Life throws curveballs, doesn’t it? Sometimes, we find ourselves in situations where paying for goods or services upfront just isn’t feasible. That’s where payment plans come in handy. A well-structured payment plan can be a lifeline for both the person owing the money (the debtor) and the person or company to whom the money is owed (the creditor). It allows for manageable repayments over a defined period, making the debt more palatable and less stressful. But to ensure everyone is on the same page and to avoid potential disputes down the line, it’s crucial to have a solid payment plan agreement in place.

In the UK, a payment plan agreement serves as a legally binding contract outlining the terms of the repayment. This includes things like the total amount owed, the amount and frequency of individual payments, the interest rate (if any), and what happens if a payment is missed. Having a written agreement protects both parties, providing clarity and recourse in case of disagreement. It provides a safety net for both parties. A verbal agreement is hard to prove if any dispute comes in the future.

Creating a payment plan agreement doesn’t have to be a daunting task. Thankfully, there are readily available payment plan agreement templates uk that can be adapted to fit your specific circumstances. These templates provide a framework, ensuring you include all the necessary information and clauses. Using a template can save you time and potentially legal fees, allowing you to focus on managing the debt and getting back on track financially. This is why a payment plan agreement template uk can be a good starting point to building your own agreement.

Key Elements of a Payment Plan Agreement

A comprehensive payment plan agreement should clearly outline the obligations of both the debtor and the creditor. The more detail included, the less room there is for misunderstanding and potential conflict. It’s important to remember that this document is a legally binding contract, so accuracy and clarity are paramount. Let’s break down some of the most important sections that should be included in your payment plan agreement.

