Starting a Limited Liability Company (LLC) in Washington state is an exciting venture. You’re taking the plunge into entrepreneurship and building something from the ground up. One of the most crucial, yet often overlooked, documents you’ll need is a Washington LLC operating agreement. Think of it as the roadmap for your business, outlining how it will be run, who is responsible for what, and what happens if disagreements arise. It’s not just a formality; it’s the foundation for a smooth and successful operation.

While Washington doesn’t legally require an operating agreement for single-member or multi-member LLCs, having one is highly recommended. It provides clarity, protects your personal assets, and demonstrates to banks, investors, and even the state that you’re serious about your business. This document acts as a shield, separating your personal liabilities from those of the company, a key benefit of forming an LLC in the first place. Without it, you might be relying on default state laws, which might not be ideal for your specific business needs.

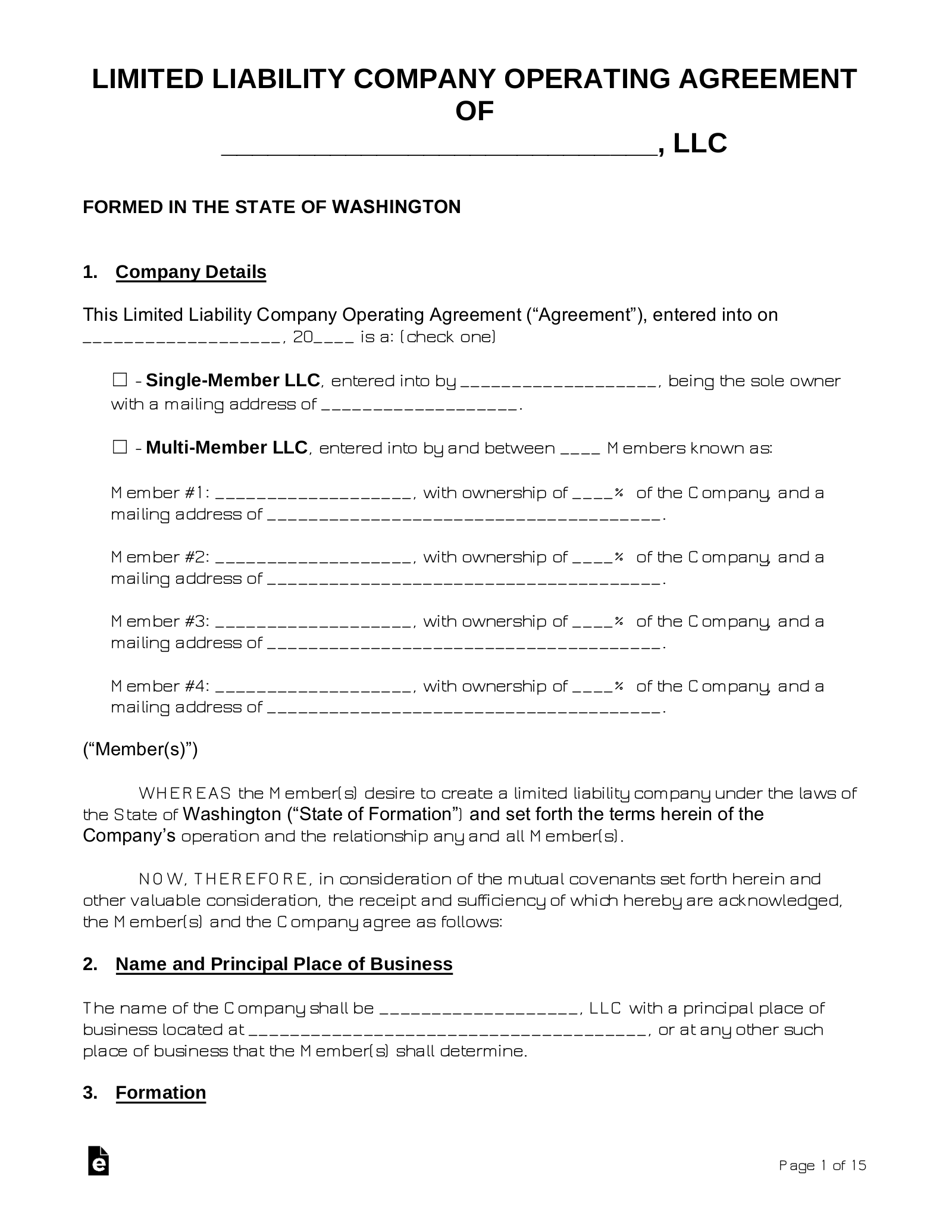

So, where do you start? Creating an operating agreement from scratch can seem daunting. Luckily, a Washington LLC operating agreement template can be a lifesaver. These templates provide a basic framework, ensuring you cover all the essential elements while allowing you to customize the agreement to fit your unique circumstances. Finding the right template and understanding how to adapt it to your business is the key to setting yourself up for success.

