Starting a business in North Carolina? Congratulations! You’ve probably already considered forming a Limited Liability Company (LLC) for its liability protection and tax benefits. But before you get too deep into the paperwork, there’s one crucial document you absolutely need: the NC LLC Operating Agreement Template. Think of it as the constitution for your business, outlining how it will be run and managed.

Many new business owners think, “Do I really need one?” The answer is a resounding YES. Even if you’re a single-member LLC, an operating agreement provides legal protection and clarity, separating your personal assets from your business liabilities. It proves your LLC is a distinct entity, preventing creditors from coming after your personal savings, home, or car in case of business debts or lawsuits. It’s also helpful when opening a business bank account or applying for a loan.

Plus, an NC LLC Operating Agreement Template isn’t just a legal shield; it’s a roadmap for your business operations. It clarifies the roles and responsibilities of each member, how profits and losses are allocated, and what happens if a member leaves or the business needs to be dissolved. Having this all laid out in writing upfront can prevent disputes and misunderstandings down the road, ensuring a smoother and more successful business journey.

Why You Need a Robust NC LLC Operating Agreement

A comprehensive NC LLC Operating Agreement isn’t just a formality; it’s the backbone of your business’s operational and legal framework. It establishes clear rules and procedures for every aspect of your LLC, from day-to-day management to long-term strategic decisions. Without one, your LLC will be subject to North Carolina’s default rules for LLCs, which might not align with your specific needs or intentions. Don’t leave your business’s fate to chance.

Consider this: what happens if a member wants to leave the LLC? Or if the members disagree on a significant business decision? An operating agreement addresses these potential scenarios, providing a clear process for resolving conflicts and handling member departures. This helps prevent costly legal battles and ensures a smooth transition in times of change. A well-drafted agreement will outline buy-sell provisions, valuation methods, and dispute resolution mechanisms. These provisions can protect the business and its members from unforeseen circumstances.

Furthermore, a solid operating agreement helps protect your personal assets. By clearly defining the separation between your personal finances and your business’s finances, you reinforce the limited liability protection that an LLC provides. This is especially important if your business incurs debt or faces a lawsuit. With a properly documented operating agreement, creditors and legal adversaries will have a harder time piercing the corporate veil and targeting your personal assets.

Another key benefit of having an NC LLC Operating Agreement Template is its flexibility. Unlike corporations, LLCs have significant flexibility in how they structure their management and operations. The operating agreement allows you to customize the rules and procedures to fit your specific business model and goals. You can specify member roles and responsibilities, profit and loss distribution methods, and decision-making processes. This customization is what makes LLCs so appealing to many business owners.

Moreover, lenders and investors often require an operating agreement before providing funding or investments. They want to understand the rules and procedures governing the LLC, including how decisions are made and how their investment will be protected. A well-drafted operating agreement demonstrates that you have carefully considered the business’s operational and legal framework, which can increase their confidence in your business.

