Thinking about buying or selling shares in a company? That’s a big step! But before you shake hands and celebrate, you need a solid foundation, and that’s where a well-crafted sale of shares agreement template comes in. This isn’t just some legal formality; it’s your roadmap to a smooth and transparent transaction, protecting both the buyer and the seller.

Imagine trying to navigate a complex business deal without a clear set of rules. That’s what it’s like selling or buying shares without a proper agreement. You’re leaving yourself open to misunderstandings, disputes, and potentially costly legal battles down the road. A comprehensive agreement lays out all the important details, from the price and payment terms to the responsibilities of each party involved.

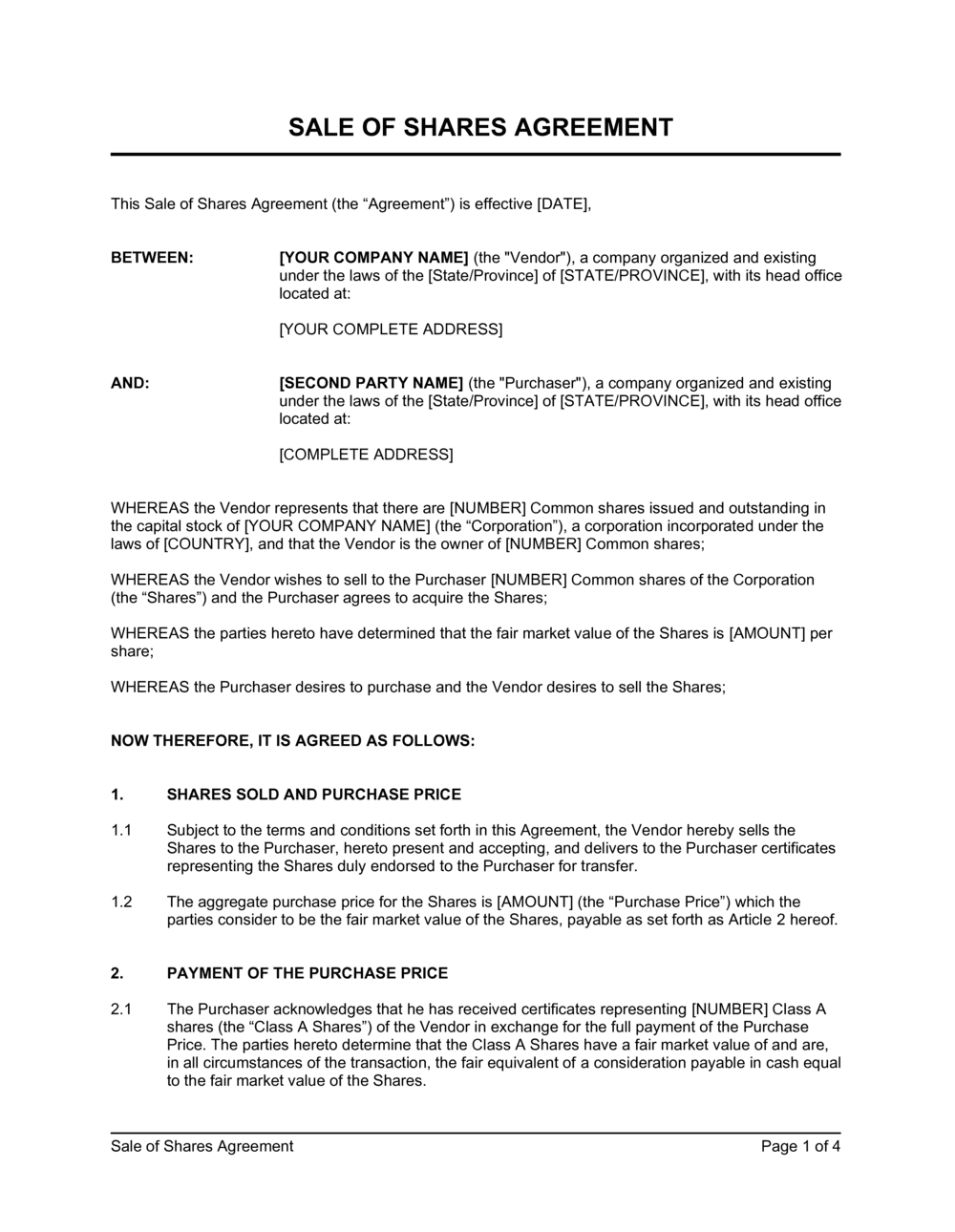

In essence, a sale of shares agreement template is a legally binding document that outlines the terms and conditions for transferring ownership of shares from one party (the seller) to another (the buyer). It’s like a detailed receipt, ensuring everyone is on the same page and minimizing the risk of future disagreements. So, let’s dive into what makes a good template and how it can benefit you.

