So, you’re thinking about leasing a vehicle in Ontario? That’s a great option for many people, offering flexibility and often lower monthly payments compared to buying. But before you drive off the lot, it’s super important to have a solid understanding of your lease agreement. A vehicle lease agreement template Ontario is your best friend here, ensuring you have all the necessary details covered and protecting both you and the leasing company.

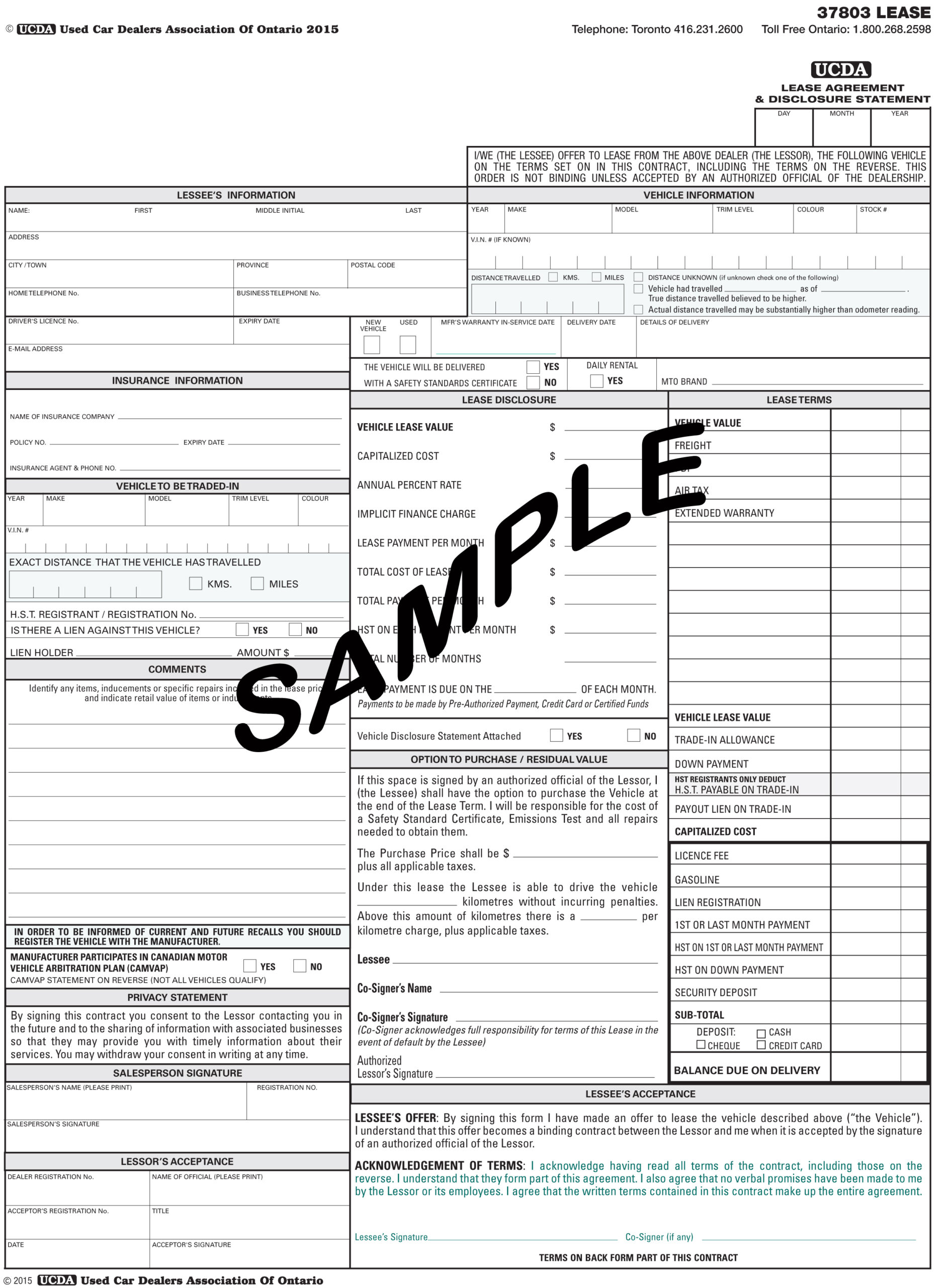

Think of a vehicle lease agreement template Ontario as a roadmap for your leasing journey. It outlines the responsibilities of both the lessor (the company leasing you the car) and the lessee (that’s you!). This includes things like the length of the lease, the monthly payment amount, any restrictions on mileage, and what happens at the end of the lease term. It’s a legally binding document, so reading it carefully is absolutely crucial.

