Ever found yourself needing a financial cushion, something you can dip into when unexpected expenses pop up or to seize a fleeting business opportunity? That’s where a revolving line of credit comes in handy. Think of it as a readily available pool of funds that you can borrow from, repay, and borrow again – up to a certain limit, of course. And to make sure everyone’s on the same page, a solid revolving line of credit agreement is essential. It’s the blueprint for the relationship between the lender and the borrower, outlining all the crucial details.

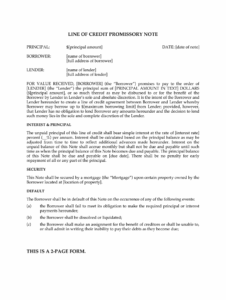

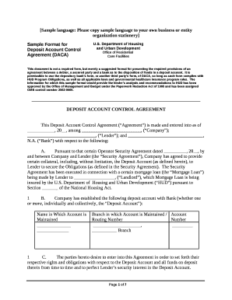

Crafting a well-defined agreement might seem daunting, filled with legal jargon and financial complexities. But fear not! A reliable revolving line of credit agreement template can be your best friend. It provides a framework, a starting point that you can customize to fit your specific needs and circumstances. Using a template ensures that you don’t miss any critical clauses and helps you avoid potential misunderstandings down the road.

In this article, we’ll delve into the intricacies of a revolving line of credit agreement, exploring what it entails, why it’s so important, and how you can leverage a template to create a document that protects both the lender and the borrower. We’ll break down the key components, discuss common pitfalls to avoid, and provide insights to help you navigate the process with confidence. So, whether you’re a business owner seeking financial flexibility or a lender offering credit solutions, understanding this type of agreement is crucial.

Understanding the Key Elements of a Revolving Line of Credit Agreement

A revolving line of credit agreement is more than just a piece of paper; it’s the foundation of a financial relationship. It clearly defines the rights and responsibilities of both the lender and the borrower. Let’s dissect the key elements that constitute a comprehensive and legally sound agreement.

First and foremost, the agreement should explicitly state the parties involved – the lender and the borrower. This includes their legal names, addresses, and any relevant business registration details. Clarity in identification is crucial to avoid any ambiguity or disputes later on.

Next up is the credit limit. This is the maximum amount of money that the borrower can access through the revolving line of credit. The agreement should clearly specify the credit limit in numerical and written form to prevent any confusion. It should also outline how the borrower can access the funds, whether through checks, electronic transfers, or other means.

Interest rates and fees are another critical aspect. The agreement should detail the interest rate applicable to the outstanding balance, whether it’s a fixed or variable rate. If it’s a variable rate, the agreement should specify the benchmark used to calculate the interest (e.g., prime rate plus a margin). Furthermore, it should clearly outline any fees associated with the credit line, such as annual fees, transaction fees, late payment fees, or over-limit fees. Transparency in fees is essential for maintaining a healthy lender-borrower relationship.

Repayment terms are just as important. The agreement should specify the minimum payment due each month, the due date, and the acceptable methods of payment. It should also address how payments are applied – whether to interest first, then principal, or vice versa. Additionally, the agreement should outline the consequences of late payments or defaults, including potential penalties or acceleration of the debt. Finally, a robust agreement will include covenants that the borrower agrees to adhere to, such as maintaining certain financial ratios or providing regular financial statements. These covenants are designed to protect the lender’s interests and ensure the borrower’s continued financial stability.

Why Use a Revolving Line of Credit Agreement Template?

Creating a comprehensive revolving line of credit agreement from scratch can be a time-consuming and error-prone process. That’s where a template comes in as a valuable resource. A well-designed template offers numerous benefits, making the process more efficient and less risky.

For starters, a template provides a pre-structured framework that includes all the essential clauses and provisions typically found in a revolving line of credit agreement. This ensures that you don’t overlook any critical elements and helps you avoid potential legal pitfalls. It acts as a checklist, guiding you through the process and ensuring completeness.

Another significant advantage of using a template is that it saves you time and effort. Instead of drafting the entire agreement from scratch, you can simply customize the template to fit your specific needs. This can significantly reduce the time spent on legal drafting, allowing you to focus on other important aspects of your business.

Templates also help ensure consistency across multiple agreements. If you’re a lender issuing multiple revolving lines of credit, using a standardized template can help you maintain consistency in your terms and conditions. This reduces the risk of errors and ensures that all borrowers are treated fairly.

However, it’s important to remember that a template is just a starting point. You should always carefully review the template and customize it to reflect the specific details of your transaction. This includes adjusting the credit limit, interest rate, fees, repayment terms, and any other relevant provisions.

Finally, while a template can be a helpful tool, it’s always advisable to consult with an attorney to ensure that your agreement is legally sound and protects your interests. An attorney can review the template, identify any potential issues, and provide tailored advice based on your specific circumstances.

With a clear agreement in place, both parties can confidently navigate their financial arrangement, knowing their rights and responsibilities are well-defined. Understanding these key elements and leveraging a template are crucial steps towards establishing a successful revolving line of credit.

A properly executed document will help to pave the way for a productive and secure financial relationship. It reduces the chances of disputes and provides a clear framework for resolving any issues that may arise.