Why You Need a Solid Sale of Shares Agreement Template

You might be thinking, “Do I really need a formal agreement? Can’t we just agree on a price and be done with it?” While a verbal agreement might seem sufficient in some cases, it’s rarely a good idea when it comes to selling or buying shares. The complexity of these transactions demands a written record to avoid ambiguity and ensure everyone understands their rights and obligations. A sale of shares agreement template provides that crucial clarity.

Think of it this way: the agreement acts as a shield, protecting you from potential issues that could arise after the sale is complete. What happens if the seller fails to disclose important information about the company’s financial situation? What if the buyer doesn’t pay the agreed-upon price on time? A well-drafted agreement addresses these kinds of scenarios, providing a clear course of action and minimizing the risk of costly disputes. It’s peace of mind in written form.

Furthermore, having a standardized template can save you significant time and money. Instead of starting from scratch, you can use a template as a framework, customizing it to fit the specific details of your transaction. This reduces the need for extensive legal advice and ensures that all the essential elements are included. It’s a practical and efficient way to manage the sale of shares.

A robust sale of shares agreement template also facilitates due diligence. It clearly defines the scope of the buyer’s investigation into the company’s affairs, ensuring they have access to the information they need to make an informed decision. This transparency builds trust between the parties and reduces the likelihood of future claims based on misrepresentation or incomplete disclosure.

In short, a solid sale of shares agreement template is an indispensable tool for anyone involved in the sale or purchase of company shares. It provides clarity, protects your interests, saves you time and money, and promotes transparency. It’s an investment that can pay off handsomely by preventing future disputes and ensuring a smooth and successful transaction. You can find a sale of shares agreement template online or have one drafted by a solicitor.

Key Elements of a Comprehensive Agreement

So, what exactly should be included in your sale of shares agreement template? While the specifics will vary depending on the nature of the transaction, there are certain core elements that should always be present. These elements ensure that the agreement is comprehensive and legally sound, providing maximum protection for all parties involved.

First and foremost, the agreement must clearly identify the parties involved: the seller and the buyer. This includes their full legal names and addresses. It should also specify the number of shares being sold, the class of shares (e.g., ordinary shares, preference shares), and the percentage of ownership that the shares represent. This information is crucial for establishing the scope of the transaction and defining the rights and obligations of each party.

Another essential element is the purchase price and payment terms. The agreement should clearly state the total price being paid for the shares, as well as the method of payment (e.g., cash, bank transfer, installment payments) and the timeline for payment. If the payment is to be made in installments, the agreement should specify the amount of each installment, the due dates, and any interest charges that may apply. This level of detail helps to avoid misunderstandings and ensures that the seller receives the agreed-upon consideration.

Representations and warranties are also crucial. These are statements made by the seller about the company and the shares being sold. For example, the seller might warrant that they have full legal title to the shares, that the company is in good standing, and that there are no undisclosed liabilities. These representations and warranties provide the buyer with assurance about the company’s condition and give them recourse if the statements turn out to be false. The agreement should clearly outline the scope of these representations and warranties and the consequences of any breach.

Finally, the agreement should include provisions for governing law and dispute resolution. This specifies which jurisdiction’s laws will govern the interpretation and enforcement of the agreement. It also outlines the process for resolving any disputes that may arise, such as mediation or arbitration. These provisions help to ensure that any disagreements are resolved fairly and efficiently, without the need for costly and time-consuming litigation. Taking the time to carefully draft your sale of shares agreement template will protect your best interest now and in the future.

In conclusion, a sale of shares agreement template isn’t just a piece of paper; it’s a vital tool for navigating the complexities of buying and selling shares. It provides a clear framework for the transaction, protects your interests, and minimizes the risk of future disputes. With careful planning and a well-drafted agreement, you can ensure a smooth and successful outcome.

Whether you’re a seasoned investor or a first-time buyer, investing in a solid sale of shares agreement template is an investment in your peace of mind. It allows you to approach the transaction with confidence, knowing that you’ve taken the necessary steps to protect your interests and ensure a fair and transparent deal.