So, you’re a shareholder who’s thinking about lending some money to your company? Or maybe you’re the company looking to borrow from a shareholder? That’s a pretty common situation, especially in startups and smaller businesses. It’s often easier than going to a bank for a loan, but just because it’s “easier” doesn’t mean you should skip the formalities. You absolutely need a solid agreement in place to protect everyone involved. That’s where a sample shareholder loan agreement template comes in handy.

Think of a shareholder loan agreement as a roadmap for the loan. It lays out all the important details like the amount of the loan, the interest rate (if any), how and when the loan will be repaid, and what happens if the company can’t repay the loan on time. Without this kind of agreement, you could end up with misunderstandings, disagreements, and even legal trouble down the road. It’s like trying to build a house without a blueprint – you might get something built, but it’s probably not going to be what you wanted, and it’s probably not going to be very stable.

This article will guide you through what a sample shareholder loan agreement template is, why you need one, and what key elements it should contain. It’s not legal advice, of course, so you should always consult with an attorney to make sure your agreement is tailored to your specific situation. But this will give you a strong starting point to understand the process and prepare for that conversation with your lawyer. So let’s dive in and get you on the right track with your shareholder loan!

Why You Need a Solid Shareholder Loan Agreement

Imagine lending a friend money without agreeing on how and when they’ll pay you back. Awkward, right? A shareholder loan to a company is similar, but with much larger sums of money and potentially more complicated business relationships involved. A well-drafted agreement isn’t just a formality; it’s a fundamental safeguard for both the shareholder and the company.

First and foremost, a shareholder loan agreement clarifies the terms of the loan. It spells out the principal amount being loaned, the interest rate (if any), the repayment schedule, and any collateral securing the loan. This clarity minimizes the risk of misunderstandings and disputes later on. Without a written agreement, memories can fade, interpretations can differ, and what started as a friendly transaction can quickly turn sour.

Secondly, having a formal agreement helps protect the shareholder’s investment. By clearly defining the terms of repayment and any security interests, the shareholder has a stronger legal claim to the loaned funds if the company runs into financial difficulties. In a bankruptcy scenario, a documented loan agreement can help the shareholder stand in line with other creditors to recover at least a portion of the loan. Without the agreement, the shareholder’s claim might be treated as equity, leaving them at the back of the line behind other creditors.

Thirdly, a shareholder loan agreement helps protect the company. By documenting the loan, the company avoids potential tax issues. The IRS scrutinizes related-party transactions, and a properly documented loan can help demonstrate that the loan is legitimate and not disguised equity contribution. This is crucial for deducting interest payments and avoiding penalties.

Finally, a well-structured agreement promotes good corporate governance. It demonstrates transparency and fairness in the company’s dealings with its shareholders. This is important not only for legal compliance but also for maintaining trust and confidence among all stakeholders, including other shareholders, employees, and potential investors. Using a sample shareholder loan agreement template is a great place to start.

