So, you’re thinking about diving into the world of real estate joint ventures? That’s fantastic! Real estate can be an incredibly rewarding investment, but sometimes, tackling projects alone can be daunting. A joint venture allows you to pool resources, expertise, and capital with other individuals or companies, making bigger and more complex projects possible. But before you shake hands and start dreaming of property empires, you absolutely need a solid foundation: a well-crafted joint venture agreement.

Think of this agreement as your roadmap to success and your shield against potential disputes. It clearly outlines the roles, responsibilities, and expectations of each party involved. It’s not just a piece of paper; it’s the glue that holds your partnership together, ensuring everyone is on the same page and working towards a common goal. Without it, you’re basically navigating unfamiliar territory without a map, which, let’s be honest, rarely ends well.

This article will explore the ins and outs of the real estate joint venture agreement template, helping you understand why it’s so crucial and what key elements it should contain. We’ll walk you through the essential clauses, explain the legal considerations, and give you some practical tips on how to customize a template to fit your specific needs. Consider this your guide to crafting a robust and reliable agreement that sets your joint venture up for success.

Understanding the Importance of a Real Estate Joint Venture Agreement

A real estate joint venture agreement is more than just a formality; it’s the bedrock of a successful partnership. It acts as a legal contract outlining every aspect of the venture, from initial investment to profit distribution. It anticipates potential conflicts and provides a framework for resolving them, saving everyone involved time, money, and a whole lot of stress down the line. In short, it’s the difference between a smooth sailing venture and a shipwreck waiting to happen.

One of the primary reasons for having a comprehensive agreement is to clearly define the roles and responsibilities of each party. Who is responsible for securing financing? Who will manage the day-to-day operations of the project? Who has the authority to make key decisions? The agreement should leave no room for ambiguity, ensuring that everyone knows exactly what is expected of them. This clarity helps prevent misunderstandings and ensures that tasks are completed efficiently.

Furthermore, a joint venture agreement should meticulously detail the financial contributions of each partner. How much capital will each party invest? Will these contributions be in the form of cash, property, or expertise? How will profits and losses be distributed? The agreement needs to specify the percentage ownership of each partner and the method for calculating and distributing returns. Addressing these financial aspects upfront is crucial for maintaining transparency and trust among the partners.

Another critical aspect of the agreement is outlining the decision-making process. How will major decisions be made? Will it require unanimous consent from all partners, or will a majority vote suffice? What happens if there’s a disagreement? The agreement should clearly define the procedures for resolving conflicts and making important decisions to avoid gridlock and ensure the venture can move forward smoothly. A well-defined decision-making process can prevent frustration and maintain momentum throughout the project.

Finally, the agreement should address exit strategies. What happens if one partner wants to leave the venture before its completion? What are the procedures for transferring ownership? How will the assets be divided if the venture is dissolved? Addressing these potential scenarios in advance can prevent costly legal battles and ensure a fair and orderly dissolution of the partnership if necessary. Planning for the end, even at the beginning, is a sign of a well-structured and thoughtful joint venture.

Key Elements to Include in Your Real Estate Joint Venture Agreement Template

When crafting your real estate joint venture agreement template, several key elements should be included to ensure comprehensive coverage and legal protection. These elements form the foundation of the agreement and address the most critical aspects of the partnership.