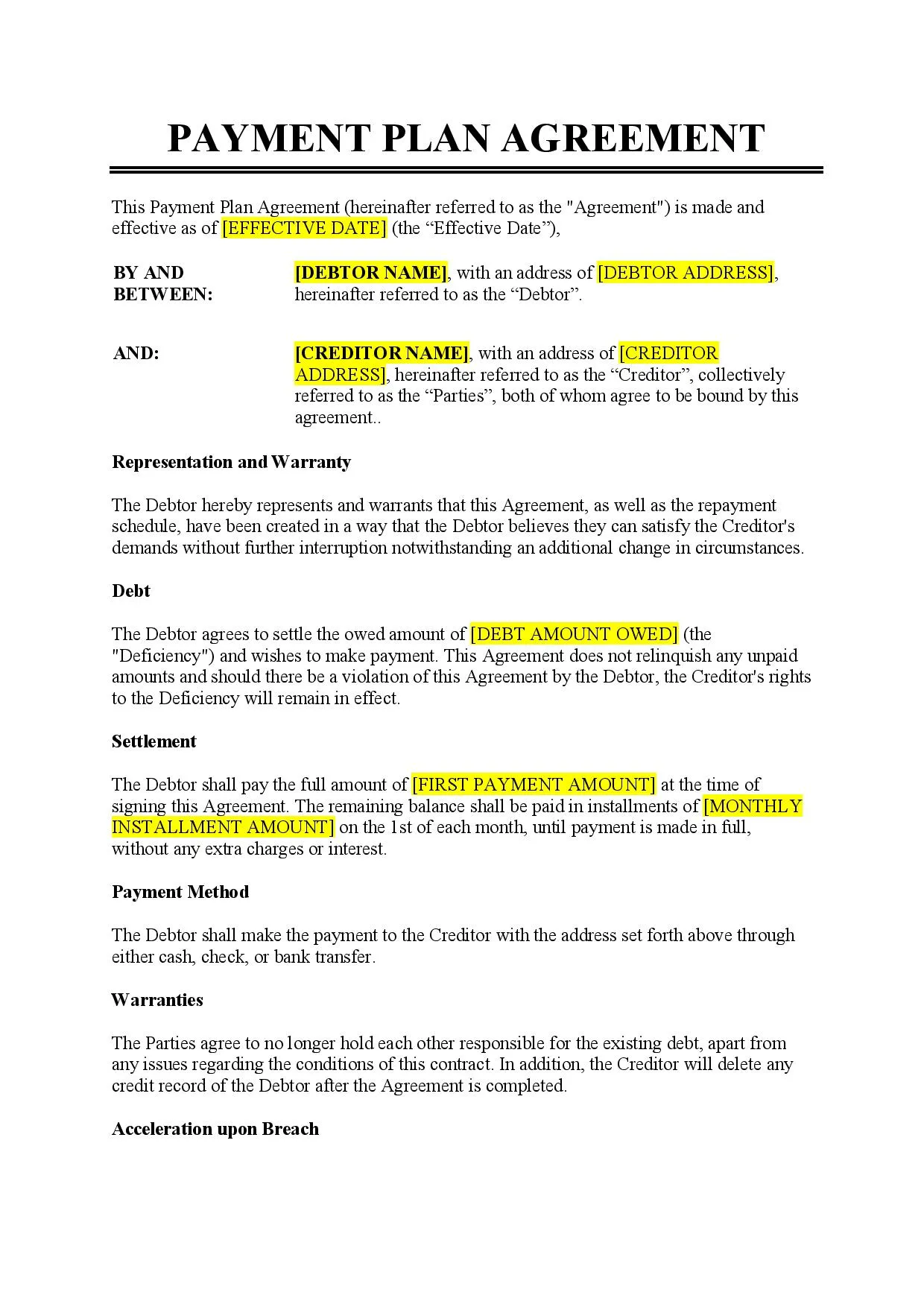

Firstly, the agreement should clearly identify the parties involved. This means stating the full legal names and addresses of both the debtor and the creditor. If either party is a business, be sure to include the company name and registered office address. Accurate identification is crucial for enforceability of the agreement. Don’t forget this is the first thing you must have on your agreement.

Next, you need to detail the original debt. This section should specify the total amount of money owed, the date the debt was incurred, and a brief description of what the debt relates to (e.g., outstanding invoice for services rendered, purchase of goods, etc.). Providing context helps avoid any confusion about the nature of the debt and its origins. This is the origin of the agreement, hence, needs to be properly defined.

The core of the payment plan agreement lies in the repayment schedule. This section should clearly outline the amount of each payment, the frequency of payments (e.g., weekly, monthly), the due date for each payment, and the method of payment (e.g., bank transfer, cheque). A clear and unambiguous repayment schedule is essential for ensuring both parties understand their obligations. If there is any tolerance for late payments, it should be included as well. A tolerance of 5 days from the original due date, for instance.

Furthermore, consider including a clause addressing late payment fees. If the creditor intends to charge a fee for late payments, the amount of the fee and the conditions under which it will be applied should be clearly stated. This helps discourage late payments and compensates the creditor for any administrative costs associated with chasing overdue payments. Always be clear with how the calculation for late payment will be done.

Finally, the agreement should include a section addressing default. This section should outline what constitutes a default (e.g., missing multiple payments) and the consequences of default (e.g., acceleration of the debt, legal action). This provides the debtor with a clear understanding of the potential ramifications of failing to adhere to the payment plan. Addressing the default section early on the agreement will avoid any legal problems in the future.

Finding and Using a Payment Plan Agreement Template

Fortunately, finding a suitable payment plan agreement template uk is relatively straightforward. A quick online search will reveal numerous options, ranging from free templates to more comprehensive paid versions. When selecting a template, it’s important to choose one that is specifically designed for use in the UK and that aligns with your specific needs. Consider the complexity of the debt and the relationship between the debtor and creditor when making your decision.

Once you’ve found a template, carefully review it to ensure it includes all the necessary clauses and information. Don’t be afraid to adapt the template to fit your specific circumstances. Remember, the template is just a starting point; you may need to add or modify certain sections to accurately reflect the agreement between the parties. This is a key point to remember.

Before finalising the payment plan agreement, it’s advisable to seek legal advice, especially if the debt is substantial or the situation is complex. A solicitor can review the agreement to ensure it is legally sound and protects your interests. While this may involve an additional cost, it can provide peace of mind and prevent potential disputes down the line. A solicitor’s advice is advisable in any case, even if the agreement is not complex.

When completing the template, ensure all information is accurate and complete. Double-check the names, addresses, dates, and amounts. Inaccuracies can render the agreement unenforceable. Both the debtor and creditor should carefully read the entire agreement before signing. It’s also a good idea to have both parties initial each page to confirm they have reviewed and understood the contents. Making sure everything is filled with accurate information.

After both parties have signed the agreement, it’s crucial to keep a copy for your records. This provides evidence of the agreement and its terms, which can be helpful in the event of a dispute. Store the agreement in a safe and accessible location. It’s also a good idea to periodically review the agreement to ensure it is still relevant and up-to-date, especially if there are any changes in circumstances. You may want to store a digital copy on the cloud as well as a hard copy.

Payment plans offer a structured way to manage debt, benefiting both creditors and debtors. With a clear agreement and a commitment from both parties, a payment plan can be a successful tool for resolving financial obligations. Remember to adapt any template you use to suit the specific circumstances of your agreement.

By utilizing a payment plan agreement template uk, individuals and businesses can establish clear terms for repayment, fostering trust and minimizing the risk of disputes. A well-crafted agreement, adapted to your unique situation, lays the foundation for a successful and mutually beneficial payment arrangement. The aim is for both the debtor and creditor to be happy.