Ever dreamed of owning a home but find yourself struggling to gather that hefty down payment or qualify for a traditional mortgage? You’re not alone. In Canada’s competitive housing market, many people are exploring alternative paths to homeownership. One such option gaining traction is the rent to own agreement. It’s essentially a lease agreement with a built in option to purchase the property at a later date.

Think of it like test driving your dream home before committing to buy. You get to live in the property, experience the neighborhood, and build equity over time. A portion of your monthly rent goes toward the eventual purchase price, making it a potentially more accessible route to owning a home, particularly for those with less than perfect credit or limited savings.

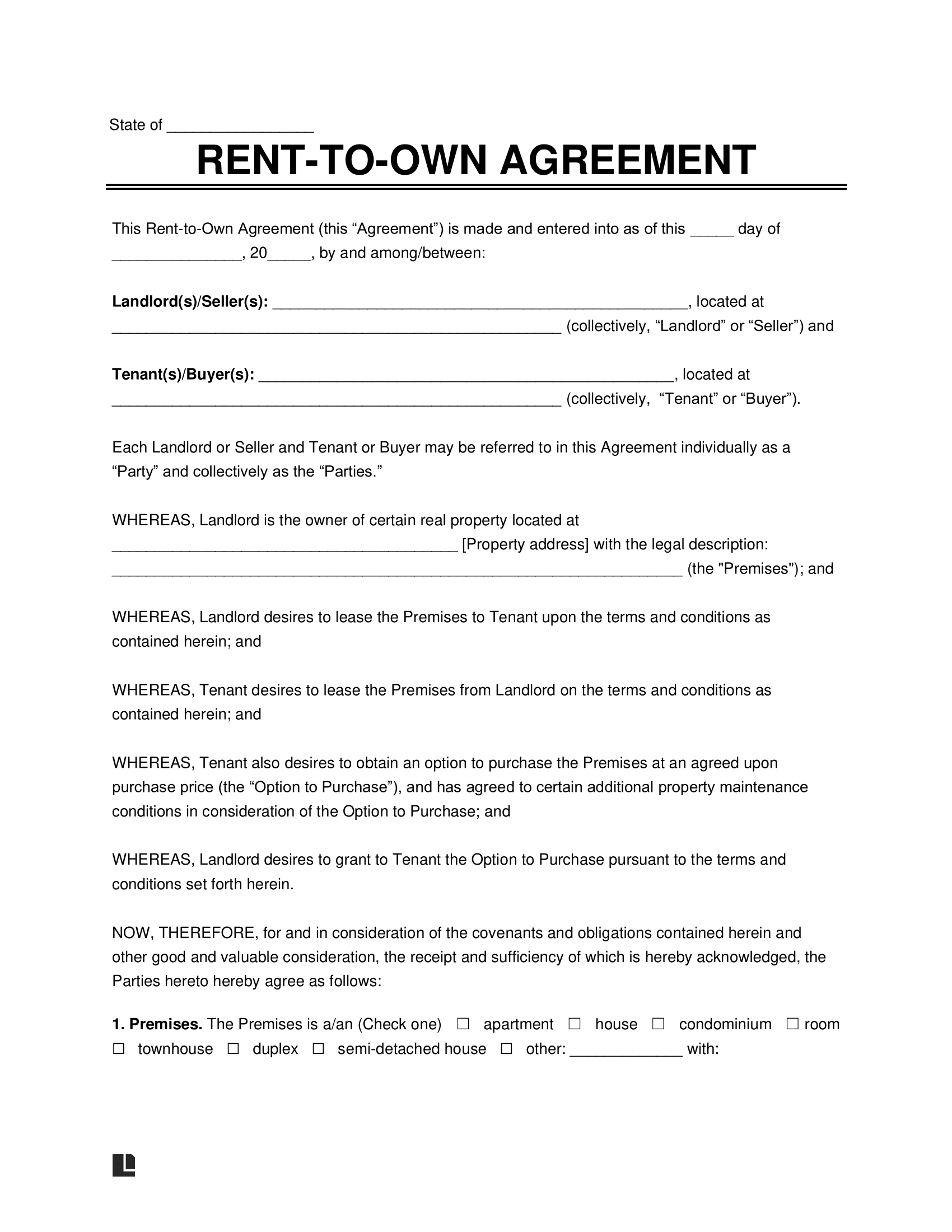

But navigating the world of rent to own agreements can feel daunting. That’s where a well drafted rent to own agreement template Canada comes in handy. It provides a structured framework outlining the rights and responsibilities of both the renter/buyer and the owner/seller, ensuring a fair and transparent process. This article will guide you through the essential elements of these agreements and help you determine if rent to own is the right choice for you.