Essential Elements of an Effective Operating Agreement

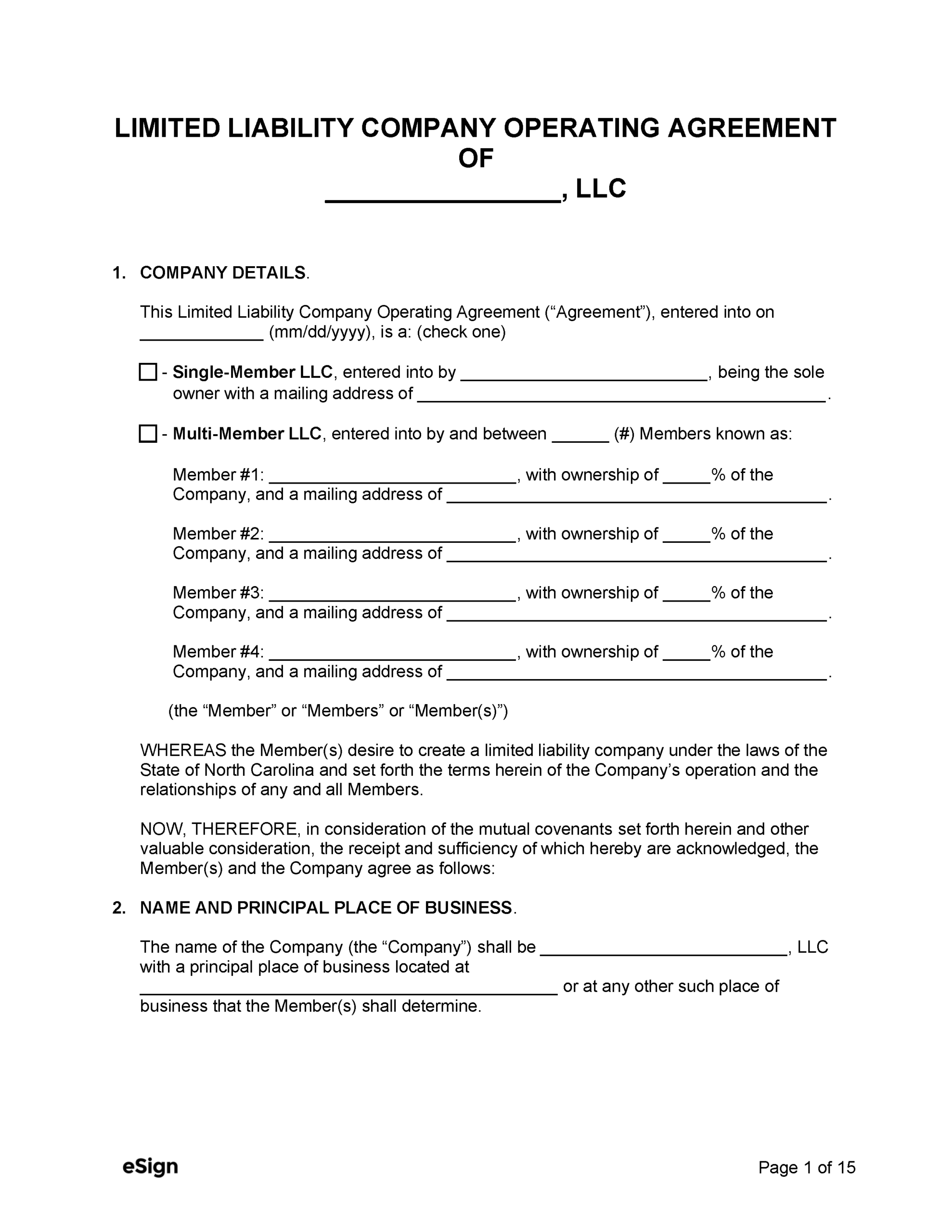

Crafting an effective operating agreement requires careful consideration of several key elements. At its core, the agreement should clearly identify the LLC’s name, purpose, and principal place of business. This establishes the basic identity and scope of your business operations. You’ll also need to specify the names and addresses of the members, as well as their initial contributions to the LLC. These initial contributions are essential for defining each member’s ownership stake and responsibilities.

A crucial section of the operating agreement deals with membership and management. It should clearly define the roles and responsibilities of each member, including their authority to make decisions on behalf of the LLC. You’ll also need to outline the process for admitting new members, transferring ownership interests, and handling member departures. These provisions help ensure a smooth transition in the event of changes in membership.

Financial matters are also paramount in an operating agreement. You’ll need to specify how profits and losses will be allocated among the members. This can be based on their ownership percentages or some other predetermined formula. The agreement should also outline the procedures for making distributions to members, including the frequency and amount of such distributions. Clear financial guidelines are essential for preventing disputes and ensuring that all members are treated fairly.

The operating agreement should also address potential conflicts and disputes among members. This can include provisions for mediation, arbitration, or other forms of dispute resolution. Having a predefined process for resolving conflicts can help prevent costly litigation and preserve the relationships among members. Additionally, the agreement should outline the procedures for amending or terminating the operating agreement itself.

Finally, consider adding provisions related to indemnification and liability. These provisions can protect members from personal liability for actions taken on behalf of the LLC, as long as they acted in good faith and within the scope of their authority. Such provisions can provide peace of mind and encourage members to take calculated risks to grow the business.

This document serves as a guide to making sure that everyone is in agreement about how to handle the business and prevent issues. It’s a smart move to spend the time creating a strong framework, even if you’re eager to start operating.