Life throws curveballs, doesn’t it? Sometimes those curveballs land right in our wallets, making it tough to keep up with payments. Whether it’s a medical bill, a car repair, or even just unexpected expenses, finding yourself in a situation where you need to negotiate a payment plan is more common than you think. That’s where a payment arrangement simple payment agreement template comes in handy. It’s a formal, yet straightforward way to document an agreement between two parties about how an outstanding debt will be repaid. It outlines the agreed-upon payment schedule, the total amount owed, and any late payment penalties.

Think of it as a handshake, but with the details written down. It protects both the person or entity owed the money and the person struggling to pay it back. For the lender, it offers assurance that they will receive the money owed, albeit over a longer period. For the borrower, it provides a structured plan to get out of debt without facing further penalties or legal action. It allows everyone to have a clear understanding of the terms, preventing misunderstandings and maintaining a positive relationship during a potentially stressful financial situation.

No one likes being in debt, and no one enjoys chasing after unpaid money. A payment arrangement simple payment agreement template bridges that gap, providing a path forward when immediate full payment isn’t possible. It’s a tool for communication, negotiation, and ultimately, resolution. Using a template makes the process easier and ensures all essential elements are covered, allowing you to focus on finding a payment plan that works for both parties.

Why Use a Payment Arrangement Simple Payment Agreement Template?

Creating a payment agreement from scratch can feel daunting. Where do you even begin? That’s where a template becomes your best friend. It takes the guesswork out of the process by providing a structured format with all the necessary sections already in place. You simply fill in the blanks with the specific details relevant to your situation. This ensures that you don’t accidentally overlook any crucial information, which could lead to disputes down the road.

A good template provides clarity and prevents misunderstandings. By clearly outlining the payment amount, due dates, and any potential penalties, both parties know exactly what’s expected of them. This transparency fosters trust and reduces the likelihood of conflicts arising later on. A simple payment agreement template can be easily customized to fit a wide range of situations, from small personal loans between friends to larger business debts. It allows for flexibility in setting payment terms that are agreeable to both the debtor and the creditor.

Using a template also saves you valuable time and money. Instead of hiring a lawyer to draft a custom agreement, you can use a readily available template and adapt it to your specific needs. This can be particularly beneficial for individuals or small businesses with limited financial resources. Moreover, a well-written template can help you maintain a professional image, demonstrating that you’re taking the matter seriously and are committed to resolving the debt in a fair and organized manner.

Furthermore, a payment arrangement simple payment agreement template serves as a legally sound record of the agreement. In the event of a dispute, the written agreement can be presented as evidence in court. This provides an extra layer of protection for both parties, ensuring that the terms of the agreement are upheld. In essence, using a payment arrangement template offers a win-win solution by simplifying the debt repayment process, promoting transparency, and providing legal protection.

Finally, consider the peace of mind that comes with having a formal agreement in place. Knowing that you have a clear plan for repaying your debt can alleviate stress and anxiety, allowing you to focus on other aspects of your life or business. For the creditor, it provides reassurance that their money will be recovered, reducing the risk of financial loss. A payment arrangement simple payment agreement template is a valuable tool for fostering positive financial relationships and resolving debt issues efficiently and effectively.

