So, you’re running a business with partners, and things are humming along nicely. Fantastic! But have you ever stopped to consider what happens if one of you wants out, retires, passes away, or just… well, life happens? That’s where a shareholder buy sell agreement comes in. Think of it as a prenuptial agreement for your business. It lays out the ground rules for how shareholders can sell their shares and who can buy them, preventing potential chaos down the road. It’s a critical document that provides clarity, protects the interests of all parties, and ensures business continuity.

Imagine trying to navigate the emotional and financial complexities of a shareholder’s departure without a clear plan. It could lead to disputes, lawsuits, and even the demise of the business you’ve all worked so hard to build. A well-drafted shareholder buy sell agreement eliminates much of the uncertainty and provides a structured process for these transitions. Finding a suitable shareholder buy sell agreement template can seem daunting, but it’s a crucial first step to safeguard your business.

A solid shareholder buy sell agreement isn’t just a formality; it’s a strategic tool. It allows you to control who becomes a shareholder in your company, preventing shares from falling into the wrong hands. It also establishes a fair valuation method for the shares, ensuring that departing shareholders receive a reasonable price for their ownership stake. In short, it’s an investment in the long-term health and stability of your business.

Understanding the Core Components of a Shareholder Buy Sell Agreement

At its heart, a shareholder buy sell agreement is designed to answer the question: what happens when a shareholder wants to sell or transfer their shares? To effectively answer that, it needs several key components that address different scenarios and protect the interests of all parties involved. These components provide a framework for managing potential transitions in ownership, ensuring fairness, and maintaining business continuity.

Firstly, the agreement should clearly define the events that trigger the buy-sell provisions. These events could include death, disability, retirement, termination of employment, divorce, bankruptcy, or simply a desire to sell shares to an outside party. By explicitly outlining these triggering events, the agreement removes ambiguity and provides a clear roadmap for when the buy-sell provisions come into play. This helps prevent disputes about whether or not a shareholder is eligible to sell their shares.

Next, the agreement must specify who has the right to purchase the shares. Typically, the remaining shareholders or the company itself have the first right of refusal. This means they have the option to buy the departing shareholder’s shares before they are offered to an outside buyer. This provision helps maintain control over the company’s ownership structure and prevents unwanted parties from becoming shareholders. The agreement also needs to outline the process for exercising this right of first refusal, including timelines and notification requirements.

Perhaps the most critical aspect of the agreement is the valuation method used to determine the price of the shares. There are several common methods, including book value, appraised value, a fixed price, or a formula-based valuation. The agreement should clearly define which method will be used and how it will be implemented. Choosing a fair and objective valuation method is essential to avoid disputes and ensure that the departing shareholder receives a reasonable price for their shares.

Finally, the agreement should address the terms of payment for the shares. Will the purchase be made in a lump sum or in installments? What interest rate, if any, will be applied to installment payments? The agreement should clearly outline the payment schedule and any security that will be provided to the departing shareholder to ensure timely payment. This aspect is crucial for providing financial security to the departing shareholder and ensuring a smooth transition.

Why You Need a Shareholder Buy Sell Agreement Template

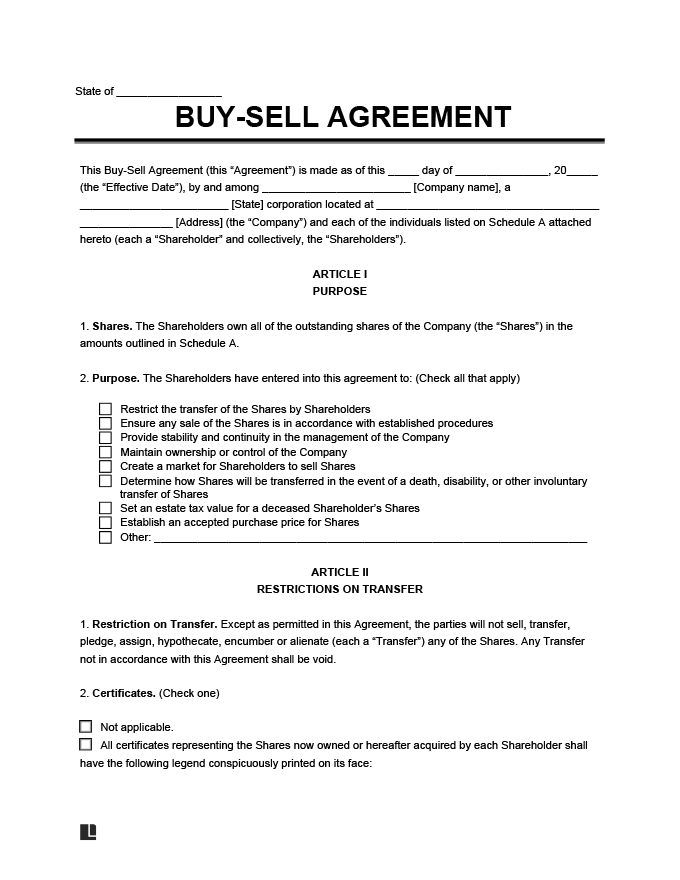

Creating a shareholder buy sell agreement from scratch can be a daunting task, requiring significant legal expertise and time. That’s where a shareholder buy sell agreement template comes in handy. Think of it as a starting point, a framework that you can customize to fit the specific needs of your business. It provides a foundation of legal language and essential provisions, saving you time and money on legal fees. While it’s always recommended to consult with an attorney to review and finalize the agreement, a template can significantly streamline the process.

A good template will cover the essential elements of a shareholder buy sell agreement, ensuring that you don’t overlook any critical provisions. It will include sections addressing triggering events, rights of first refusal, valuation methods, payment terms, and dispute resolution mechanisms. By using a template, you can be confident that you’re addressing the key issues and protecting the interests of your business and its shareholders. It serves as a checklist to ensure all bases are covered.

Furthermore, a shareholder buy sell agreement template can help you understand the different options available and the implications of each choice. For example, you might not be aware of the various valuation methods and their potential impact on the price of the shares. A template can provide explanations and examples, helping you make informed decisions that are best suited to your business. It educates you on the nuances of shareholder agreements.

However, it’s crucial to remember that a template is just a starting point. It’s essential to customize the template to reflect the specific circumstances of your business and the unique agreements between the shareholders. Don’t simply fill in the blanks without carefully considering the implications of each provision. Consult with an attorney to ensure that the final agreement is legally sound and enforceable in your jurisdiction. A template is a tool, not a substitute for legal advice.

Ultimately, a well-chosen and properly customized shareholder buy sell agreement template can save you time, money, and potential headaches down the road. It provides a solid foundation for creating a legally sound and effective agreement that protects the interests of your business and its shareholders. Take the time to find a reputable template and work with an attorney to ensure that it’s tailored to your specific needs.

Creating a thriving business involves much more than just a great idea and hard work; it also requires careful planning and preparation for the unexpected. A shareholder buy sell agreement template is an invaluable tool in this regard. It’s an investment in the future stability and success of your company, ensuring that ownership transitions are handled smoothly and fairly. By proactively addressing these issues, you can focus on growing your business with confidence.

Remember, your business is likely one of your most valuable assets, so protecting it should be a top priority. Investing the time and effort to create a comprehensive shareholder buy sell agreement, using a quality template as a foundation, is a smart move that can pay dividends for years to come. It provides peace of mind knowing that you have a plan in place to handle whatever the future may hold, safeguarding the interests of all stakeholders.