Ever found yourself scrambling to remember to pay a bill on time? We’ve all been there. Late fees, potential service disruptions, it’s a headache nobody wants. That’s where the beauty of a pre authorized debit agreement comes in. It’s essentially a simple way to automate your payments, ensuring your bills are paid consistently and on time, directly from your bank account. Think of it as setting your bills on autopilot.

This article will guide you through everything you need to know about pre authorized debit agreements, also known as PAD agreements. We’ll cover what they are, how they work, and most importantly, how to create one using a pre authorized debit agreement template. This template makes setting up this convenient payment method simple and straightforward.

By the end of this read, you’ll be equipped to take control of your recurring payments, avoid late fees, and enjoy the peace of mind that comes with knowing your bills are handled automatically. Let’s dive in and explore the world of automated payments and how a pre authorized debit agreement template can simplify your financial life.

Understanding Pre Authorized Debit Agreements

So, what exactly *is* a pre authorized debit agreement? In a nutshell, it’s a written agreement between you (the payer) and a business or organization (the payee) that authorizes them to withdraw funds directly from your bank account on a regular basis. Think of it like giving someone permission to automatically deduct your monthly rent, utility bill, or subscription fee. The beauty lies in its convenience and reliability. Instead of manually paying each bill, the agreement ensures the payment is made on time, every time, without you having to lift a finger.

