So, you’ve decided to lend some money to a friend, family member, or maybe even a not-so-close acquaintance. That’s fantastic! Lending money can be a great way to help someone out, and even earn a little interest in the process. But before you hand over the cash, it’s absolutely crucial to protect yourself and ensure everyone’s on the same page. That’s where a peer to peer loan agreement template comes in handy. It’s basically a formal IOU that outlines all the important details of the loan, making sure there are no misunderstandings down the road.

Think of a peer to peer loan agreement template as a safety net. It’s not about distrusting the person you’re lending to; it’s about being smart and responsible. Life happens, and circumstances can change. Having a written agreement ensures that both parties understand their obligations and protects you legally if things don’t go as planned. It’s much better to have it and not need it, than to need it and not have it. We are going to talk about the importance of this agreement and when you should use it.

In this article, we’ll walk you through everything you need to know about peer to peer loan agreements, why they’re essential, and how to use a peer to peer loan agreement template effectively. We’ll break down the key components of a good agreement and give you some tips on how to tailor it to your specific situation. So, let’s dive in and get you equipped to lend money with confidence and peace of mind. We’ll explore what to include, how to adapt it, and why it’s always a good idea to have one. This is not a legal advice, consult with an attorney to know more.

Why You Absolutely Need a Peer To Peer Loan Agreement

Let’s face it, lending money, even to people you care about, can be tricky. Emotions can run high, memories can be selective, and good intentions can sometimes get lost in translation. That’s why a peer to peer loan agreement is so important. It’s not just a piece of paper; it’s a clear and concise record of the loan terms that everyone agrees to.

Without a written agreement, you’re relying on verbal promises and potentially flawed memories. Imagine lending a friend a significant amount of money and then, months later, disagreeing about the interest rate or the repayment schedule. Suddenly, a friendly loan turns into a source of tension and resentment. A peer to peer loan agreement template can help prevent these situations by clearly defining all the key terms upfront.

Moreover, a written agreement provides legal protection. If the borrower defaults on the loan, you’ll have a legally binding document that you can use to pursue legal action to recover your funds. Without a written agreement, it can be difficult to prove the existence of the loan and the agreed-upon terms. This leaves you in a vulnerable position, potentially losing your money and damaging your relationship.

Think of it this way: A peer to peer loan agreement is like an insurance policy for your loan. It protects you from potential losses and misunderstandings. It also helps to maintain a healthy relationship with the borrower by ensuring that everyone is on the same page and accountable for their obligations. It is a win win situation as well.

When you use a peer to peer loan agreement template, you are formalizing the agreement which makes the other person understand that this is not a gift. It is a loan. A loan needs to be paid back. If your friend or family does not want to sign it, you should reconsider giving the loan. If you are okay of not getting paid back, you can give it to them as a gift.

