Ever felt the pinch of needing supplies or services now but not having the immediate cash flow? That’s where net 30 terms come in handy! It’s like a short-term loan from a supplier, giving you a little breathing room to get your finances in order. Businesses, especially startups and small businesses, often rely on these arrangements to manage their working capital effectively. Think of it as a way to smooth out the bumps in your cash flow road.

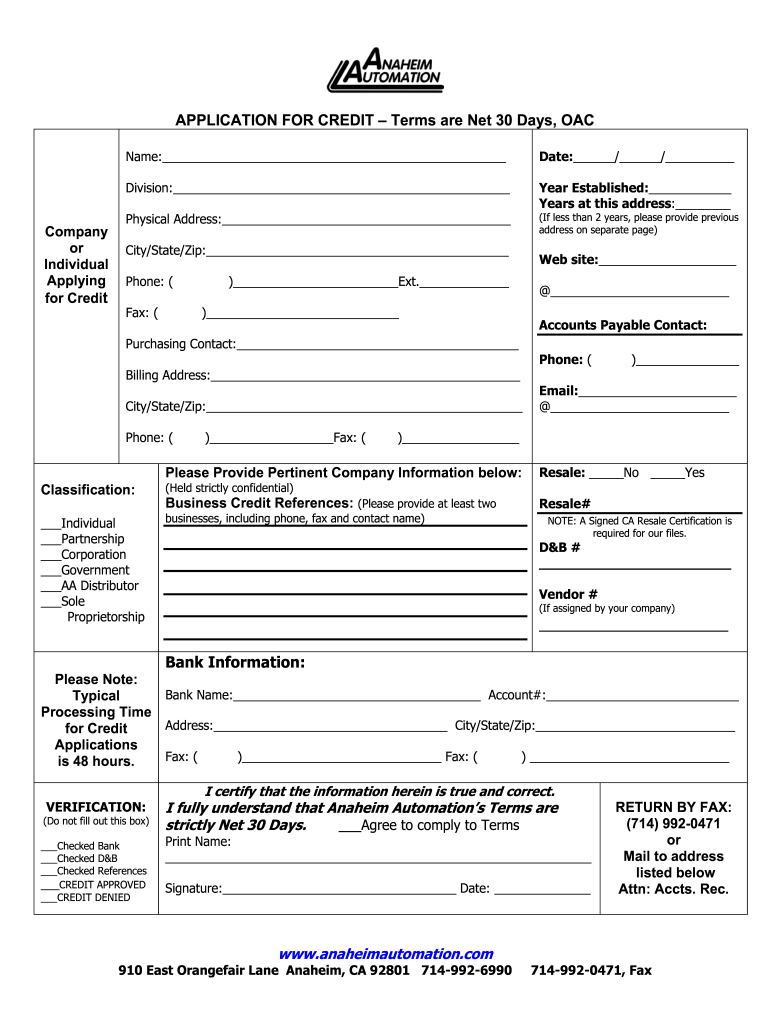

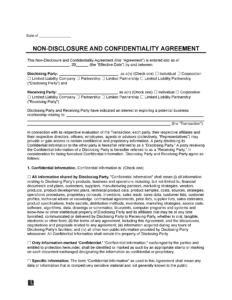

But before diving into this world of delayed payments, it’s crucial to have a solid agreement in place. This isn’t just a handshake deal; it’s a legally binding document that outlines the terms and conditions of the credit arrangement. A clear and comprehensive net 30 terms agreement template protects both the supplier and the customer, preventing misunderstandings and potential disputes down the line. It sets the stage for a healthy and mutually beneficial business relationship.

This article will guide you through the essentials of a net 30 terms agreement, highlighting the key clauses and considerations to ensure a smooth and successful transaction. We’ll also explore why a template is so valuable and where to find reliable ones. By the end, you’ll be well-equipped to confidently navigate the world of net 30 terms and create agreements that work for your business.

Understanding the Ins and Outs of a Net 30 Agreement

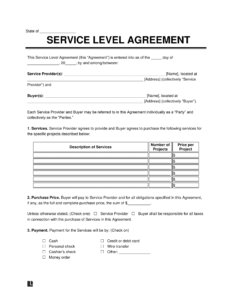

At its core, a net 30 agreement is a credit agreement between a supplier and a buyer. It states that the buyer has 30 days from the date of the invoice to pay for the goods or services received. This provides the buyer with a short-term credit line, allowing them to manage their cash flow more effectively. The supplier, in turn, can potentially increase sales by offering more flexible payment options to their customers. This is extremely important in building loyalty and maintaining long-term business relationships.

