So, you’re thinking about lending money to a friend or family member in California, or maybe you’re the one borrowing. That’s great! Helping each other out is what it’s all about. But before you hand over that cash, or before you accept it, it’s super important to get everything in writing. This is where a personal loan agreement comes in handy. Think of it as a friendly, but official, roadmap for your financial arrangement. It protects both the lender and the borrower by clearly outlining the terms of the loan, leaving little room for misunderstandings down the road. Trust me, a little paperwork now can save a whole lot of headaches later.

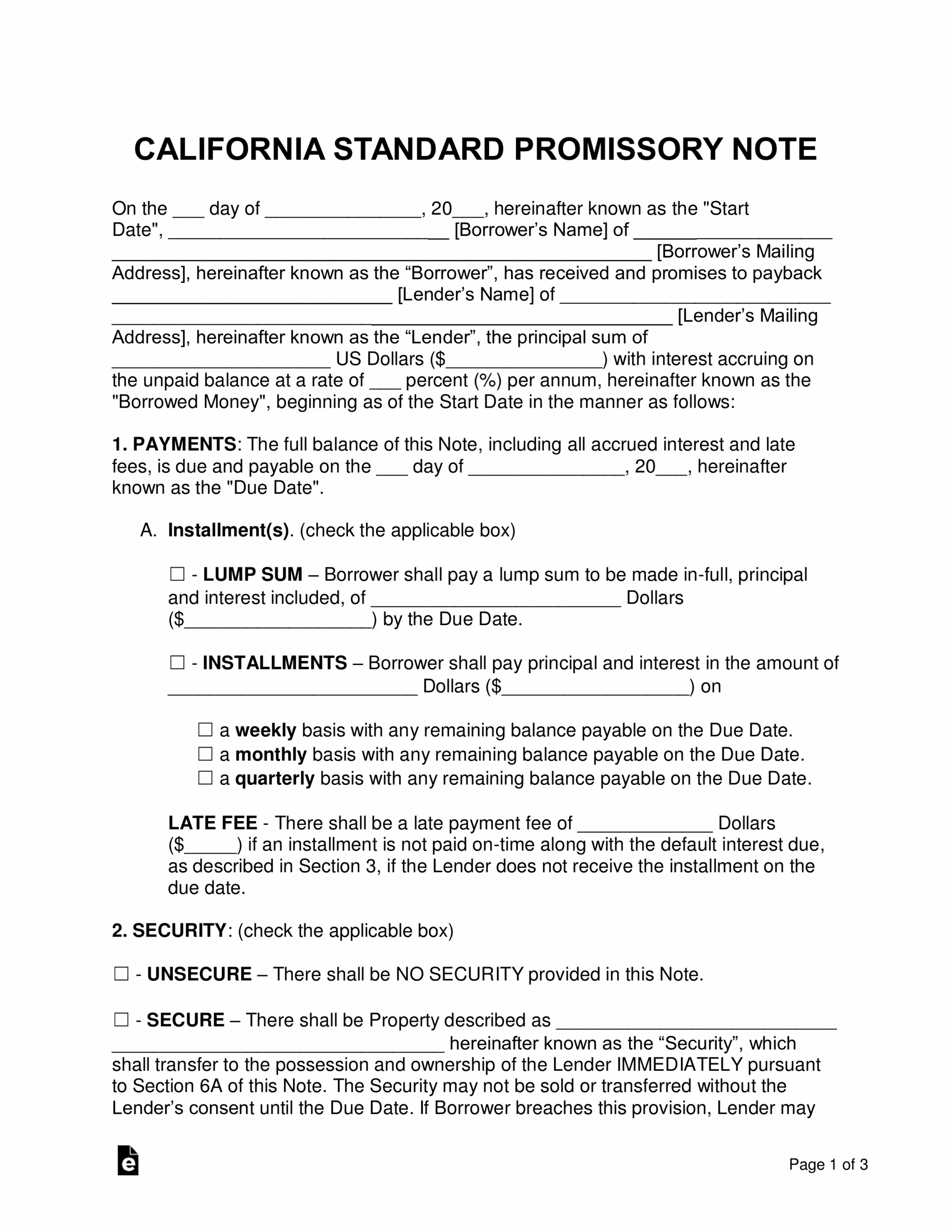

Why is this important specifically in California? Well, California has its own set of laws and regulations that govern loan agreements. A generic, one-size-fits-all loan agreement might not hold up in a California court if a dispute arises. Using a personal loan agreement template California that’s tailored to the state’s legal requirements ensures that your agreement is enforceable and protects your interests. It’s like having a legal safety net specifically designed for California’s financial landscape.

In this article, we’ll break down why using a personal loan agreement template California is so crucial, what key elements you need to include, and where you can find reliable templates to get you started. We’ll walk you through the process in plain English, avoiding confusing legal jargon. By the end, you’ll feel confident in creating a loan agreement that protects everyone involved and fosters a positive relationship throughout the loan term.