Key Elements of a Solid Peer To Peer Loan Agreement Template

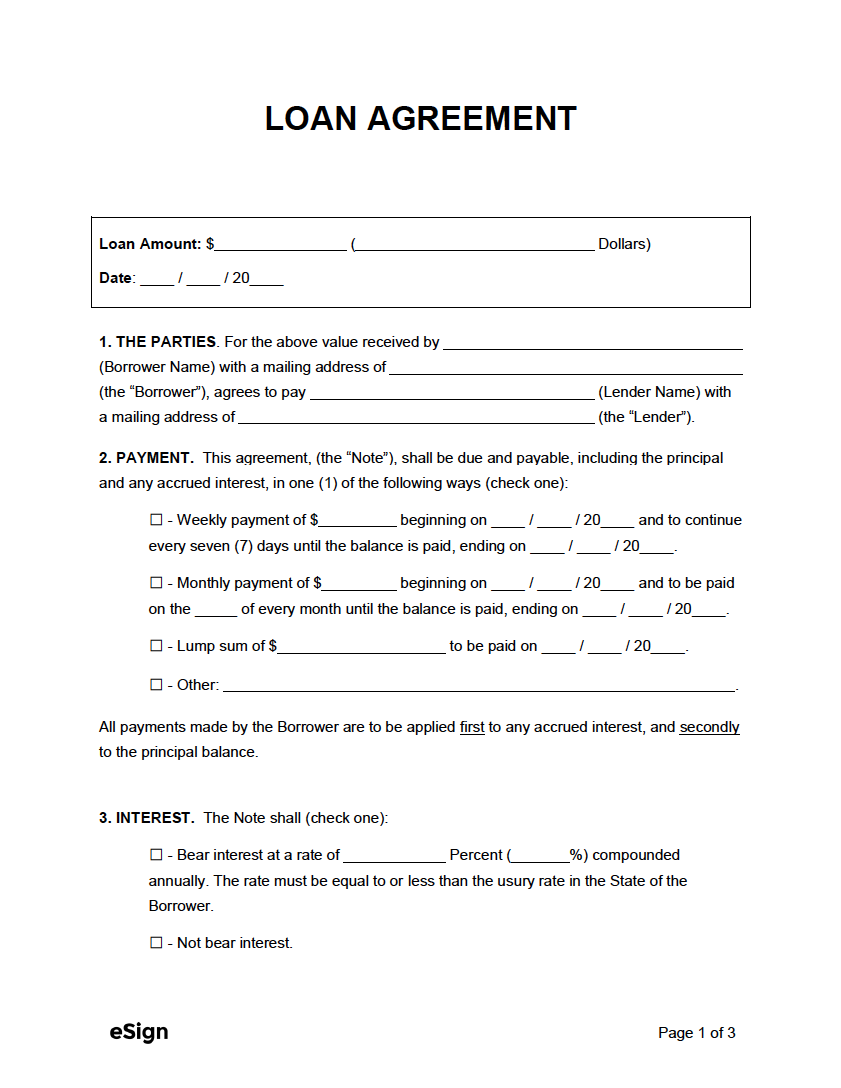

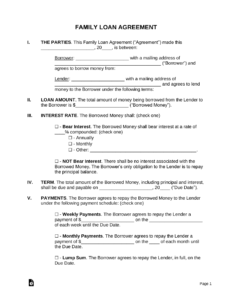

So, what exactly should be included in a peer to peer loan agreement template? While the specific details may vary depending on the circumstances of the loan, there are some key elements that should always be included.

First and foremost, the agreement should clearly identify the lender and the borrower. This includes their full names, addresses, and contact information. This is important for legal purposes and helps to avoid any confusion about who is involved in the agreement.

Next, the agreement should state the principal amount of the loan. This is the total amount of money that is being lent. It’s important to be precise and avoid any ambiguity. It is also worth noting the currency of the money being lent. For example, if you are lending 1000 US Dollar to your friend, please put “$1,000” in the agreement. If you are lending 1000 Euro to your friend, put “€1,000” in the agreement.

The agreement should also specify the interest rate, if any. If you’re charging interest, be sure to state the interest rate clearly and how it will be calculated. This is important for tax purposes and to ensure that the loan complies with any applicable usury laws. It is very common for loans between friends and family not to include interest to make the deal more enticing. However, if you do want to profit from lending the money, this is the best way to do it.

Finally, the agreement should outline the repayment schedule. This includes the amount of each payment, the frequency of payments (e.g., monthly, quarterly), and the date on which the first payment is due. The repayment schedule should be clear and easy to understand, to avoid any confusion or disputes. You can also include late payment penalties if the borrower doesn’t make the payment on time. This can be a percentage of the amount due or a fixed fee for each late payment. If you set this penalty, ensure to put this in the loan agreement.

Remember, a well-drafted peer to peer loan agreement template is a valuable tool for protecting your interests and maintaining healthy relationships. It’s an investment in peace of mind. A peer to peer loan agreement template can also have some special additions that applies to the specific situation. For example, if the borrower can not repay the money, you can take his valuable asset as payment. This can be included in the agreement as well. It is possible for you to use a peer to peer loan agreement template and get your money back.

It’s about making sure everyone’s on the same page from the get-go. Lending money can be a wonderful act of support, and with a little forethought and a solid agreement, you can ensure that it remains a positive experience for everyone involved.

Having a peer to peer loan agreement template is not about mistrust; it’s about creating clarity and setting expectations. This way, you can help your friend or family member without risking your financial wellbeing or damaging your relationship.