Navigating legal documents can feel overwhelming, but it doesn’t have to be! This guide will walk you through the key components of a vehicle lease agreement template Ontario, helping you understand what to look for and how to ensure you’re getting a fair deal. We’ll break down the jargon and provide helpful tips to make the process as smooth as possible. Let’s dive in!

Understanding the Key Components of a Vehicle Lease Agreement Template Ontario

A vehicle lease agreement template Ontario is a comprehensive document designed to protect both parties involved in the lease transaction. It’s much more than just a payment plan; it’s a detailed outline of rights, responsibilities, and potential consequences. Let’s break down some of the most important sections you’ll find in a typical template.

First, pay close attention to the lease term. This specifies the exact duration of your lease, usually expressed in months. Make sure the term aligns with your needs and budget. Longer lease terms might mean lower monthly payments, but they could also mean you’re stuck with the same vehicle for a longer period, even if your needs change.

Next up is the monthly payment. This section will clearly state the amount you’re required to pay each month. However, be sure to look beyond just the monthly payment figure! Consider any additional fees that might be included, such as taxes, insurance, or maintenance charges. A seemingly low monthly payment can quickly become expensive if you’re hit with unexpected fees.

Mileage allowances are another crucial factor to consider. Most lease agreements come with a mileage limit, specifying the maximum number of kilometers you can drive during the lease term. Exceeding this limit will result in per-kilometer charges, which can add up quickly. Carefully estimate your annual driving needs and choose a mileage allowance that adequately covers them. It’s often better to overestimate slightly than to underestimate and face hefty overage fees.

Finally, understand the end-of-lease options. At the end of your lease term, you’ll typically have a few choices. You can return the vehicle, purchase it at a predetermined price, or sometimes extend the lease. Carefully review the terms and conditions related to each option, especially the condition in which the vehicle must be returned to avoid any penalties for excessive wear and tear. Make sure you are aware of any disposition fees that may be charged at the end of the lease. These fees are often used to cover the cost of preparing the vehicle for resale.

Tips for Reviewing and Negotiating Your Vehicle Lease Agreement Template Ontario

So, you’ve got your hands on a vehicle lease agreement template Ontario. Now what? Don’t just sign on the dotted line! Take your time to carefully review every section and understand the implications. Here are some tips to help you navigate the process and potentially negotiate better terms.

First and foremost, read the fine print! We know it’s tempting to skim over the small details, but that’s where important information often lies. Pay particular attention to clauses related to early termination, penalties, and your responsibilities for maintaining the vehicle. Don’t be afraid to ask questions if anything is unclear. The leasing company should be able to explain any terms or conditions you don’t understand.

Don’t be afraid to negotiate! The terms of a lease agreement are often negotiable, especially if you’re a good negotiator or have a strong credit history. You might be able to negotiate a lower monthly payment, a higher mileage allowance, or a more favorable purchase option at the end of the lease. Research the market value of the vehicle and come prepared with evidence to support your desired terms.

Consider the total cost of the lease. Don’t just focus on the monthly payment. Factor in all the additional costs, such as down payments, taxes, fees, and potential penalties. This will give you a more accurate picture of the overall financial commitment.

Get a second opinion. If you’re feeling unsure about any aspect of the lease agreement, consider having it reviewed by a lawyer or financial advisor. They can provide valuable insights and help you protect your interests.

Document everything. Keep copies of all documents related to the lease, including the agreement itself, any correspondence with the leasing company, and any maintenance records. This will be helpful if any disputes arise down the road.

The leasing process involves careful consideration of the monthly payments, the vehicle’s condition, and the associated fees. Understanding these aspects will empower you to make informed decisions.

Ultimately, entering into a vehicle lease should leave you feeling confident and secure. Careful attention to detail and a proactive approach will ensure a positive leasing experience.