Why Use a Personal Loan Agreement Template California?

Think of a personal loan agreement as the foundation of a successful and stress-free lending arrangement. Without it, you’re building on shaky ground, and disagreements are far more likely to arise. A well-written agreement clarifies expectations, sets clear boundaries, and provides a framework for resolving any potential issues that may crop up during the loan period. This is especially critical when dealing with friends or family, where emotions can sometimes cloud judgment.

One of the most significant benefits of using a personal loan agreement template California is that it ensures compliance with California state law. As mentioned earlier, California has specific regulations that govern loan agreements, including requirements for interest rates, late fees, and default provisions. A template specifically designed for California will incorporate these legal requirements, helping you avoid potential legal challenges down the line. Trying to adapt a generic template could lead to costly errors and unenforceable clauses.

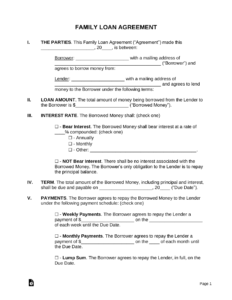

Another key advantage is that a template provides a structure for your agreement, prompting you to consider all the important elements that should be included. These include the principal loan amount, the interest rate (if any), the repayment schedule, any collateral securing the loan, and the consequences of default. Having a template ensures that you don’t accidentally overlook any crucial details, which could leave you vulnerable in case of a dispute.

Beyond the legal and practical benefits, a loan agreement can also strengthen the relationship between the lender and borrower. By openly discussing and documenting the terms of the loan, you demonstrate respect for each other’s financial well-being. This transparency can foster trust and understanding, making it less likely that disagreements will arise due to misunderstandings or unmet expectations. It shows you both are taking the loan seriously and are committed to fulfilling your respective obligations.

Furthermore, having a written agreement can be invaluable if you ever need to take legal action to recover the loan amount. While hopefully, it never comes to that, having a legally sound document will significantly improve your chances of success in court. Without a written agreement, you’ll be relying solely on verbal agreements and potentially conflicting recollections, which can be very difficult to prove in court. The agreement serves as concrete evidence of the loan’s terms and conditions.

Key Elements to Include in Your California Personal Loan Agreement

When crafting your personal loan agreement template California, certain elements are absolutely essential. First and foremost, clearly state the full legal names and addresses of both the lender and the borrower. This establishes the identities of the parties involved and ensures that they can be easily contacted if necessary. Next, specify the exact principal amount of the loan. This is the amount of money that the lender is lending to the borrower. Leave no room for ambiguity here.

The interest rate, if any, should also be clearly stated. California law sets limits on the amount of interest that can be charged on personal loans, so be sure to comply with these regulations. The repayment schedule is another critical element. Specify the amount of each payment, the frequency of payments (e.g., monthly, weekly), and the due date for each payment. A detailed repayment schedule will help the borrower stay on track and avoid late fees. Finally, outline the consequences of default. What happens if the borrower fails to make payments on time? What remedies does the lender have available?

Finding the Right Personal Loan Agreement Template California

So, where do you find a reliable personal loan agreement template California? The internet is a vast resource, but it’s important to be discerning about the templates you choose. Not all templates are created equal, and some may not be legally compliant or tailored to California law. Start by checking reputable legal websites and online legal service providers. These sites often offer a variety of legal forms and templates, including loan agreements, that have been reviewed by attorneys.

Another option is to consult with a California-licensed attorney. While this may involve a cost, an attorney can provide valuable guidance and ensure that your loan agreement is tailored to your specific needs and circumstances. An attorney can also review the agreement to ensure that it complies with California law and protects your interests. This is especially important if the loan amount is significant or if there are any complex issues involved.

When searching for a template, look for one that is specifically designed for use in California. The template should include all the essential elements mentioned earlier, such as the principal loan amount, interest rate, repayment schedule, and default provisions. It should also be clearly written and easy to understand, avoiding unnecessary legal jargon. A good template will also include instructions and guidance to help you complete the form accurately.

Before using any template, be sure to carefully review it and make any necessary modifications to fit your specific situation. Don’t simply fill in the blanks without understanding the legal implications of each clause. If you’re unsure about any aspect of the template, seek legal advice from a qualified attorney. Remember, a little bit of due diligence upfront can save you a lot of headaches down the road.

Finally, consider using a template that allows for customization. Every loan situation is unique, and a customizable template will allow you to tailor the agreement to your specific needs and preferences. For example, you may want to add additional clauses to address specific issues, such as the use of collateral or the consequences of early repayment. A customizable template will give you the flexibility to create an agreement that truly reflects the terms of your loan.

Having a clear, written personal loan agreement template California offers peace of mind for both parties. It avoids misunderstandings and sets clear expectations. It documents the loan’s terms in a way that can be referenced should questions or issues arise.

Ultimately, taking the time to create a well-written personal loan agreement is an investment in your relationships. It demonstrates respect and fosters open communication, setting the stage for a successful financial arrangement and strong personal connections.