So, you’re thinking of lending a friend or family member some cash to buy a car, or maybe you’re the one borrowing the money? That’s awesome! Helping each other out is what it’s all about. But, before you just hand over the keys (or the money!), it’s a really good idea to get everything in writing. That’s where a personal car loan agreement template comes in handy. Think of it as a way to protect both of you and keep your relationship smooth sailing. It’s all about clarity and avoiding misunderstandings down the road.

A personal car loan agreement template isn’t some scary legal document meant to intimidate anyone. It’s simply a structured way to outline the terms of the loan, making sure everyone understands their responsibilities. Things like the loan amount, interest rate (if any), repayment schedule, and what happens if payments are late – all of these details are clearly laid out. This way, you have a written record of your agreement. This helps keep things fair and transparent for both parties. No need for awkward conversations later!

Using a personal car loan agreement template can save you a lot of headaches and potential disagreements down the line. It’s about setting clear expectations and having a reference point to fall back on if any questions or issues arise. Plus, it’s just good financial practice. Think of it as a safety net for your friendship or family connection. Let’s dive in and see what exactly goes into one of these templates and why it’s so important to use one.

What Makes a Great Personal Car Loan Agreement Template?

A solid personal car loan agreement template needs to cover all the essential details of the loan. It’s not just about saying “I’ll lend you money for a car.” It’s about spelling out everything to avoid any confusion or ambiguity later on. This includes the obvious stuff, like the exact amount of the loan, but also less obvious things, like the method of repayment. It also needs to specify the consequences if a payment is missed or late. A well-crafted agreement protects both the lender and the borrower and helps maintain a healthy relationship.

Think about it this way: The template is like a roadmap for the loan. It should clearly outline the route (repayment schedule), landmarks (payment due dates), and potential detours (late payment consequences). Without a clear roadmap, you might end up lost and confused, and that’s the last thing you want when dealing with money and personal relationships. A good template covers all the bases, ensuring that everyone is on the same page.

Beyond the basic details, the template should also include clauses that protect both parties. For example, there might be a clause specifying what happens if the borrower sells the car before the loan is repaid. Or perhaps a clause outlining the process for resolving disputes. These kinds of provisions might seem unnecessary at first, but they can be incredibly valuable if unexpected circumstances arise. It’s always better to be prepared for anything.

Furthermore, a great template is easy to understand and use. It should be written in plain language, avoiding legal jargon that can be confusing to the average person. The template should also be easily customizable so that it can be adapted to fit the specific needs of the lender and borrower. A user-friendly template will encourage both parties to fill it out thoroughly and accurately, leading to a stronger and more reliable agreement.

Finally, consider the source of your personal car loan agreement template. Make sure it comes from a reputable source or has been reviewed by someone with legal or financial expertise. This can help ensure that the template is legally sound and covers all the necessary elements. There are plenty of resources available online. Just do your research to find a template that you can trust. After all, you’re relying on this document to protect your financial interests and your relationships.

Key Elements to Include in Your Agreement

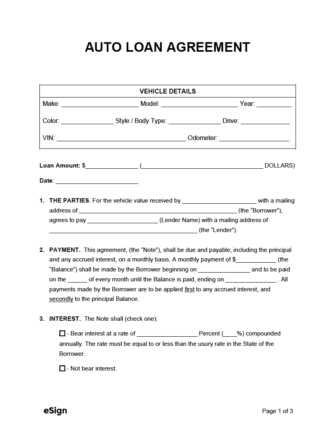

So, you’ve found a personal car loan agreement template, but what exactly should it include? Let’s break down the essential components to ensure you’re covering all your bases. First and foremost, the agreement should clearly identify the lender and the borrower, including their full names and addresses. This might seem obvious, but it’s an important detail to get right from the start. Then, you need to specify the exact amount of the loan being provided. This should be a precise figure, not an estimate.

Next up, the agreement needs to outline the interest rate, if any. If you’re lending money to a friend or family member, you might choose to forgo interest altogether. However, if you do decide to charge interest, make sure to specify the rate clearly. You’ll also need to specify how the interest will be calculated. Is it simple interest or compound interest? This is important information to include to avoid any confusion later on. The template should also have a section for the repayment schedule. How often will payments be made? Weekly, bi-weekly, or monthly? And what is the exact date each payment is due?

Another crucial element is detailing the method of repayment. Will the borrower be sending you a check, using an online payment platform, or making direct deposits into your account? Specify the preferred method to avoid any missed payments or confusion. The template should also include a section outlining the consequences of late or missed payments. What happens if the borrower is late with a payment? Will there be a late fee? And if so, how much? How many missed payments before the lender can take legal action?

The agreement should also specify what happens if the borrower defaults on the loan. This might include taking possession of the car or pursuing legal action to recover the outstanding debt. It’s important to be clear about these consequences from the beginning. Also, include a section that covers the sale of the vehicle. What happens if the borrower decides to sell the car before the loan is fully repaid? Will the proceeds from the sale be used to pay off the remaining debt? This is an important consideration to address in the agreement.

Finally, remember to include a section for signatures. Both the lender and the borrower should sign and date the agreement to indicate their acceptance of the terms. It’s also a good idea to have the signatures notarized to make the agreement legally binding. Having a well-documented and signed agreement is the best way to protect yourself, your finances, and your relationship with the borrower.

Creating a loan, whether lending or borrowing, is always an exercise in trust, but putting the proper structure in place ensures peace of mind. The personal car loan agreement template can smooth the process for both the lender and borrower by outlining expectations, responsibilities, and possible issues.

Ultimately, taking the time to create a clear and comprehensive agreement is a smart decision that benefits everyone involved. This demonstrates respect for each other and sets the foundation for a successful financial arrangement.