Buying a car is a big deal, right? Whether it’s a shiny new ride or a trusty pre-owned vehicle, figuring out the finances can sometimes feel like navigating a maze. Not everyone can pay the full amount upfront, and that’s where payment plans come in handy. But to ensure everyone is on the same page and to avoid potential misunderstandings down the road, a well-structured vehicle payment plan agreement template is essential.

Think of a vehicle payment plan agreement template as a roadmap for how the car will be paid off. It outlines the key details, like the agreed-upon price, the down payment amount (if any), the payment schedule, and what happens if a payment is missed. It’s a legally binding document that provides clarity and protection for both the seller and the buyer, making the whole process smoother and more transparent.

In essence, having a solid agreement in place is like having a safety net. It protects everyone involved and ensures that the transaction is handled fairly and professionally. Let’s dive into what makes a good agreement and why using a vehicle payment plan agreement template is a smart move.

Why You Need a Vehicle Payment Plan Agreement

Let’s face it: buying or selling a vehicle privately can sometimes feel a bit like the Wild West. Without a formal agreement, misunderstandings can easily arise, leading to disputes and headaches for everyone involved. A vehicle payment plan agreement acts as a clear record of the terms and conditions of the sale, leaving little room for ambiguity. It establishes the responsibilities of each party, setting the stage for a successful transaction.

Imagine you’re selling your car to a friend. You both verbally agree on a payment plan, but what happens if your friend forgets a payment or claims you agreed on a different amount? Without a written agreement, it becomes a “he said, she said” situation, and resolving the issue can be difficult and strain your friendship. A detailed agreement spells out the exact payment amounts, due dates, and any late payment penalties, making sure everyone knows what’s expected.

Furthermore, a vehicle payment plan agreement template protects both the seller and the buyer. For the seller, it provides assurance that they will receive the agreed-upon payment for the vehicle. For the buyer, it secures their right to ownership of the vehicle once all payments are made. It also outlines the process for transferring the title and registration, ensuring a smooth transition of ownership.

Think about it from a legal standpoint. Should a dispute arise, a written agreement provides concrete evidence to support your claim. It can be used in court to demonstrate the terms of the sale and the obligations of each party. Without a written agreement, you’re relying solely on your memory and the other party’s cooperation, which may not always be reliable.

Beyond the legal protection, a vehicle payment plan agreement template also fosters trust and transparency. By clearly outlining the terms of the sale, it shows that you’re committed to a fair and honest transaction. This can help build a positive relationship with the other party, even after the sale is complete.

