Ever bought something and thought, “Okay, I really want this, but paying for it all at once is going to sting”? That’s where installment payment agreements come to the rescue. They’re like a friendly financial handshake, letting you spread out the cost of a purchase over time. Whether you’re selling a used car, offering freelance services, or just lending a friend some money, having a clear agreement in place protects everyone involved. And the best part? It doesn’t have to be complicated. That’s where a simple installment payment agreement template shines.

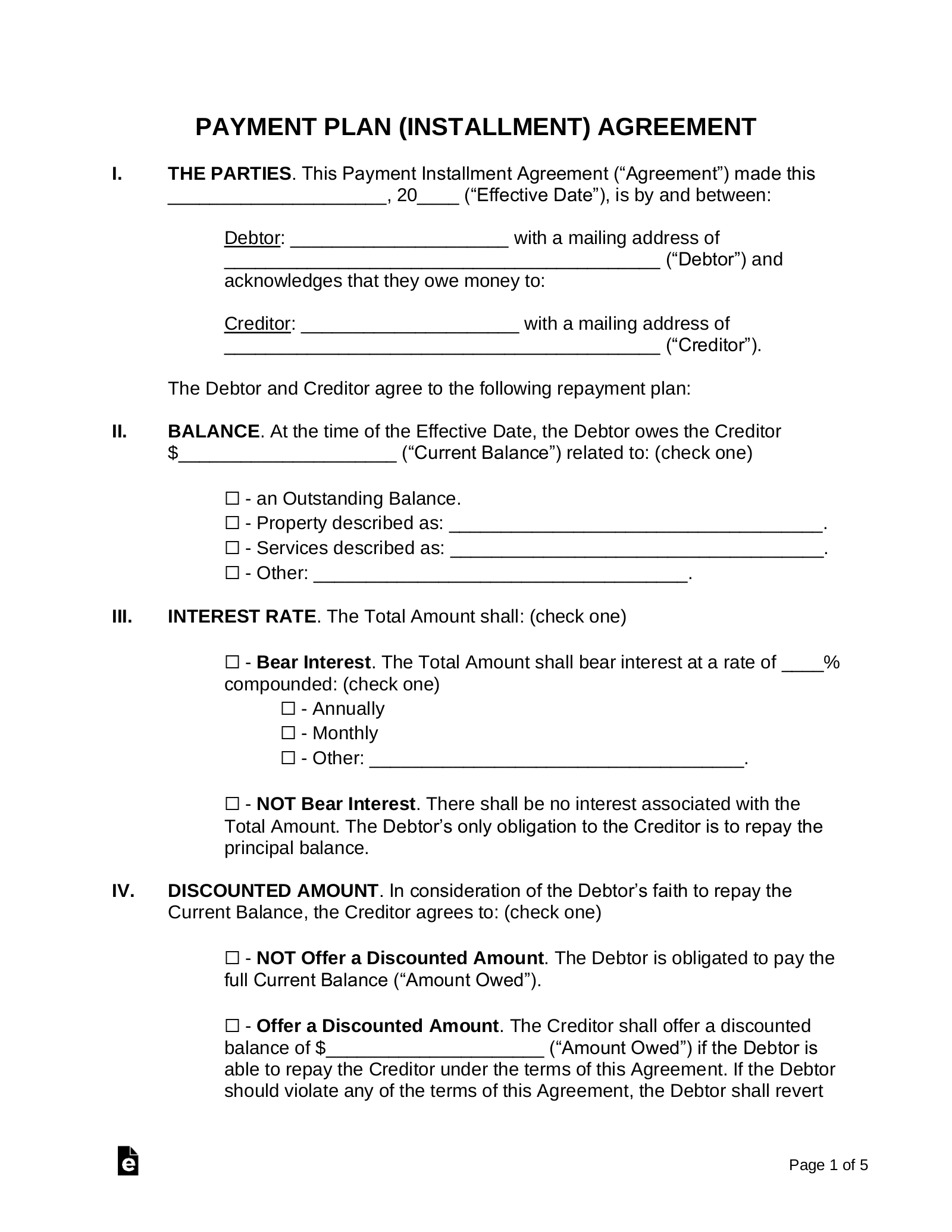

Think of a simple installment payment agreement template as a pre-written script for your financial arrangement. It outlines the key details, such as the total amount owed, the installment amount, the payment schedule, and what happens if someone misses a payment. Using a template ensures that nothing important gets overlooked and provides a professional framework for the agreement. It takes the guesswork out of creating a payment plan, saving you time and potential headaches down the road.