Key Elements of a Payment Arrangement Simple Payment Agreement Template

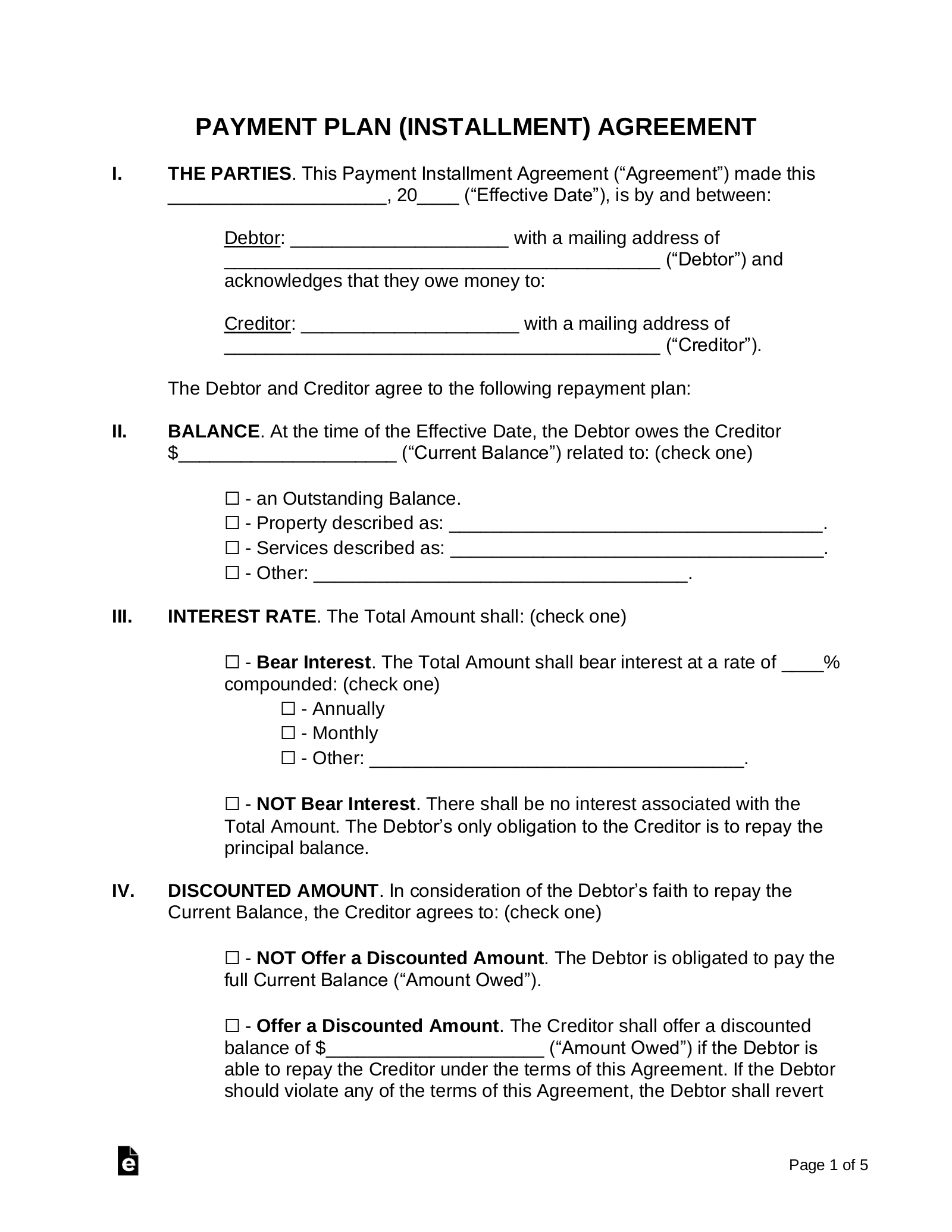

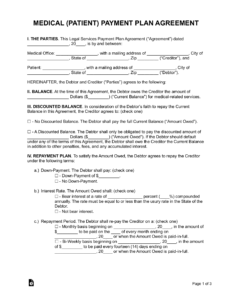

Before diving into using a payment arrangement simple payment agreement template, let’s break down the essential components that should be included. First and foremost, the template needs to clearly identify the parties involved. This means stating the full legal names and addresses of both the debtor (the person owing the money) and the creditor (the person or entity to whom the money is owed). Accuracy is crucial here, so double-check all the information before proceeding.

Next, the agreement must specify the total amount of debt owed. This should be a precise figure, including any outstanding principal, interest, or late fees. Be as detailed as possible to avoid any ambiguity. Following that, the payment schedule needs to be clearly defined. This includes the amount of each payment, the frequency of payments (e.g., weekly, bi-weekly, monthly), and the due date for each payment. A table or list format can be helpful for presenting this information in an organized manner.

The template should also address what happens in the event of a late payment. Will there be a penalty fee? If so, how much? Will there be a grace period? These details are important to outline upfront to prevent misunderstandings and potential disputes. Additionally, the agreement may include a clause specifying how payments will be applied (e.g., first to interest, then to principal). This can impact the total amount of interest paid over the life of the agreement.

Another crucial element is the governing law clause. This specifies which state or jurisdiction’s laws will govern the agreement in the event of a legal dispute. It’s generally best to choose the jurisdiction where the debtor resides or where the agreement was signed. Finally, the agreement must include a section for signatures. Both the debtor and the creditor should sign and date the agreement to signify their acceptance of the terms. It’s also a good idea to have the signatures witnessed by a third party to further strengthen the validity of the agreement.

In summary, a comprehensive payment arrangement simple payment agreement template should cover all these essential elements to ensure clarity, transparency, and enforceability. Taking the time to carefully review and complete each section will help you create a solid agreement that protects both your financial interests and your relationship with the other party. A well-drafted payment arrangement simple payment agreement template provides a solid foundation for resolving debt issues and achieving financial stability.

A payment arrangement simple payment agreement template provides a path toward financial recovery and peace of mind. It formalizes the agreement, making sure both parties are protected and understand their obligations.

By using a template, you’re setting yourself up for a successful resolution, fostering a healthier financial future and preserving important relationships.