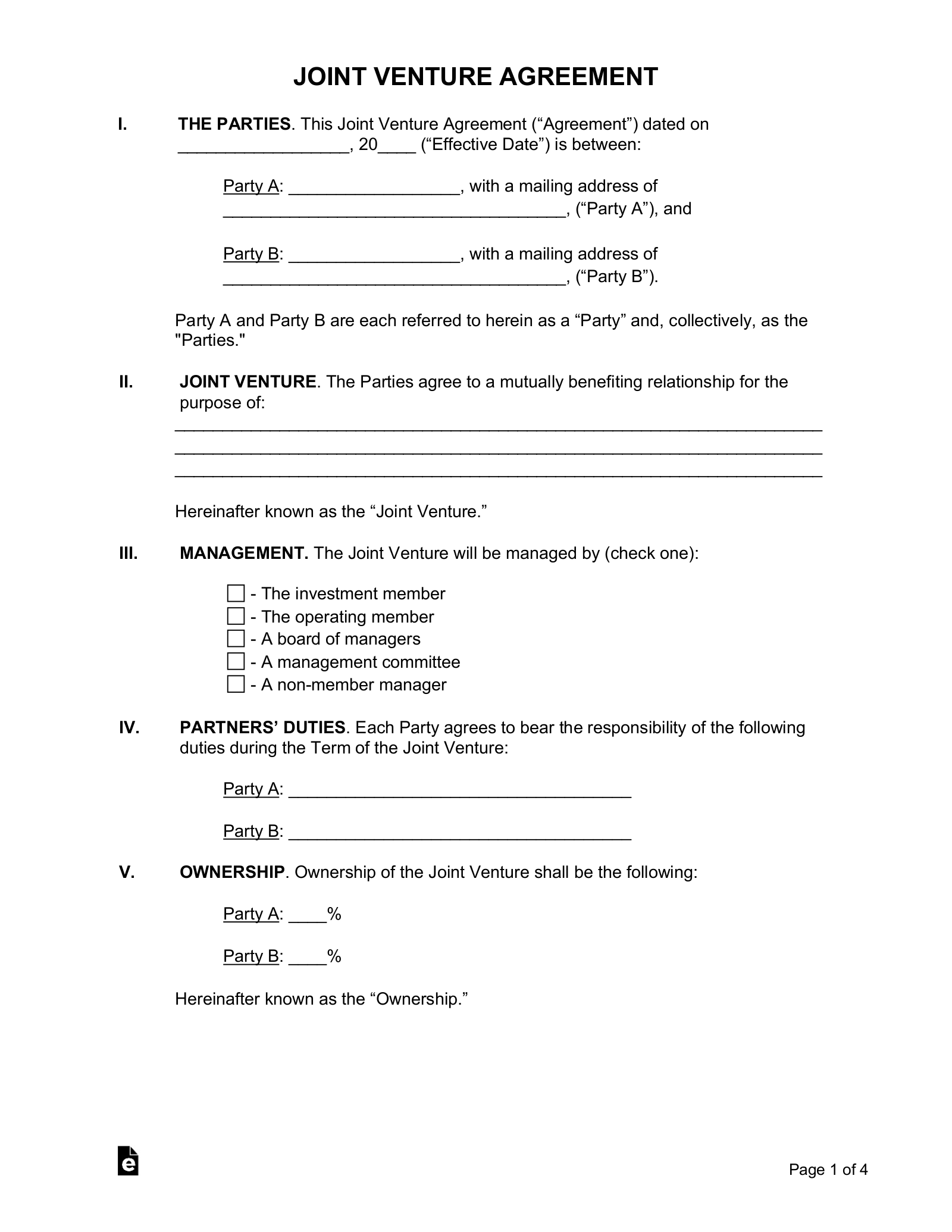

First and foremost, the agreement should clearly identify all parties involved, including their legal names and addresses. It should also state the purpose of the joint venture, specifying the particular real estate project or investment that the partnership intends to undertake. Providing a clear and concise description of the venture’s objectives sets the stage for the rest of the agreement.

The capital contributions of each partner should be detailed, specifying the amount of cash, property, or other assets that each party will contribute to the venture. The agreement should also outline the procedure for making additional capital contributions if needed, as well as the consequences for failing to meet those obligations. Clear financial terms are essential for ensuring that each partner understands their responsibilities and preventing financial disputes.

The management and decision-making structure of the joint venture should be clearly defined. The agreement should specify who will be responsible for managing the day-to-day operations, making key decisions, and overseeing the project. It should also outline the voting rights of each partner and the procedures for resolving disputes. A well-defined management structure promotes efficiency and accountability within the partnership.

Profit and loss distribution is another crucial element to address in the agreement. The agreement should specify how profits and losses will be allocated among the partners, taking into account their respective capital contributions and roles in the venture. It should also outline the timing and method of distributing profits, as well as the procedures for handling losses. Clear profit and loss distribution terms are essential for maintaining fairness and transparency among the partners.

Finally, the agreement should include provisions for termination and dissolution of the joint venture. This section should outline the circumstances under which the venture can be terminated, such as the completion of the project or a material breach of the agreement by one of the partners. It should also specify the procedures for distributing assets and winding up the affairs of the venture upon termination. A comprehensive termination clause can prevent costly legal battles and ensure a fair and orderly dissolution of the partnership.

Having a clear understanding of these elements can help you choose the right real estate joint venture agreement template that will fit your needs. You can also customize the real estate joint venture agreement template to suit the needs of your joint venture.

In the end, creating a solid real estate joint venture agreement is not just about protecting your own interests. It’s about fostering a collaborative environment where everyone involved can thrive and contribute to the success of the project. It’s about building a strong foundation for a mutually beneficial partnership.