So, you’re thinking about lending money to a friend or family member, or maybe you’re the one asking for a little financial help. That’s fantastic! Helping each other out is what makes the world go round. But before you hand over that cash or accept the loan, it’s really, really important to get everything down in writing. That’s where a person to person loan agreement template comes in handy. It’s not just about the money; it’s about protecting your relationship and ensuring everyone is on the same page.

Think of a person to person loan agreement template as a roadmap for your financial arrangement. It clarifies the loan amount, interest rate (if any), repayment schedule, and what happens if things don’t go according to plan. It’s like a safety net for both the lender and the borrower. Without a proper agreement, misunderstandings can arise, leading to awkward conversations and potentially strained relationships. Nobody wants that, right?

This article will guide you through why using a person to person loan agreement template is crucial, what key elements it should include, and how to use one effectively. We’ll break it down in a simple, easy-to-understand way, so you can confidently create a loan agreement that works for everyone involved. Let’s get started!

Why You Absolutely Need a Loan Agreement When Lending to Friends and Family

Okay, let’s be honest. Talking about money with loved ones can be uncomfortable. It’s tempting to just say, “Here’s the money, pay me back when you can,” and leave it at that. But trust me, that’s a recipe for disaster. The main reason to use a person to person loan agreement template is to avoid future disputes and maintain a healthy relationship. A well-defined agreement eliminates ambiguity and clearly outlines the responsibilities of both parties. It shows that you’re taking the loan seriously and that you value the relationship enough to handle the situation professionally.

Consider this: what happens if the borrower loses their job and can’t make the payments? Or what if the lender suddenly needs the money back sooner than expected? Without a written agreement, these situations can quickly escalate into heated arguments and resentment. A loan agreement provides a framework for addressing these issues in a fair and transparent manner. It specifies the consequences of late payments, the process for renegotiating the terms, and the options for resolving disputes.

Another crucial aspect is clarity on interest. While you might choose not to charge interest to a loved one, it’s essential to state that explicitly in the agreement. This prevents any misunderstandings later on, especially if the borrower assumes there’s no interest while the lender secretly expects some return on their investment. Laying out everything in black and white ensures that everyone is on the same page regarding the financial obligations involved.

Furthermore, having a loan agreement can be helpful for tax purposes. If you are charging interest on the loan, you will need to report that income to the IRS. A written agreement provides documentation of the loan terms, which can be useful in case of an audit. While it might seem formal, it’s simply about being responsible and compliant with tax regulations.

Ultimately, a person to person loan agreement template is about building trust and fostering open communication. It demonstrates that you value the relationship more than the money and that you are committed to handling the loan in a fair and transparent manner. It’s a proactive step that can prevent future problems and strengthen your bond with the person you are lending to or borrowing from.

Key Elements to Include in Your Person To Person Loan Agreement Template

Now that you understand the importance of a loan agreement, let’s delve into the essential components that should be included in your person to person loan agreement template. Think of these as the building blocks that will make your agreement solid and enforceable. Each element plays a crucial role in defining the terms of the loan and protecting the interests of both the lender and the borrower.