Why You Absolutely Need an Operating Agreement (Even if Washington Doesn’t Require It)

Even though Washington state law does not mandate that LLCs have an operating agreement, overlooking this important document is a serious mistake. Think of it like this: you wouldn’t drive across the country without a map, would you? An operating agreement is your business’s map, guiding it through potential roadblocks and ensuring everyone is on the same page. It establishes clear rules and procedures for how your LLC will function, preventing misunderstandings and conflicts down the road.

One of the most important reasons to have an operating agreement is to maintain the limited liability protection that an LLC offers. This protection shields your personal assets from business debts and lawsuits. However, if you don’t have a clear separation between your personal and business finances and operations, a court might “pierce the corporate veil,” leaving your personal assets vulnerable. An operating agreement helps demonstrate that your LLC is a separate and distinct entity, reinforcing this crucial liability protection.

Furthermore, an operating agreement allows you to tailor your LLC’s rules to your specific needs. Washington state law provides default rules for LLCs, but these might not be the best fit for your business. For example, the default rules might dictate how profits are distributed or how decisions are made. With an operating agreement, you can customize these rules to reflect your unique circumstances and preferences. This is especially important for multi-member LLCs, where clear agreements on management, ownership, and profit sharing are essential.

Beyond protecting your personal assets and customizing your LLC’s rules, an operating agreement provides clarity and structure. It outlines the responsibilities of each member, the process for making decisions, and what happens if a member leaves or the LLC dissolves. This clarity can prevent disputes and ensure that everyone is working towards the same goals. It can also be helpful when seeking funding from banks or investors, as they often want to see a well-defined operating agreement.

Consider the scenario where one member wants to leave the LLC. Without an operating agreement outlining the process for transferring ownership and distributing assets, this situation could quickly escalate into a legal battle. An operating agreement anticipates such scenarios and provides a clear framework for resolving them, saving you time, money, and stress. Using a Washington LLC operating agreement template as a starting point helps you consider all these potential issues and create a document that protects your interests.

Key Elements to Include in Your Washington LLC Operating Agreement

Creating a comprehensive operating agreement doesn’t have to be overwhelming. A good Washington LLC operating agreement template will guide you through the essential elements. However, it’s important to understand what those elements are and how they apply to your specific business.

First and foremost, you’ll need to clearly identify the members of the LLC and their respective ownership percentages. This section should specify who owns what portion of the company and how profits and losses will be distributed. It’s also important to define the roles and responsibilities of each member. Who will manage the day-to-day operations? Who will handle the finances? Clearly outlining these roles prevents confusion and ensures accountability.

The operating agreement should also address how decisions will be made. Will decisions be made by a majority vote? Will some decisions require unanimous consent? This section should also specify the process for holding meetings and documenting decisions. It’s important to have a clear process for resolving disputes among members. This could involve mediation, arbitration, or even a buyout provision.

Another crucial element is the transfer of ownership. What happens if a member wants to sell their interest in the LLC? Does the other member(s) have the right of first refusal? This section should also address what happens if a member dies or becomes incapacitated. Having a clear plan for these scenarios can prevent significant disruptions to the business.

Finally, the operating agreement should outline the process for dissolving the LLC. Under what circumstances will the LLC be dissolved? How will the assets be distributed? This section should also address any outstanding debts or liabilities. It’s important to have a clear plan for dissolving the LLC to avoid potential legal complications. Remember to tailor your Washington LLC operating agreement template to reflect your specific needs and circumstances.

Creating an operating agreement might seem like just another task on your long to-do list. But taking the time to craft a solid one is an investment in the long-term success and stability of your Washington LLC. It provides clarity, protects your personal assets, and sets the stage for a thriving business.

In conclusion, while you might be tempted to skip this step, remember that the small upfront investment of time and effort in creating a well-drafted operating agreement far outweighs the potential headaches and legal issues you might face down the line. Consider it cheap insurance for your business and peace of mind for you.