Running a business is a constant juggling act. You’re managing inventory, paying employees, marketing your products or services, and chasing invoices all while trying to grow. Sometimes, all you need is a little extra cash to keep things running smoothly, bridge a gap between receivables and payables, or seize a new opportunity. That’s where a working capital loan comes in. But before you jump in, it’s essential to have a solid agreement in place, which is where a working capital loan agreement template becomes your best friend.

Think of a working capital loan as a short term financial boost. It’s not for long term investments like buying a building; it’s more for covering your day to day operational costs. Now, securing such a loan requires a formal agreement that clearly outlines the terms and conditions for both the lender and the borrower. This document, often referred to as a working capital loan agreement, ensures everyone is on the same page and helps prevent misunderstandings down the line.

This is where a working capital loan agreement template proves invaluable. It’s a pre designed framework that you can customize to fit your specific needs. Instead of starting from scratch, which can be daunting and time consuming, you can use a template as a starting point, saving you time, legal fees, and potential headaches. Let’s explore what makes a good working capital loan agreement template and why it’s a must have for any business seeking short term funding.

Understanding the Core Components of a Working Capital Loan Agreement Template

A comprehensive working capital loan agreement template is more than just a fill in the blanks form. It’s a legally sound document that protects both the lender and the borrower by clearly defining the rights, responsibilities, and obligations of each party. It’s like the instruction manual for your loan, ensuring everyone knows what to do and what to expect. A well crafted template will cover all the essential elements, leaving no room for ambiguity. This clarity is crucial for a smooth and successful loan process.

