So, you’re looking to formalize a loan between two companies that are under the same ownership umbrella? That’s smart! While it might seem like a handshake deal is sufficient when you’re dealing with related entities, having a solid, written agreement in place protects both sides and keeps things crystal clear. Think of it as good housekeeping for your business finances. It ensures everyone is on the same page regarding repayment terms, interest rates (if any), and what happens if, well, things don’t go exactly as planned.

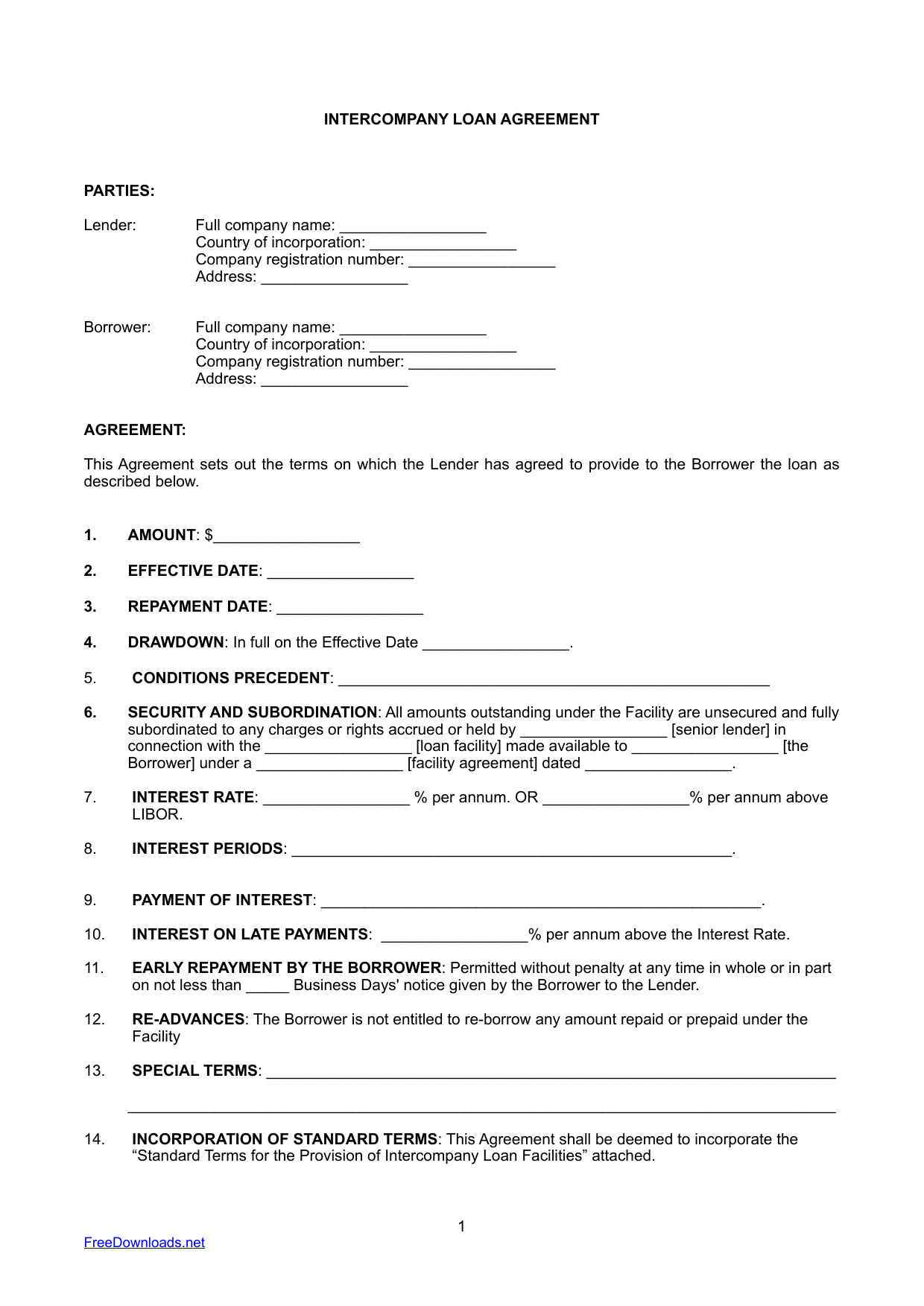

An intercompany loan agreement is essentially a contract that outlines the terms and conditions of a loan made between two related companies. This could be a parent company lending money to a subsidiary, or vice versa, or even between two sister companies under the same parent. This document formalizes the financial arrangement, clarifying the loan amount, interest rate, repayment schedule, and other crucial details. Using a simple intercompany loan agreement template can save you time and legal fees, but it’s important to understand the key components and tailor it to your specific situation.