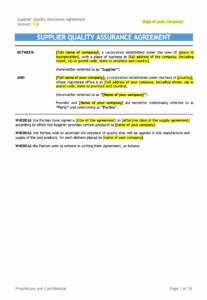

However, it’s more than just a simple “pay in 30 days” statement. A comprehensive net 30 terms agreement template should cover several crucial aspects, including the specific goods or services being provided, the agreed-upon price, the due date for payment, any late payment penalties, and the process for resolving disputes. It may also include details about shipping costs, returns, and warranties. Think of it as a detailed roadmap for the entire transaction, ensuring that both parties are on the same page.

One of the most important elements of a net 30 agreement is the late payment clause. This outlines the consequences of failing to pay within the agreed-upon 30-day period. Penalties can range from interest charges to suspension of future credit, or even legal action. This clause serves as a deterrent to late payments and helps the supplier protect their revenue stream. It also encourages the buyer to prioritize timely payments and maintain a positive credit standing.

Furthermore, the agreement should clearly define the responsibilities of both the supplier and the buyer. The supplier is responsible for providing the goods or services as described and for issuing accurate invoices. The buyer is responsible for accepting the goods or services, reviewing the invoice, and making payment within the agreed-upon timeframe. A clearly defined division of responsibilities minimizes the risk of misunderstandings and ensures a smoother transaction process.

Using a reliable net 30 terms agreement template saves you time and effort in drafting a document from scratch. Templates provide a pre-structured framework that covers all the essential elements of the agreement. However, it’s crucial to customize the template to fit the specific needs of your business and the particular transaction. Don’t just blindly fill in the blanks; carefully review each clause and make sure it accurately reflects your intentions and protects your interests.

Why a Solid Net 30 Agreement is Crucial for Your Business

Imagine lending money to a friend without any written agreement. It might work out fine, but what happens if they forget the amount, the repayment date, or even deny borrowing the money in the first place? A net 30 agreement is like that written loan agreement, but for business transactions. It provides a clear record of the terms and conditions, protecting both the supplier and the buyer from potential disputes and misunderstandings. Without it, you’re relying solely on trust, which, while valuable, isn’t always enough in the business world.

For suppliers, a well-drafted net 30 agreement is essential for managing risk. It allows them to offer credit to customers while minimizing the potential for late payments or defaults. The agreement outlines the consequences of non-payment, providing the supplier with recourse options in case of a breach. This is especially important for small businesses and startups that can’t afford to absorb significant losses due to unpaid invoices. A clear agreement empowers them to enforce their rights and protect their bottom line.

From the buyer’s perspective, a net 30 agreement provides access to much-needed goods or services without requiring immediate payment. This can be especially beneficial for businesses with fluctuating cash flow or those who need to make large purchases. The 30-day payment window allows them to generate revenue from the goods or services before having to pay for them, improving their working capital management. It’s essentially a short-term loan that helps them grow their business.

Furthermore, a clear agreement fosters trust and strengthens the business relationship between the supplier and the buyer. By outlining the terms and conditions in writing, both parties know exactly what is expected of them. This transparency builds confidence and reduces the likelihood of disputes. A positive and mutually beneficial relationship can lead to repeat business, referrals, and long-term partnerships, all of which contribute to the success of both companies.

Finally, having a standardized net 30 terms agreement template streamlines the transaction process. Instead of drafting a new agreement for each transaction, you can simply customize the template to fit the specific circumstances. This saves time and effort, allowing you to focus on other aspects of your business. It also ensures consistency in your agreements, reducing the risk of errors or omissions. Using a template demonstrates professionalism and attention to detail, further enhancing your business reputation.

Navigating the world of business requires careful planning and a focus on establishing clear guidelines. A well-constructed net 30 terms agreement serves as a solid foundation for a mutually beneficial business relationship.

Therefore, taking the time to draft a comprehensive agreement is an investment that protects your interests, fosters trust, and ultimately contributes to the long-term success of your business.