Ever find yourself needing a little extra cash to kickstart a project, consolidate debt, or maybe even seize a great investment opportunity? Sometimes, a traditional loan just won’t cut it, or the interest rates are simply too high. That’s where a collateral loan comes into play. It’s a way to borrow money by using something you own, like a car, real estate, or even valuable collectibles, as security. Think of it as putting your assets to work for you. But before you jump in, it’s crucial to understand the legal framework that governs this type of transaction. That’s why having a solid loan agreement is absolutely essential.

A well-drafted collateral loan agreement spells out all the terms and conditions of the loan, protecting both the lender and the borrower. It clarifies what happens if the borrower can’t repay the loan, ensuring everyone understands their rights and responsibilities. Without a clear agreement, you risk misunderstandings, disputes, and even legal battles down the road. Nobody wants that headache! So, whether you’re lending money to a friend, family member, or working with a financial institution, having a legally sound document in place is paramount.

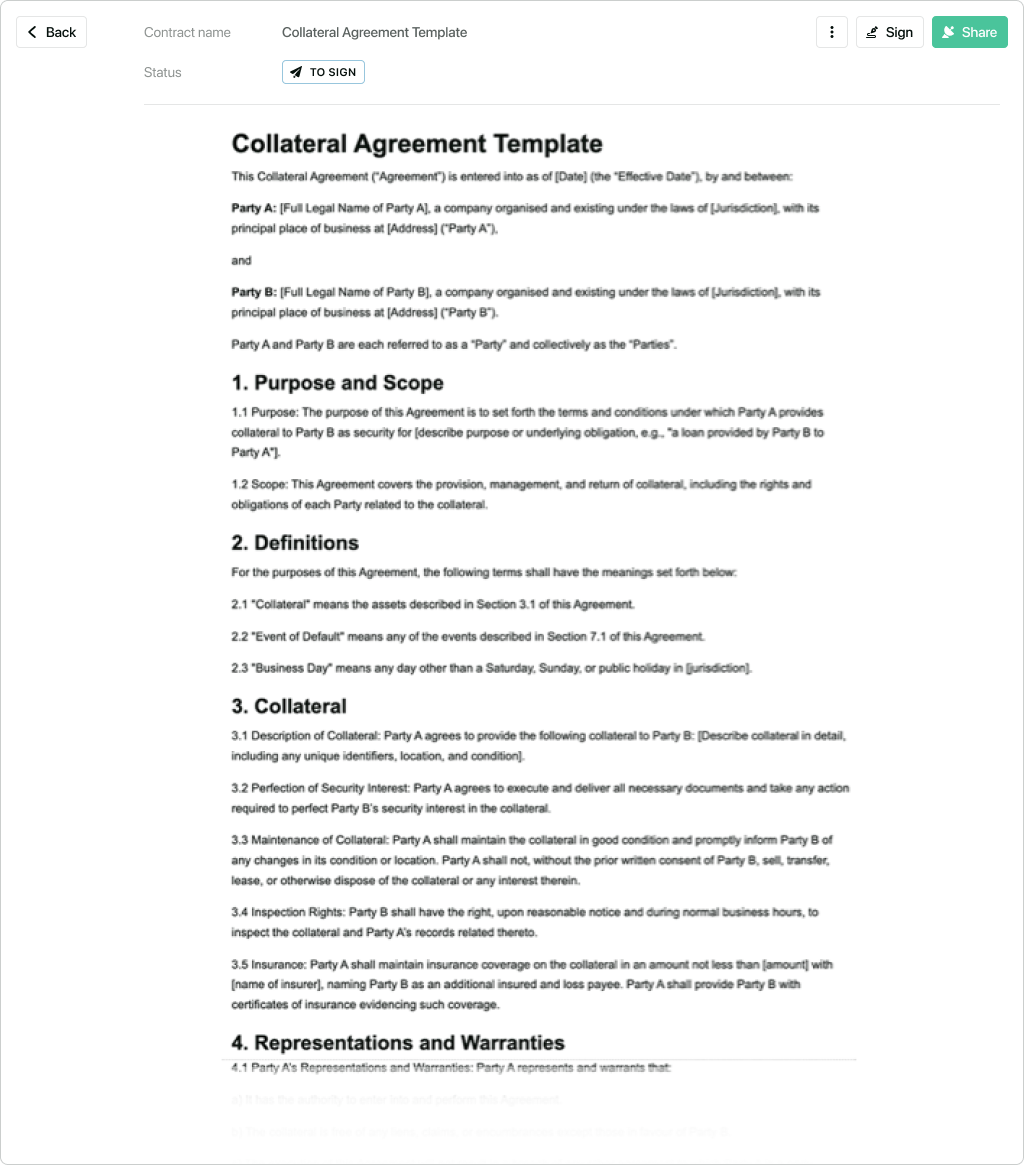

This brings us to the importance of using a sample collateral loan agreement template. These templates provide a framework, a starting point, for creating your own personalized agreement. They ensure you cover all the essential elements, leaving no room for ambiguity. Of course, every situation is unique, so you’ll need to adapt the template to fit your specific needs. But by starting with a solid foundation, you’re much more likely to create a loan agreement that’s both legally sound and fair to all parties involved. Let’s delve into what makes a good agreement and where you can find a helpful sample.