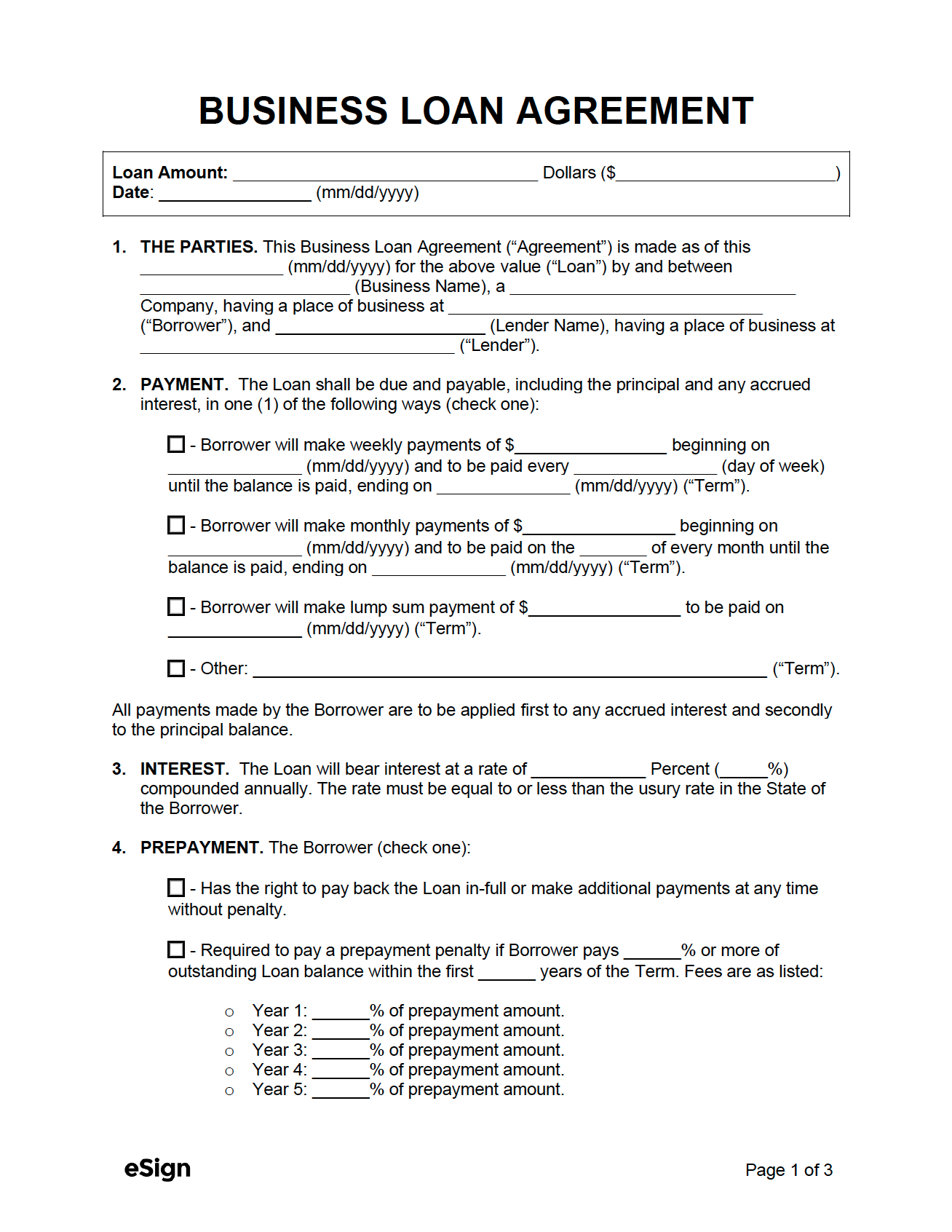

So, what exactly should be included in a robust working capital loan agreement template? First and foremost, the agreement needs to clearly identify the parties involved: the lender (the entity providing the loan) and the borrower (the business receiving the funds). This section should include the full legal names and addresses of both parties. Next, the agreement must specify the loan amount, the interest rate, and the repayment schedule. These are the core financial terms of the loan, and they need to be crystal clear to avoid any confusion later on. The agreement should detail whether the interest rate is fixed or variable, and how it is calculated. The repayment schedule should outline the frequency and amount of payments, as well as the date on which the final payment is due.

Beyond the basic financial terms, a solid template will also address important clauses such as default conditions, collateral (if any), and governing law. Default conditions specify what happens if the borrower fails to meet the repayment obligations. This might include penalties, acceleration of the loan, or even legal action. If the loan is secured by collateral, the agreement should clearly describe the collateral and the lender’s rights to it in the event of default. The governing law clause specifies which jurisdiction’s laws will govern the interpretation and enforcement of the agreement. This is important in case of disputes.

Moreover, a well drafted agreement will include clauses covering representations and warranties made by the borrower, outlining that the borrower has the legal authority to enter into the agreement and that the information provided is accurate. It might also include clauses related to confidentiality, ensuring that sensitive information shared during the loan process is protected. Finally, the agreement should have a clear termination clause, specifying how and when the agreement can be terminated by either party.

Ultimately, a robust working capital loan agreement template serves as a roadmap for the entire loan process. By carefully considering and incorporating all of these essential elements, you can create an agreement that is fair, transparent, and legally sound, protecting the interests of both the lender and the borrower.

Benefits of Using a Working Capital Loan Agreement Template

Opting for a working capital loan agreement template offers a multitude of advantages, primarily saving you valuable time and resources. Instead of grappling with the complexities of drafting a legal document from scratch, which can be a daunting task even for experienced business owners, a template provides a pre structured framework that covers all the essential aspects of the loan agreement. This allows you to focus on customizing the template to your specific circumstances, rather than reinventing the wheel.

Cost effectiveness is another significant benefit. Hiring a lawyer to draft a loan agreement can be expensive. A working capital loan agreement template allows you to significantly reduce legal fees. While it’s always a good idea to have a lawyer review the final document to ensure it meets your specific needs, using a template as a starting point can save you a considerable amount of money. It gives you a solid foundation to work from, minimizing the amount of time the lawyer needs to spend on the project.

Furthermore, templates often incorporate standard legal language and clauses that are widely recognized and accepted. This helps ensure that the agreement is legally sound and enforceable. A template can help prevent misunderstandings by clearly outlining the rights and responsibilities of each party. The clarity of the agreement minimizes the potential for disputes and creates a more harmonious business relationship.

Beyond the immediate benefits of time and cost savings, a template also provides a sense of security. Knowing that you have a legally sound document in place can give you peace of mind, allowing you to focus on running your business. It is a safety net to protect your business interests and ensures that all parties understand their obligations.

In essence, utilizing a working capital loan agreement template is a smart and practical approach to securing short term financing. It streamlines the process, reduces costs, and provides a solid legal foundation for the loan agreement. It is a valuable tool that can help businesses of all sizes navigate the complexities of borrowing and lending.

A business’s success often hinges on the ability to manage its cash flow effectively, and a working capital loan can be a powerful tool in achieving this.

Having a clear, comprehensive agreement in place is paramount. Whether you’re a lender or a borrower, using a working capital loan agreement template is a practical step toward a successful and mutually beneficial financial arrangement.