Key Elements of a Comprehensive Vehicle Payment Plan Agreement Template

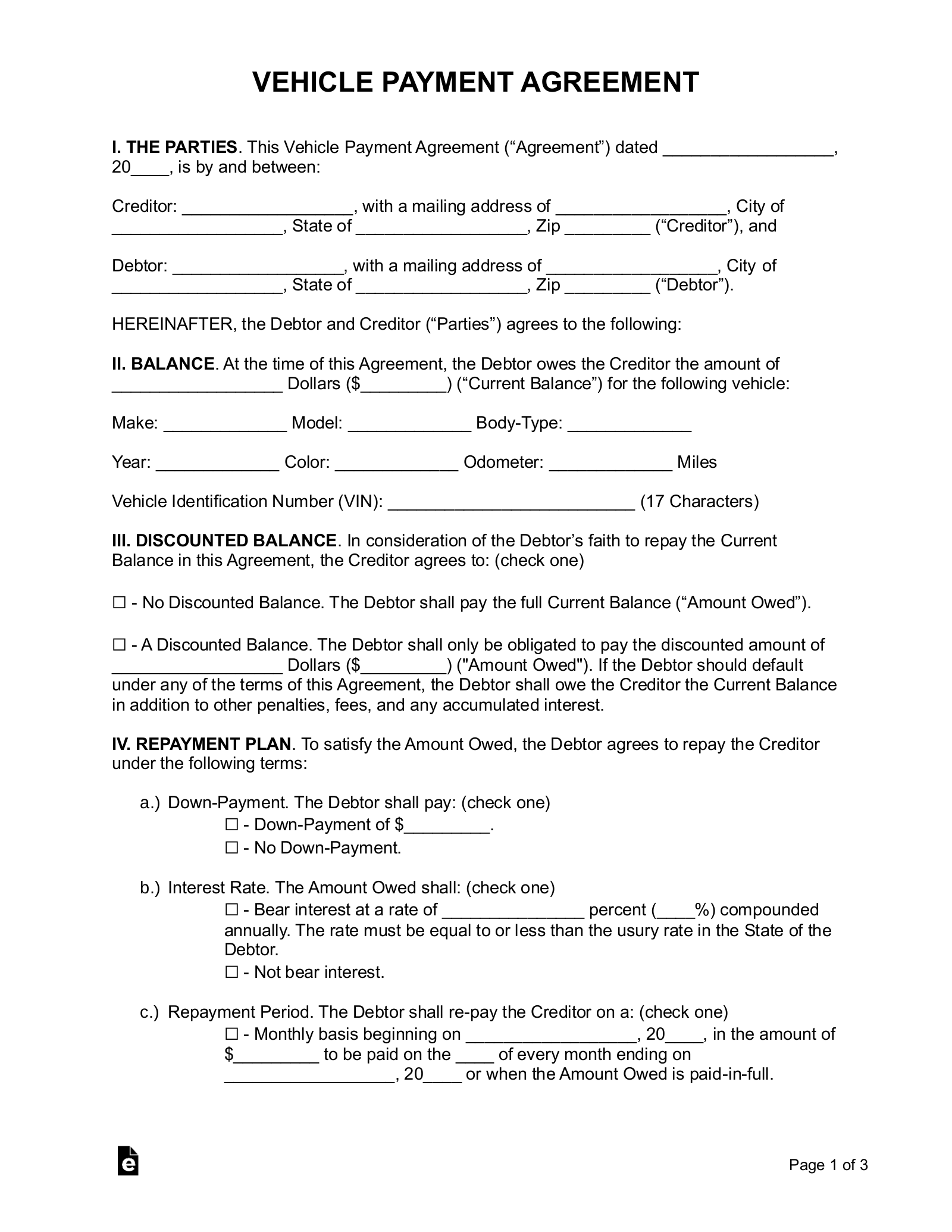

Creating a vehicle payment plan agreement from scratch can seem daunting, but breaking it down into key elements makes the task much more manageable. A comprehensive agreement should include the following:

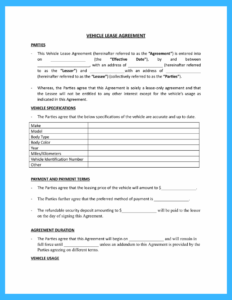

Firstly, identify all parties involved, including the seller’s full name, address, and contact information, as well as the buyer’s corresponding details. A clear identification is crucial for legal purposes. Next, describe the vehicle in detail. Include the year, make, model, VIN (Vehicle Identification Number), and mileage. This ensures that there’s no confusion about which vehicle the agreement pertains to.

Now, let’s talk money. Specify the agreed-upon purchase price of the vehicle. Clearly state the amount of any down payment made by the buyer. Outline the payment schedule, including the amount of each payment, the due dates, and the method of payment (e.g., cash, check, electronic transfer). Consider stating late payment penalties. What happens if a payment is missed? Include details about late fees, grace periods, and potential repossession of the vehicle if payments are consistently late.

Also important is the transfer of ownership. Clearly outline the process for transferring the title and registration to the buyer once all payments have been made. Specify who is responsible for the costs associated with the transfer. Don’t forget to address insurance coverage. State who is responsible for insuring the vehicle during the payment period. The buyer may be required to obtain insurance coverage, or the seller may maintain coverage until the vehicle is fully paid for.

Finally, include terms for breach of contract. Outline the consequences of either party failing to fulfill their obligations under the agreement. This could include legal action or repossession of the vehicle. Both the seller and the buyer should carefully read and understand the entire agreement before signing it. It’s advisable to seek legal counsel to review the agreement and ensure it complies with local laws.

A well-crafted vehicle payment plan agreement is like a well-tuned engine. It runs smoothly, efficiently, and reliably, providing peace of mind for everyone involved.

By having everything in writing and agreed upon upfront, both parties can move forward with confidence, knowing that their interests are protected. The car sale or purchase is more likely to be a positive experience.