Without a proper agreement, things can get messy. Imagine trying to remember verbal promises years down the line, especially if personnel changes occur. A written agreement eliminates ambiguity and provides a clear reference point for all parties involved. It also provides a trail that makes sense for accounting and potentially for any future audits. Plus, it can help demonstrate the arm’s length nature of the transaction, a crucial aspect for tax compliance. In essence, it turns a potentially complex issue into a well documented and easily understandable transaction.

Key Elements of an Intercompany Loan Agreement

Creating a robust intercompany loan agreement doesn’t have to be overly complicated. The goal is clarity and comprehensiveness. A simple intercompany loan agreement template will usually cover several essential elements, but you must adapt it to your specific needs. Let’s break down the most important sections you’ll find in such a template.

First and foremost, you need to clearly identify the parties involved. This includes the full legal names and addresses of both the lender and the borrower. This seems obvious, but accuracy is key. Mistakes here can lead to legal challenges down the road. Also, specify their roles, like Lender and Borrower. Don’t use names in the document, use the roles to identify each party.

Next, the agreement should detail the loan amount with precision. State the exact principal amount being lent. In addition, specify the currency in which the loan is being denominated. It is also crucial to spell out the interest rate, if any, being charged on the loan. Indicate how the interest rate will be calculated (e.g., fixed rate, variable rate tied to a benchmark like LIBOR or SOFR). Don’t forget to specify when the interest is due to be paid and how often.

The repayment schedule is another critical component. This section should clearly outline the dates and amounts of each repayment installment. Will it be a lump sum payment at the end of the loan term, or will there be regular installments (monthly, quarterly, annually)? Specify the method of payment and where payments should be sent. Include what happens if payments are missed, including any penalties for late payments.

Furthermore, the agreement should address the issue of default. What constitutes a default on the loan? Common examples include failure to make timely payments, breach of other covenants in the agreement, or the borrower becoming insolvent. Outline the lender’s remedies in the event of a default, such as accelerating the loan repayment or pursuing legal action. It also may include which jurisdiction the matter will be settled if ever there is a need to settle it by legal action.

Finally, include provisions for governing law and dispute resolution. Specify which jurisdiction’s laws will govern the interpretation and enforcement of the agreement. Also, include a mechanism for resolving disputes, such as mediation or arbitration, before resorting to litigation. This can save time and money in the long run. Make sure you understand the differences between them before adding it to the agreement.

Benefits of Using a Simple Intercompany Loan Agreement

Why bother going through the effort of creating and implementing a simple intercompany loan agreement? The advantages extend beyond simply formalizing a transaction. A well-drafted agreement offers substantial benefits for both the lending and borrowing companies.

One significant advantage is enhanced financial clarity and transparency. With a clear, written agreement, everyone knows the terms of the loan. This reduces the likelihood of misunderstandings or disputes down the road. It also facilitates accurate financial reporting and budgeting for both companies, leading to better overall financial management.

Furthermore, a formal agreement provides crucial documentation for tax purposes. Tax authorities often scrutinize intercompany transactions to ensure they are conducted at arm’s length – meaning, on terms that would be agreed upon by unrelated parties. A written loan agreement with a reasonable interest rate and repayment schedule helps demonstrate the arm’s length nature of the loan, reducing the risk of tax penalties or adjustments.

Another benefit is the protection of shareholder value. By clearly outlining the terms of the loan, the agreement helps ensure that the transaction is fair to all shareholders, not just those directly involved in the lending or borrowing company. This promotes good corporate governance and minimizes the potential for conflicts of interest.

Moreover, a simple intercompany loan agreement template can streamline the process of obtaining external financing. If either company needs to borrow from a bank or other lender in the future, having a well-documented track record of intercompany loans can demonstrate financial discipline and improve creditworthiness. It shows the external lender that you keep your finances organized and up-to-date.

Finally, having a simple intercompany loan agreement template on hand saves time and resources. Instead of starting from scratch each time, you can simply customize the template to fit the specific circumstances of the loan. This reduces the time and cost associated with legal review and drafting, freeing up resources for other important business activities. A simple intercompany loan agreement template is a valuable tool for any organization with related entities.

Using a well-defined loan agreement between related entities promotes clarity and accountability, essential for maintaining sound financial practices within the organization. It establishes a professional framework for managing intercompany transactions.

Implementing a formal intercompany loan agreement supports regulatory compliance and helps mitigate potential financial risks. It showcases prudent financial management to stakeholders and safeguards the company’s long-term financial health.