protects your interests.