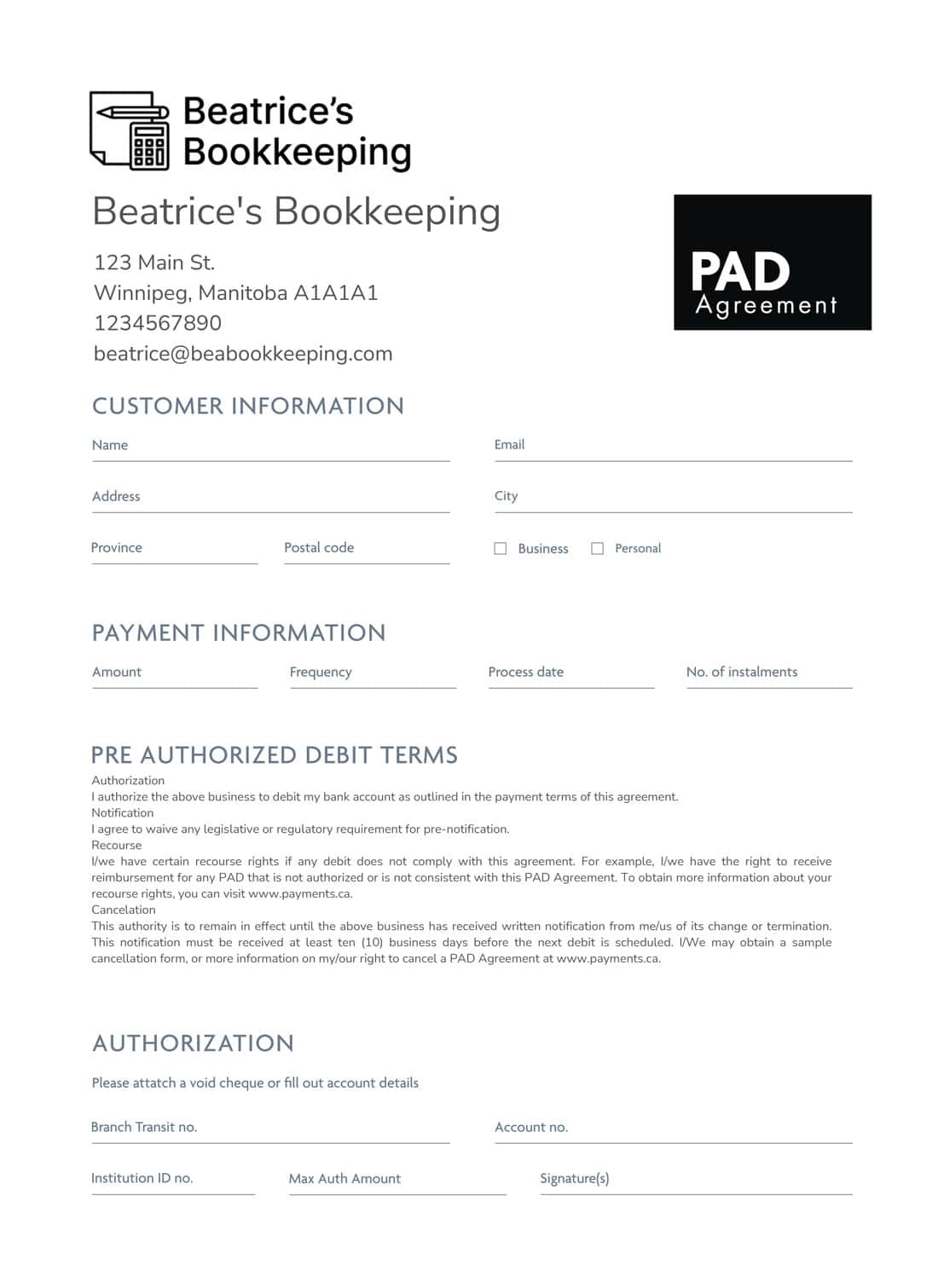

Several key elements make up a solid pre authorized debit agreement. First, it clearly identifies both the payer and the payee, including contact information and bank details. Second, it specifies the amount to be debited, the frequency of the debits (e.g., monthly, bi-weekly), and the date on which the debits will occur. Thirdly, it outlines the terms and conditions of the agreement, including how to cancel or modify it. Finally, a crucial part is the authorization clause, where you, the payer, explicitly give your consent for the debits to take place. Without this explicit consent, the agreement is invalid.

Why are PAD agreements so popular? Besides the convenience factor, they also offer increased security. By automating payments, you reduce the risk of forgetting to pay a bill and incurring late fees. You also gain more control over your finances because you can easily track your recurring expenses through your bank statements. Furthermore, many businesses and organizations offer discounts or incentives for customers who opt for pre authorized debit payments, making it a win-win for both parties. You can find a pre authorized debit agreement template online to help you create the document.

However, it’s essential to exercise caution and due diligence when setting up a pre authorized debit agreement. Before signing any agreement, carefully review the terms and conditions to ensure you understand your rights and obligations. Make sure the payee is a reputable organization and that you trust them with your banking information. It’s also a good idea to set up alerts or notifications from your bank so you can monitor your account for unauthorized debits. If you ever suspect fraudulent activity, contact your bank immediately to dispute the charges.

Key Considerations Before Authorizing a PAD

Before you jump into using a pre authorized debit agreement template, there are some things to consider. First, carefully evaluate your budget and make sure you can comfortably afford the recurring payments. Second, choose a payee you trust and are familiar with. Third, read the fine print of the agreement to understand your rights and responsibilities. Finally, keep a copy of the agreement for your records, and always be proactive in monitoring your bank statements for any unexpected or unauthorized debits. By taking these precautions, you can enjoy the convenience of pre authorized debit payments while protecting yourself from potential risks.

Creating Your Pre Authorized Debit Agreement with a Template

Using a pre authorized debit agreement template is a fantastic way to streamline the process and ensure you include all the necessary information. These templates are readily available online and often offered as free downloads. When selecting a template, ensure it’s from a reputable source and covers all the essential elements we discussed earlier. Look for templates that are customizable and easy to adapt to your specific needs. A good pre authorized debit agreement template will guide you through each section, prompting you to provide the relevant details.

The first step is to download a suitable pre authorized debit agreement template. Then, carefully fill in all the required information, including your name, address, bank account details, and the payee’s information. Be precise and double-check all entries to avoid errors. Next, specify the amount to be debited, the frequency of the debits, and the debit start date. Most templates will also include a section for special instructions or additional terms and conditions. If necessary, add any relevant details or modifications to tailor the agreement to your unique situation.

Once you’ve completed filling in the template, it’s crucial to review the entire document thoroughly. Double-check all the information for accuracy, and make sure you understand every clause and condition. If anything is unclear or confusing, seek clarification from the payee before signing the agreement. It’s always better to ask questions and ensure you’re comfortable with the terms before committing to the pre authorized debit arrangement.

After you’re satisfied with the content of the agreement, print a copy and sign it. Then, provide a copy to the payee and retain a copy for your records. It’s also a good idea to inform your bank about the pre authorized debit agreement so they can monitor your account for the authorized debits. By following these steps, you can create a legally binding and effective pre authorized debit agreement that will simplify your payment process and protect your interests.

Remember, a pre authorized debit agreement template is a helpful tool, but it’s not a substitute for professional legal advice. If you have any complex financial or legal concerns, it’s always best to consult with a qualified professional. They can provide personalized guidance and ensure your agreement complies with all applicable laws and regulations.

Automating your payments can free up your time and mental energy. Knowing your bills are taken care of reduces stress and allows you to focus on other important aspects of your life.

Imagine a future where you no longer have to worry about missing a payment deadline. That’s the promise of pre authorized debits – a simpler, more efficient way to manage your recurring financial obligations.