Navigating the world of mortgages can feel like traversing a complex maze. With countless lenders, loan options, and intricate paperwork, it’s easy to get lost. That’s where a mortgage broker comes in. They act as your guide, helping you find the best loan for your specific needs and circumstances. But before you embark on this journey together, it’s crucial to establish a clear understanding of their services and, most importantly, their fees. This is where a mortgage broker fee agreement template becomes an invaluable tool.

Think of a mortgage broker fee agreement template as a roadmap for your financial partnership. It spells out exactly what services the broker will provide, how they will be compensated, and what happens if certain situations arise. It’s designed to protect both you and the broker, ensuring transparency and avoiding any misunderstandings down the road. By having a written agreement in place, everyone is on the same page from the very beginning.

Using a mortgage broker fee agreement template isn’t just about ticking off boxes; it’s about building trust and fostering a positive working relationship. It empowers you to make informed decisions and helps you understand the value the broker brings to the table. So, let’s delve into the essential elements of this crucial document and how it can benefit you in your home-buying journey.

Understanding the Components of a Mortgage Broker Fee Agreement

A well-crafted mortgage broker fee agreement template should be comprehensive and easy to understand. It should cover all the key aspects of the relationship between you and the broker, leaving no room for ambiguity. Let’s break down the essential components you should expect to find in such a document.

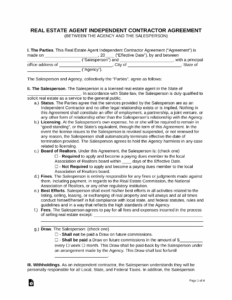

First and foremost, the agreement should clearly define the scope of services the mortgage broker will provide. This includes outlining their responsibilities in terms of researching loan options, negotiating with lenders, assisting with the application process, and guiding you through closing. The agreement should also specify whether the broker will be representing you as your agent or acting as an intermediary between you and the lender. This distinction is important as it affects the broker’s fiduciary duty to you.

The heart of any fee agreement is, of course, the fee structure. This section should detail how the mortgage broker will be compensated for their services. Common compensation models include a percentage of the loan amount, a flat fee, or a combination of both. The agreement must clearly state the exact amount or percentage of the fee, when it is due, and under what circumstances it is refundable. For instance, if the loan doesn’t close due to no fault of your own, the agreement should specify whether you’re entitled to a refund of any upfront fees.

Another crucial element is the disclosure of any potential conflicts of interest. Mortgage brokers often work with a network of lenders, and it’s important to understand if the broker receives any incentives or commissions from specific lenders that could influence their recommendation. The agreement should require the broker to disclose any such relationships and to act in your best interests regardless of these incentives.

Finally, the mortgage broker fee agreement template should include provisions for termination of the agreement, dispute resolution, and governing law. It should outline the conditions under which either party can terminate the agreement and what happens to any fees paid in advance. It should also specify how disputes will be resolved, whether through mediation, arbitration, or litigation. And lastly, it should state which state’s laws will govern the agreement.

Additional Considerations for Your Agreement

When reviewing a mortgage broker fee agreement template, pay close attention to any clauses regarding exclusivity. Some agreements may require you to work exclusively with the broker for a certain period, preventing you from seeking quotes from other brokers or lenders. Make sure you understand the implications of such clauses before signing.

Benefits of Using a Mortgage Broker Fee Agreement Template

Utilizing a mortgage broker fee agreement template provides benefits for both the borrower and the broker, contributing to a smoother and more transparent mortgage process. For borrowers, the primary advantage is clarity. A well-drafted agreement ensures you understand exactly what services you’re paying for and how the broker is compensated. This eliminates any surprises down the road and allows you to budget accordingly.

From the broker’s perspective, a fee agreement template provides legal protection. It serves as written documentation of the agreed-upon terms and conditions, protecting them from potential disputes or misunderstandings with clients. A clear agreement also enhances the broker’s professional image, demonstrating their commitment to transparency and ethical business practices. It can be a valuable tool for building trust with potential clients.

Furthermore, using a mortgage broker fee agreement template can help streamline the mortgage process. By clearly defining roles and responsibilities upfront, it minimizes the risk of delays or complications later on. This allows both parties to focus on the common goal: securing the best possible mortgage for the borrower’s needs.

Ultimately, a comprehensive agreement empowers borrowers to make informed decisions. It allows you to compare the fees and services of different brokers and choose the one that best fits your requirements. It also provides a valuable point of reference throughout the mortgage process, ensuring that the broker is delivering on their promises.

Having a properly filled out mortgage broker fee agreement template helps avoid many problems down the road and can bring peace of mind to both parties. It solidifies that professional relationship and begins it on the right foot.

Remember, a solid mortgage broker fee agreement template is your shield and sword in the mortgage battlefield. It ensures everyone’s on the same page and protects your interests.

Investing time in understanding and customizing your agreement will pay dividends in a stress-free home buying experience. It’s more than just a document; it’s the foundation for a successful partnership.