Ever feel like you’re wading through a jungle of invoices and hourly rates? Sometimes, a clean, simple solution is exactly what you need. That’s where a lump sum payment comes in. It’s a straightforward way to pay for a project, removing the complexities of tracking every single hour or expense. Think of it as a one-and-done deal, a clear understanding upfront that benefits both parties involved.

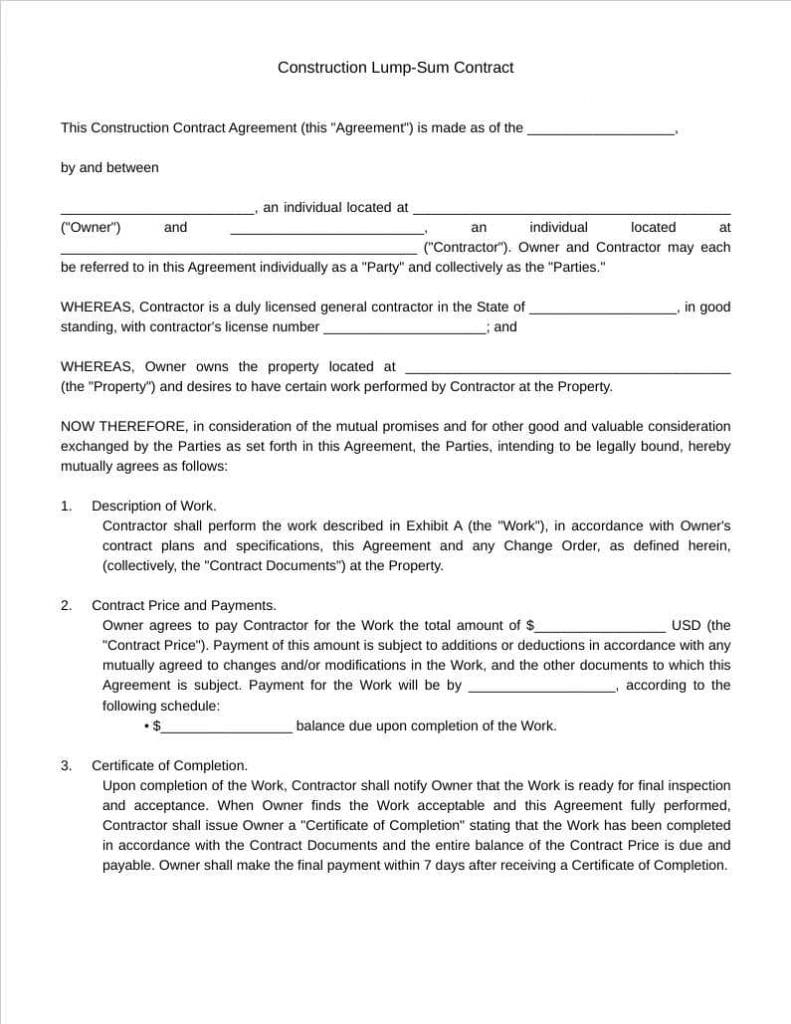

But just like any financial arrangement, it’s crucial to have a solid agreement in place. This is where a well-crafted template steps in. It provides a framework to document all the important details: the project scope, the agreed-upon price, and the payment terms. Using a template ensures that everyone is on the same page, minimizing the risk of misunderstandings or disputes down the line.

This article will guide you through the ins and outs of using a lump sum payment agreement template, highlighting its advantages and key elements. We’ll explore how it can simplify your payment process and provide peace of mind for both the client and the service provider. Consider this your handy guide to understanding and utilizing this valuable tool.

Why Use a Lump Sum Payment Agreement Template?

Choosing a lump sum payment offers a number of advantages, streamlining the payment process and reducing administrative headaches. First and foremost, it provides clarity and predictability. With a fixed price agreed upon upfront, both parties know exactly what to expect. This eliminates the uncertainty associated with hourly rates or cost-plus arrangements, where the final bill can fluctuate significantly.

Think about it: no more endless tracking of hours, no more scrutinizing expense reports. A lump sum agreement simplifies budgeting and financial planning. The client knows the total cost from the outset, allowing them to allocate resources accordingly. The service provider, in turn, can estimate their profit margin and manage their workload effectively. This transparent approach fosters trust and strengthens the working relationship.

Another key benefit is increased efficiency. Because the payment is fixed, the service provider is incentivized to complete the project quickly and efficiently. There’s no financial incentive to drag things out; instead, the focus is on delivering quality work within the agreed-upon timeframe. This can lead to faster project completion and increased client satisfaction.

Furthermore, a lump sum payment agreement template reduces the administrative burden. By using a standardized form, you avoid the need to draft a new agreement from scratch each time. The template provides a structure, ensuring that all essential clauses are included. This saves time and reduces the risk of overlooking important details.

However, it’s important to remember that lump sum payments aren’t suitable for every project. They work best when the scope of work is well-defined and unlikely to change significantly. If there’s a high degree of uncertainty or the potential for scope creep, an alternative payment structure might be more appropriate. A template can help you assess these factors by prompting you to clearly outline the project scope.

Key Elements of a Solid Lump Sum Payment Agreement

A well-structured lump sum payment agreement is more than just a price tag. It’s a comprehensive document that outlines the responsibilities, expectations, and rights of both parties. To create an effective agreement, you need to include several key elements. First and foremost, the agreement must clearly define the scope of work. What specific tasks or services are included in the lump sum price? Be as detailed as possible to avoid any ambiguity.

Next, the agreement should specify the total lump sum amount and the payment schedule. Will the payment be made in a single installment upon completion, or will there be multiple milestones with corresponding payments? Clearly outlining the payment terms is essential to avoid confusion and ensure timely payment. Also, address what happens if the scope of the project increases or changes. Having a change order clause in your agreement will prevent disputes in the future.

Another crucial element is a clause addressing potential delays or unforeseen circumstances. What happens if the project is delayed due to factors outside of either party’s control? Will there be any penalties or adjustments to the payment schedule? Addressing these scenarios in advance can help mitigate potential conflicts.

The agreement should also include clauses related to warranties, guarantees, and liability. What guarantees are provided regarding the quality of the work? What recourse does the client have if the service provider fails to meet their obligations? Defining these aspects provides clarity and protects both parties.

Finally, ensure that the agreement includes a section outlining the process for dispute resolution. How will disagreements be handled? Will mediation or arbitration be used? Having a clear process for resolving disputes can save time and money in the long run. Using a lump sum payment agreement template will help you to address all of these key items.

It’s all about laying the groundwork for a smooth and successful collaboration. A clear, well-defined agreement, built from a solid lump sum payment agreement template, is your best bet for a positive outcome.

In the end, the goal is to create a win-win scenario where both parties feel confident and protected. A lump sum agreement, when properly implemented, can foster trust, streamline the payment process, and contribute to the overall success of the project.