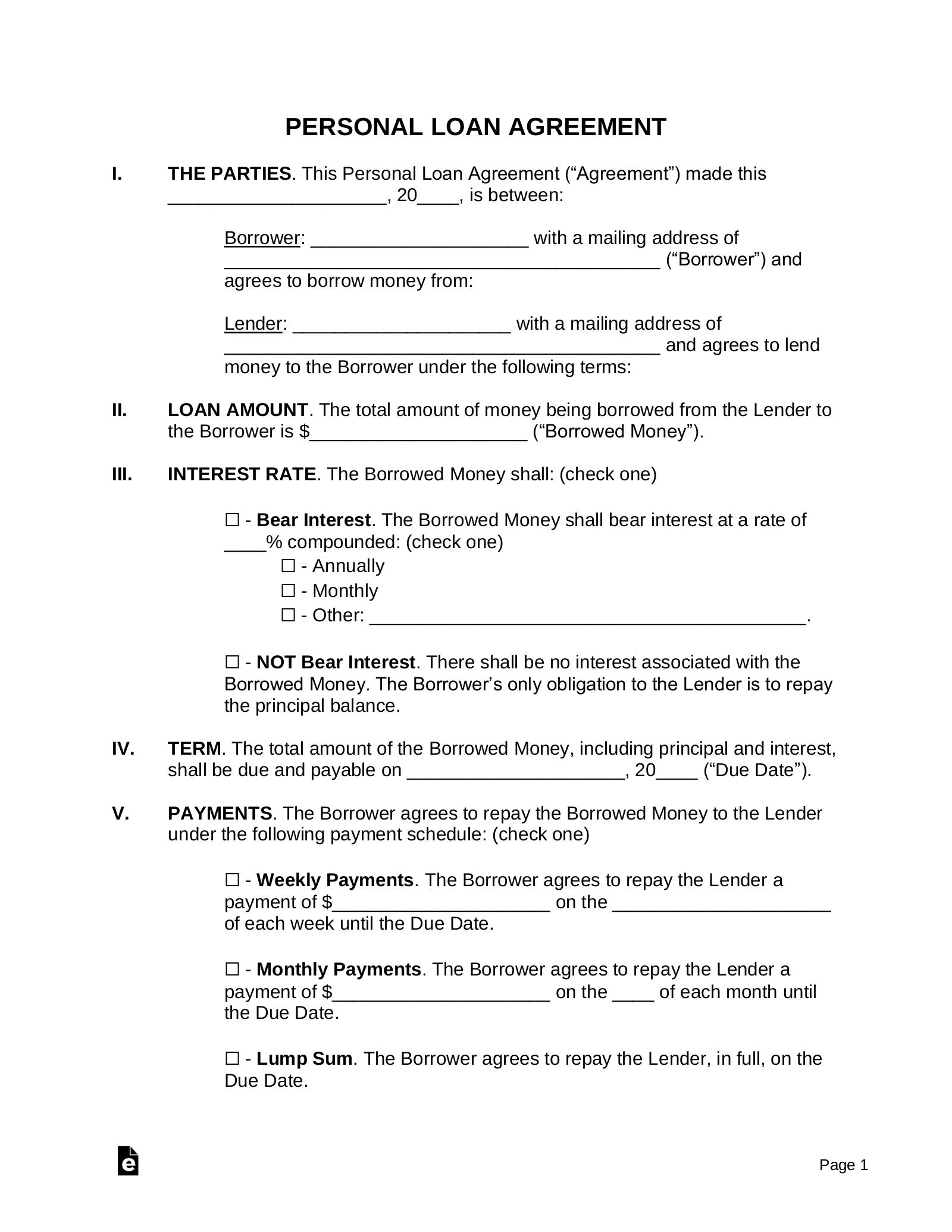

First and foremost, you need to clearly identify the parties involved. Include the full legal names and addresses of both the lender and the borrower. This establishes who is making the loan and who is receiving it, leaving no room for confusion. Next, specify the principal amount of the loan. This is the exact amount of money being lent. Be precise and avoid using vague terms like “around $500” or “a couple thousand.” State the exact dollar amount.

The interest rate, if applicable, should be clearly stated. If you are not charging interest, explicitly state that the interest rate is 0%. If you are charging interest, specify the annual interest rate and how it will be calculated. It’s also important to outline the repayment schedule. This includes the frequency of payments (e.g., monthly, weekly, bi-weekly), the amount of each payment, and the due date for each payment. Provide a clear timeline for the loan repayment.

Late payment penalties should also be addressed. What happens if the borrower misses a payment? Will there be a late fee? How many days does the borrower have to make the payment before it’s considered late? Clearly outlining the consequences of late payments will incentivize the borrower to stay on track and avoid potential disputes. Moreover, include a section on default and remedies. This outlines what happens if the borrower fails to repay the loan as agreed. What actions can the lender take? Can the lender take legal action to recover the funds?

Finally, don’t forget to include a governing law clause. This specifies which state’s laws will govern the agreement. Both the lender and the borrower should sign and date the agreement in the presence of a witness. This adds an extra layer of security and demonstrates that both parties willingly entered into the agreement. Remember, a well-crafted person to person loan agreement template is your best defense against misunderstandings and disagreements. By including these key elements, you can create a solid foundation for a successful loan arrangement.

Creating a loan agreement might seem daunting, but it’s a worthwhile investment in your relationship and financial security. When done correctly, it can prevent potential conflicts and ensure that everyone is on the same page. Take your time, be thorough, and remember that clear communication is key. This small investment of time and effort can save you a lot of heartache down the road.

Whether you’re lending or borrowing, having everything in writing creates peace of mind for everyone involved. A simple person to person loan agreement template can turn a potentially awkward financial exchange into a smooth and transparent transaction. It sets expectations, clarifies responsibilities, and protects your relationship from unnecessary stress.