Key Components of a Robust Collateral Loan Agreement

A comprehensive collateral loan agreement is more than just a simple promise to pay back money. It’s a detailed document that outlines the rights, responsibilities, and expectations of both the lender and the borrower. Think of it as a roadmap for the loan, ensuring everyone stays on the same page throughout the repayment process. Ignoring crucial components can lead to serious issues, potentially putting your assets at risk or damaging important relationships. So, what are the essential ingredients of a strong collateral loan agreement?

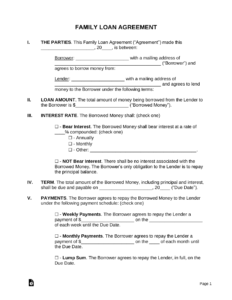

First and foremost, the agreement should clearly identify the parties involved: the lender (the one providing the loan) and the borrower (the one receiving the loan). It should include their full legal names and addresses. Next, the agreement must specify the exact amount of the loan (the principal amount) and the interest rate being charged. The repayment schedule is also critical. This section should detail how often payments are due (weekly, monthly, etc.), the amount of each payment, and the final due date for the entire loan. Clarity in these areas prevents confusion and ensures both parties are aware of their financial obligations.

The description of the collateral is another non-negotiable element. The agreement needs to thoroughly describe the asset being used as collateral, including its make, model, serial number (if applicable), condition, and any other relevant details. The more specific the description, the better. This prevents disputes over which asset is actually securing the loan. Furthermore, the agreement should address what happens if the borrower defaults on the loan. It should clearly state the lender’s right to seize and sell the collateral to recoup the outstanding debt. The process for doing so, including any required notices or legal procedures, should also be outlined.

Finally, a well-drafted agreement should include provisions for things like insurance on the collateral (if applicable), who is responsible for maintaining the collateral, and what happens if the collateral is damaged or destroyed. It should also address issues like late payment fees and any other penalties for failing to meet the terms of the agreement. A clearly defined process for resolving disputes is essential. This might involve mediation, arbitration, or even legal action. Including these clauses can save both parties time and money in the long run.

Remember, a solid collateral loan agreement isn’t just a formality; it’s a safeguard for both the lender and the borrower. It protects their interests and ensures a fair and transparent transaction. If you’re unsure about any aspect of the agreement, it’s always best to seek legal advice from a qualified attorney. They can help you understand your rights and obligations and ensure that the agreement is tailored to your specific circumstances. If you are looking for a starting point, consider using a sample collateral loan agreement template.

Finding and Adapting a Sample Collateral Loan Agreement Template

Ready to get started? Great! Finding a sample collateral loan agreement template is easier than you might think. The internet is full of resources, offering a wide range of templates that you can download and customize. However, not all templates are created equal. It’s important to choose a template from a reputable source and to carefully review it before using it. Look for templates provided by legal websites, law firms, or financial institutions. These sources are more likely to offer templates that are accurate, comprehensive, and legally sound.

Once you’ve found a template that looks promising, take the time to read through it thoroughly. Make sure you understand all the terms and conditions. Don’t be afraid to ask questions if anything is unclear. Keep in mind that a template is just a starting point. You’ll need to customize it to fit your specific situation. This might involve adding or removing clauses, changing the wording, or adjusting the terms to reflect the unique details of your loan agreement. For instance, the sample collateral loan agreement template may not include a specific clause that is relevant to your particular situation, such as provisions for the insurance or maintenance of the collateral.

Consider seeking legal advice to ensure that the template accurately reflects the agreement you intend to create. An attorney can review the template and provide guidance on how to adapt it to your specific needs. They can also help you identify any potential legal issues and ensure that the agreement complies with all applicable laws and regulations. Remember, every loan agreement is different. What works for one situation might not work for another. It’s important to tailor the template to your individual circumstances to ensure that it’s both legally sound and fair to all parties involved.

When customizing the template, pay close attention to the details. Double-check all the information, including the names and addresses of the parties, the loan amount, the interest rate, and the repayment schedule. Make sure the description of the collateral is accurate and complete. And be sure to include any other relevant information that might affect the loan agreement. Remember, accuracy and clarity are key. The more specific and detailed the agreement, the less likely there will be misunderstandings or disputes down the road. Take your time and don’t rush the process.

In conclusion, start with a solid sample collateral loan agreement template, carefully review and adapt it to your specific needs, and consider seeking legal advice to ensure that it’s both legally sound and fair to all parties involved. By taking these steps, you can create a collateral loan agreement that protects your interests and provides a clear roadmap for the loan repayment process. This will give you confidence and peace of mind knowing that you’ve taken the necessary steps to protect yourself and the other party involved.

Creating a collateral loan agreement might seem daunting, but with a little bit of research and attention to detail, it’s definitely achievable. Remember to prioritize clarity, accuracy, and fairness. A well-drafted agreement can help you avoid misunderstandings and disputes, and ensure that everyone is on the same page. Don’t hesitate to seek professional help if you feel overwhelmed or uncertain. A little bit of effort upfront can save you a lot of headaches in the long run.