Key Elements of a Shareholder Loan Agreement Template

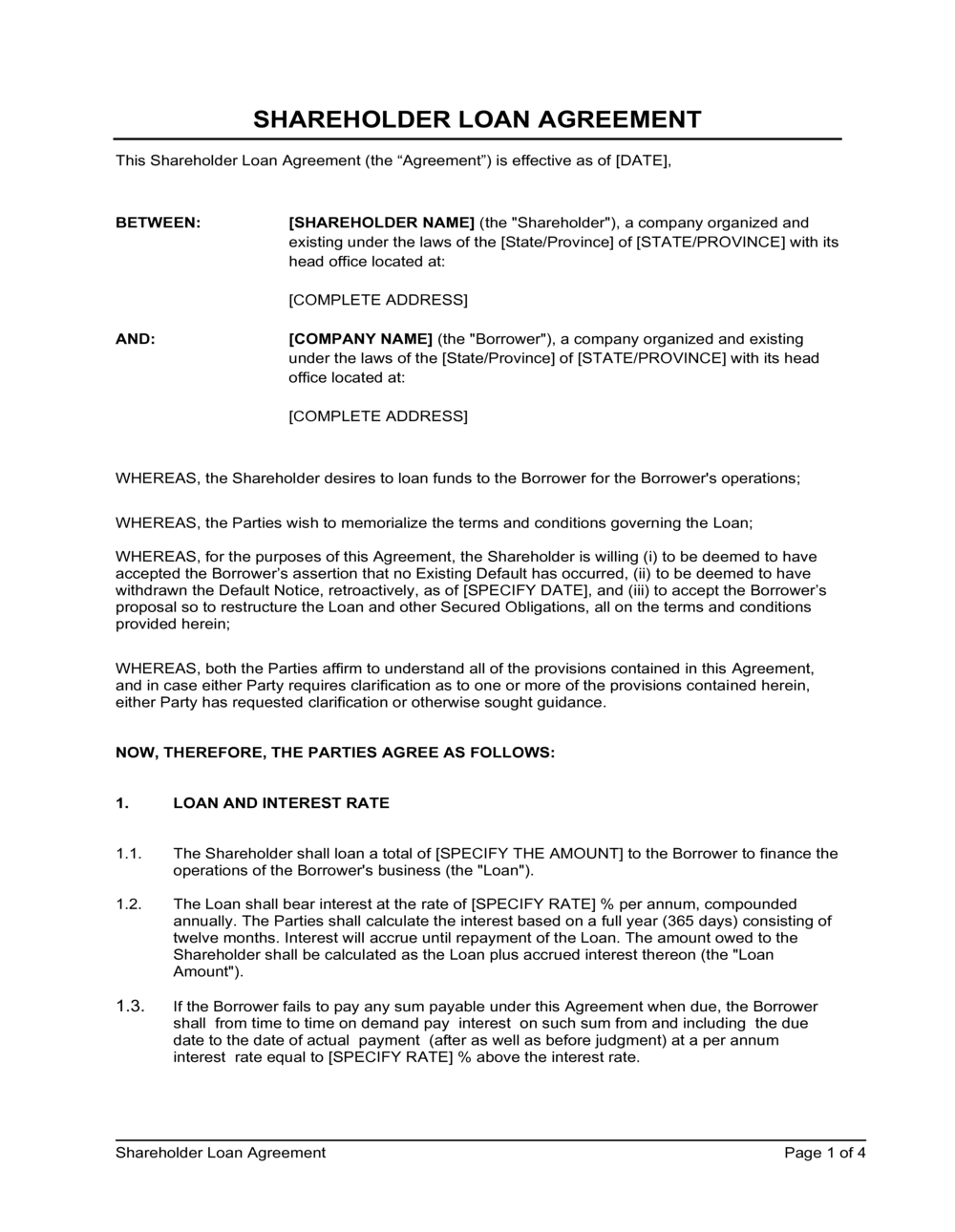

Okay, so you understand why you need an agreement. Now, what exactly goes into one? While the specific details will vary depending on your circumstances, there are several key elements that every solid shareholder loan agreement template should include.

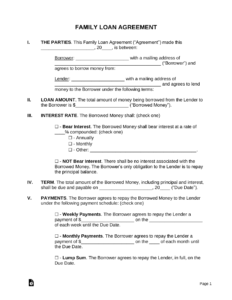

First, you’ll need clear identification of the parties involved. This includes the full legal names and addresses of both the shareholder (the lender) and the company (the borrower). Ensure that the company is properly identified as a legal entity, such as a corporation or limited liability company (LLC).

Second, you’ll need a detailed description of the loan itself. This section should specify the principal amount of the loan (the total amount being borrowed), the interest rate (if applicable), and the repayment schedule. Be very specific about how frequently payments are to be made (e.g., monthly, quarterly, annually), the amount of each payment, and the date on which the first payment is due. If there’s no interest being charged, state that explicitly.

Third, the agreement should address any security or collateral for the loan. Is the loan secured by any assets of the company, such as equipment, inventory, or accounts receivable? If so, clearly describe the assets and the process for the shareholder to take possession of them if the company defaults on the loan. If the loan is unsecured, state that clearly as well.

Fourth, include provisions for default and remedies. What happens if the company fails to make payments on time? What constitutes a default? The agreement should specify the steps the shareholder can take if the company defaults, such as demanding immediate repayment of the entire loan balance or initiating legal action. It’s important to be clear about the consequences of default to protect the shareholder’s investment.

Finally, the agreement should include standard legal clauses such as governing law (which state’s laws will govern the agreement), dispute resolution (how disputes will be resolved, such as through mediation or arbitration), and severability (if one part of the agreement is found to be unenforceable, the rest of the agreement remains in effect). All parties must sign and date the agreement, ideally in the presence of a notary public.

Navigating the intricacies of financial agreements can be daunting, but understanding the core components provides a strong foundation. With a sample shareholder loan agreement template in hand, you can confidently approach your business endeavors, knowing you’ve taken steps to secure your investments.

So there you have it – a solid foundation for understanding shareholder loan agreements. Remember, while this information is helpful, it’s no substitute for professional legal advice. A lawyer can tailor the agreement to your specific situation and ensure that it complies with all applicable laws.