Buying a car from a dealership isn’t the only option out there. Sometimes, you might find a better deal or a specific model you’re after from a private seller. But when you’re dealing with a private party, financing can get a little trickier. That’s where a private party car loan agreement template comes in handy. It’s a legal document that outlines the terms of a loan between two individuals for the purchase of a vehicle.

Think of it as a safety net for both the buyer and the seller. It clearly defines the loan amount, interest rate, repayment schedule, and what happens if payments are missed. Without a written agreement, things can get messy fast. Relying on a handshake deal might seem friendly, but it leaves you vulnerable to misunderstandings and potential legal disputes down the road.

This article will guide you through understanding what a private party car loan agreement template is, why you need one, and what key elements should be included. We’ll also touch on some common pitfalls to avoid, helping you navigate the process with confidence. Let’s dive in and explore how to protect yourself in a private car sale transaction.

Understanding the Importance of a Private Party Car Loan Agreement

A private party car loan agreement isn’t just a piece of paper; it’s a vital tool for protecting your interests in a private vehicle sale. When you borrow money from a bank or credit union to buy a car, they typically have standardized loan agreements in place. However, in a private sale, you’re responsible for creating a clear and legally sound agreement. This document ensures everyone is on the same page and minimizes the risk of future disagreements or legal issues.

Imagine lending a friend or family member money to buy a car without a formal agreement. What happens if they fall behind on payments? How do you handle late fees? Without a documented agreement, it becomes incredibly difficult to enforce the loan terms and recover your money. A well-drafted agreement serves as evidence of the loan and clearly outlines the consequences of non-payment.

Moreover, a private party car loan agreement can help prevent misunderstandings about the vehicle itself. It can include details about the car’s condition, any known issues, and whether or not a warranty is included. This transparency can build trust between the buyer and seller and reduce the likelihood of disputes arising after the sale.

Furthermore, using a private party car loan agreement template can simplify the process and save you time and money. Instead of hiring a lawyer to draft a custom agreement, you can use a template as a starting point and customize it to fit your specific needs. This can be especially helpful if you’re on a tight budget or simply want to avoid the expense of legal fees. Many reliable templates are available online, offered by reputable sources.

Finally, it’s always a good idea to have a lawyer review any legal document, including a private party car loan agreement template, before signing it. This can help ensure that the agreement is legally sound and protects your interests effectively. While using a template can be convenient, a lawyer can provide valuable insights and identify any potential loopholes or areas of concern.

Key Elements to Include in Your Agreement

A comprehensive private party car loan agreement should include several key elements to ensure clarity and enforceability. Let’s break down some of the most important components.

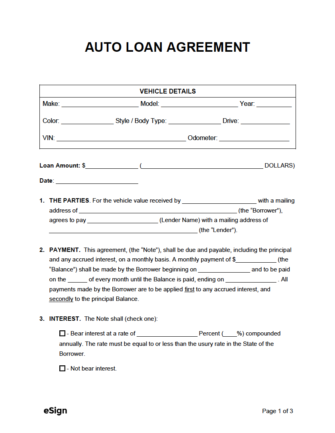

First and foremost, the agreement should clearly identify the parties involved: the lender (the seller or whoever is providing the loan) and the borrower (the buyer). Include their full legal names and addresses. This information is crucial for legal identification and communication.

Next, specify the loan amount and the interest rate. The loan amount is the total amount of money being borrowed. The interest rate is the percentage charged on the loan, which determines the cost of borrowing. Clearly state whether the interest rate is fixed or variable. Also include the details about the car being sold. Year, Make, Model, VIN should be included.

The repayment schedule is another critical element. Outline the frequency of payments (e.g., monthly, bi-weekly), the amount of each payment, and the due date. It’s also a good idea to specify the method of payment (e.g., check, electronic transfer) and where payments should be sent. Consider adding a grace period for late payments, but also clearly define the penalties for late or missed payments.

The agreement should also address what happens if the borrower defaults on the loan. Default occurs when the borrower fails to make payments as agreed. The agreement should outline the lender’s rights in the event of default, such as the right to repossess the vehicle. Also, make sure the document clearly specifies who is responsible for insuring the car during the loan period. Typically, the buyer is responsible for maintaining insurance coverage to protect against damage or loss.

Finally, include a section for signatures and dates. Both the lender and the borrower should sign and date the agreement in the presence of a notary public. Notarization adds an extra layer of legal validity to the document, making it more difficult to challenge in court. Remember, a well-crafted private party car loan agreement template is a valuable tool for protecting your interests and ensuring a smooth and legally sound transaction.

Navigating a private car sale doesn’t need to be stressful. Armed with the right knowledge and a solid private party car loan agreement template, you can confidently manage the transaction and secure your financial interests. Remember to personalize the template and seek legal advice when necessary for a secure and satisfactory outcome.

In the end, taking the time to create a comprehensive loan agreement can save you headaches and heartache in the future. A little planning goes a long way when it comes to protecting your finances and ensuring a fair and transparent transaction for both parties involved.