Understanding the Ins and Outs of a Rent To Own Agreement

A rent to own agreement, at its core, is a legal contract that combines a lease agreement with an option to purchase. It’s crucial to understand that it’s not the same as a traditional mortgage. You’re essentially renting the property for a specified period, during which you have the option, but not the obligation, to buy it at a predetermined price. The agreement typically includes several key components.

First, there’s the lease agreement itself. This section outlines the standard terms of tenancy, such as the monthly rent amount, payment schedule, security deposit, and rules regarding property maintenance. It’s vital to pay close attention to these details, as any breach of the lease terms could jeopardize your option to purchase the property later on. For example, consistently late rent payments could be grounds for the seller to terminate the agreement.

Next, the agreement will specify the option fee. This is a one time, non refundable fee paid upfront for the right to purchase the property at the end of the lease term. The option fee serves as consideration for the seller granting you the exclusive right to buy the property during the agreed upon period. The agreement will clearly state how much of the rent is credited towards the purchase price and how much covers rent. It’s important to carefully analyze the rent credit structure to ensure it aligns with your financial goals.

Another critical element is the purchase price. The agreement will stipulate the price at which you can buy the property at the end of the lease term. This price might be fixed at the beginning of the agreement or determined based on a predetermined formula. It’s essential to consider factors like potential market fluctuations and property appreciation when negotiating the purchase price. A good rent to own agreement template Canada will provide space to consider these factors.

Finally, the agreement will outline the responsibilities of both the renter/buyer and the owner/seller regarding property maintenance and repairs. It’s crucial to clarify who is responsible for what to avoid disputes down the line. Generally, the renter/buyer is responsible for routine maintenance, while the owner/seller remains responsible for major repairs and structural issues. It’s important to ensure the agreement is well written and clearly outlines who handles the responsibilities for property taxes and property insurance too.

Key Considerations Before Entering a Rent To Own Agreement

Before diving headfirst into a rent to own agreement, it’s essential to carefully weigh the pros and cons and assess whether it aligns with your financial situation and long term goals. One of the biggest advantages is the opportunity to build equity while renting. A portion of your rent payments goes towards the eventual purchase price, allowing you to gradually accumulate funds towards your down payment.

Rent to own arrangements can also be a good option for those who may not qualify for a traditional mortgage due to credit issues or limited savings. It provides a pathway to homeownership while you work on improving your credit score and saving for a larger down payment. You are essentially given time to prove yourself as a future homeowner.

However, there are also potential downsides to consider. One of the biggest risks is the possibility of losing your option fee and accumulated rent credits if you’re unable to secure financing or decide not to purchase the property at the end of the lease term. This is why it’s crucial to carefully assess your financial situation and ability to qualify for a mortgage before entering the agreement.

Another potential risk is the possibility of the property’s value declining during the lease term. If the market takes a downturn, the predetermined purchase price might be higher than the current market value, making it less attractive to exercise your option to buy. It’s important to do your research and consider the potential risks of market fluctuations.

Ultimately, a rent to own agreement can be a viable path to homeownership for some, but it’s not without its risks. Carefully review the terms of the agreement, seek legal advice if needed, and assess your financial situation before committing. Using a comprehensive rent to own agreement template Canada can help you understand the various conditions that should be addressed in such a contract. Understand all the components before you sign.

Purchasing real estate in Canada doesn’t have to be a far-fetched dream. There are different paths that can be explored.

With careful consideration and due diligence, owning a home through rent to own can be a reality.