Running a business is all about managing cash flow. You need to make sure you’re getting paid on time to cover your expenses and continue operating smoothly. That’s where payment terms come into play. Net 30 is a pretty common payment term, and it essentially means that your customer has 30 days from the date of the invoice to pay you. Seems simple enough, right? But to make sure everyone is on the same page and to protect your business, it’s a great idea to have a clear, written agreement in place.

Think of a payment terms agreement as a roadmap for your financial transactions with clients. It lays out the specifics of how and when you expect to be paid. This can prevent misunderstandings, disputes, and late payments – all of which can put a strain on your business’s financial health. Having a solid agreement also demonstrates professionalism and builds trust with your clients.

This article will walk you through everything you need to know about net 30 payment terms agreements, why they’re important, and how to create one that works for your business. We’ll even explore the option of using a net 30 payment terms agreement template to make the process easier and ensure you cover all the essential bases. Let’s dive in!

Why a Net 30 Payment Terms Agreement is Essential

A formal agreement outlining your net 30 payment terms is far more than just a formality; it’s a crucial tool for protecting your business and fostering healthy client relationships. Without a clear, written agreement, you’re essentially relying on unspoken expectations and potentially leaving yourself vulnerable to late payments, disputes, and even non-payment. Imagine having to chase down invoices every month, unsure of when you’ll actually receive the funds. That’s a stressful situation you can easily avoid with a proper agreement.

One of the biggest advantages of a payment terms agreement is clarity. It clearly defines the payment schedule, acceptable payment methods, and any late payment penalties. This eliminates ambiguity and ensures that both parties are on the same page from the outset. When clients understand their obligations, they are more likely to pay on time, improving your cash flow and reducing the need for constant follow-ups.

Beyond financial security, a well-crafted agreement demonstrates professionalism. It shows your clients that you take your business seriously and are committed to establishing clear and transparent working relationships. This can enhance your reputation and make you a more attractive partner in the long run. Think of it as an investment in your brand’s credibility.

Furthermore, in the event of a payment dispute, a written agreement serves as valuable evidence. It provides a clear record of the agreed-upon terms, making it easier to resolve conflicts and protect your interests. Without such documentation, you may find it challenging to prove your case and recover outstanding payments.

Using a net 30 payment terms agreement template can significantly streamline this process. These templates provide a structured framework, ensuring you include all the necessary clauses and information. While you should always tailor the template to your specific business needs, it saves you time and effort compared to drafting an agreement from scratch. It also reduces the risk of overlooking important details that could protect your business. Always remember to review and potentially customize the template with your legal counsel.

Key Elements of a Solid Net 30 Payment Terms Agreement

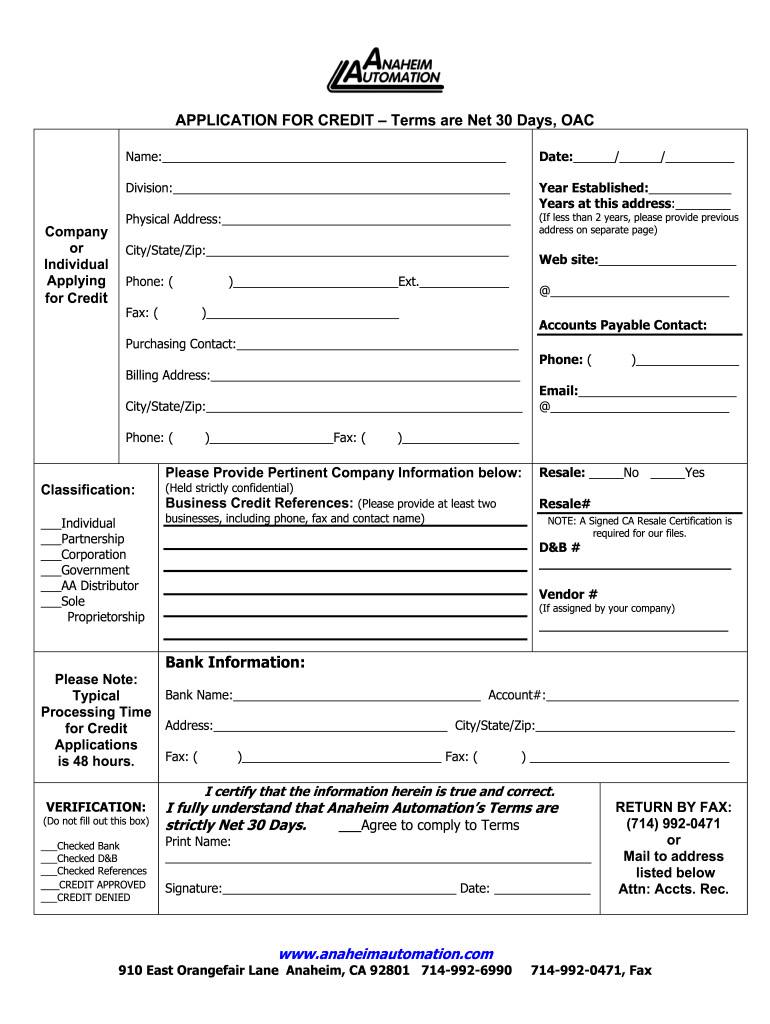

Crafting a comprehensive net 30 payment terms agreement involves several essential components. First and foremost, clearly identify both parties involved – your business and your client. Include full legal names and addresses to avoid any confusion. This might seem obvious, but it’s a fundamental step in establishing a legally sound document.

Next, specify the effective date of the agreement and the scope of the services or products covered. Be as detailed as possible to avoid any ambiguity regarding which transactions are subject to the net 30 payment terms. For example, you might state, “This agreement applies to all invoices issued for web design services provided by [Your Business Name] to [Client Name] after [Effective Date].”

Clearly state the payment terms, including the net 30 deadline. This should be unambiguous: “Payment is due within 30 days of the invoice date.” Specify the acceptable methods of payment, such as bank transfer, credit card, or check. Providing multiple payment options makes it easier for clients to pay on time. You should also include clear instructions on how to remit payment, including bank details or online payment links.

Crucially, address late payment penalties. Clearly outline the consequences of late payments, such as interest charges or suspension of services. For example, you might state, “A late payment fee of [Percentage]% will be applied to any invoices not paid within 30 days.” This provides an incentive for clients to adhere to the payment schedule and helps cover any financial losses incurred due to late payments.

Finally, include a clause regarding dispute resolution. Specify how disputes related to payments will be resolved, such as through mediation or arbitration. This can help prevent costly and time-consuming litigation. Also, consider including a clause outlining the governing law that will apply to the agreement. Remember, a net 30 payment terms agreement template can be a great starting point, but it’s essential to tailor it to your specific needs and consider seeking legal advice to ensure it fully protects your business.

Having a clear understanding and agreement around payment terms ensures clarity and avoids misunderstandings.

Using a net 30 payment terms agreement template can greatly assist in ensuring the payment terms are clear to both you and your client.