These templates are incredibly versatile, suitable for a wide range of situations. From small-scale personal loans to larger business transactions, a well-crafted simple installment payment agreement template can provide clarity and security. They help avoid misunderstandings and keep the entire payment process smooth and transparent for both the buyer and the seller. It’s all about clear communication and setting expectations from the start.

Why You Need a Simple Installment Payment Agreement

Imagine selling a piece of furniture online. You find a buyer who loves it, but they can’t afford to pay the full price upfront. You’re willing to work with them, but you also want to ensure you get paid. A simple installment payment agreement is your safeguard. It acts like a roadmap, guiding both parties through the payment process and clarifying each person’s responsibilities.

Without a written agreement, you’re relying on verbal promises and good faith. While that might work sometimes, it’s a risky approach, especially when money is involved. Memories fade, interpretations differ, and disagreements can easily arise. A written agreement provides concrete evidence of the terms agreed upon, protecting you if the buyer fails to make payments as scheduled.

Consider also the scenario where you’re providing a service, perhaps web design or freelance writing. You’ve completed the work, but the client needs to spread out the payments. A simple installment payment agreement outlines the payment schedule, including the amount due with each installment and the due dates. This clarity helps ensure timely payments and minimizes the risk of late or missed payments.

Furthermore, a simple installment payment agreement template can also specify what happens if the buyer defaults on their payments. Will there be a late fee? Will the seller have the right to repossess the item or take legal action? By addressing these potential issues upfront, you can avoid future disputes and protect your financial interests.

In essence, a simple installment payment agreement template provides peace of mind. It’s a tool that helps you manage your finances responsibly and protects you from potential financial losses. It fosters a clear understanding between the buyer and the seller, reducing the risk of misunderstandings and disputes. Using such a template is a sign of professionalism and helps establish a trustworthy relationship.

Key Elements of a Good Installment Payment Agreement

So, what exactly goes into creating a solid installment payment agreement? It’s not just about stating the amount owed. A comprehensive agreement covers all the essential details to ensure clarity and protect both parties. Let’s break down the key components of a robust agreement. The first and foremost element is clearly stating the names and addresses of all parties involved. This ensures there’s no confusion about who is responsible for the obligations outlined in the agreement.

Next, you need a detailed description of the goods or services being purchased. If it’s a physical item, include its make, model, and serial number if applicable. If it’s a service, specify the scope of work and the deliverables. This helps avoid any ambiguity about what the buyer is receiving in exchange for their payments. Of course, the total purchase price is crucial. This section should clearly state the full amount owed before any installments are applied.

The installment schedule is the heart of the agreement. This section outlines the amount of each installment, the due date for each payment, and the method of payment (e.g., check, electronic transfer, cash). Be specific and avoid vague terms like “bi-weekly” without stating the exact days. Another essential element is addressing the consequences of late or missed payments. Will there be a late fee? How many missed payments will constitute a default? What actions can the seller take if the buyer defaults?

Finally, include clauses that cover things like governing law (which state’s laws will apply if there’s a dispute), dispute resolution (will you use mediation or arbitration?), and entire agreement (stating that this document represents the complete agreement between the parties). Remember that even a simple installment payment agreement template should be reviewed carefully and adjusted to suit the specific circumstances of your transaction. It’s always a good idea to consult with a legal professional if you have any doubts or concerns.

By including these key elements in your installment payment agreement, you create a legally sound document that protects your interests and promotes a fair and transparent transaction. Using a simple installment payment agreement template can greatly streamline the process, but it’s important to understand the purpose of each section and customize it to your specific needs. Clear and comprehensive agreements are the foundation of successful financial arrangements.

Having a documented agreement offers invaluable security for everyone involved. It establishes clear boundaries and sets expectations, fostering trust and encouraging responsible financial practices.

Ultimately, taking the time to create a simple installment payment agreement template is an investment in your financial well-being. It minimizes risks, promotes transparency, and helps ensure a smooth and successful transaction for all parties.