Securing a loan often involves more than just a handshake and a promise to pay it back. When significant sums of money are involved, lenders understandably want assurance that they’ll get their money back. That’s where a loan and security agreement comes into play. It’s a legally binding contract that outlines the terms of the loan, but more importantly, it provides the lender with a security interest in specific assets of the borrower.

Think of it like this: you’re borrowing money to buy a car. The bank isn’t just giving you the money out of the goodness of their hearts. They’re holding a lien on the car itself. If you fail to repay the loan according to the agreed-upon terms, the bank has the right to repossess the car and sell it to recover their losses. This principle extends to various types of assets, from equipment and inventory to accounts receivable and even intellectual property.

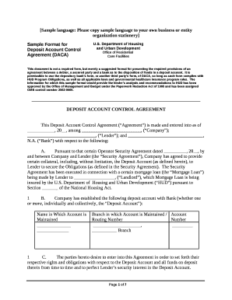

Crafting a comprehensive loan and security agreement from scratch can be a daunting task. Legal jargon, specific clauses, and jurisdictional nuances can easily overwhelm even experienced business owners. Luckily, a well-structured loan and security agreement template can provide a solid foundation. However, it’s crucial to understand what these templates are, what they cover, and how to customize them to fit your specific needs.

Understanding the Core Elements of a Loan and Security Agreement

At its heart, a loan and security agreement is a detailed roadmap that governs the relationship between a lender and a borrower. It’s far more comprehensive than a simple promissory note, which primarily focuses on the borrower’s promise to repay. A loan and security agreement delves into the specifics of the collateral being offered as security, the lender’s rights in the event of default, and the procedures for enforcing those rights.

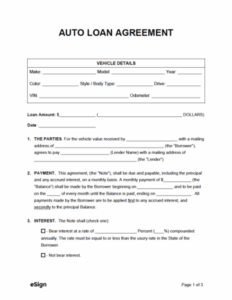

The agreement typically begins by clearly identifying the parties involved: the lender (the entity providing the loan) and the borrower (the entity receiving the loan). It then meticulously outlines the loan amount, the interest rate, the repayment schedule (including the frequency and amount of payments), and any associated fees. This section is paramount, as it defines the financial obligations of the borrower.

One of the most critical components of the agreement is the security interest clause. This clause grants the lender a security interest in specific assets of the borrower. These assets, known as collateral, serve as security for the loan. The agreement must clearly describe the collateral, whether it’s equipment, inventory, real estate, or other valuable assets. The description needs to be precise and unambiguous to avoid any disputes later on.

The loan and security agreement also includes provisions addressing events of default. These are situations where the borrower fails to meet their obligations under the agreement. Common events of default include failure to make timely payments, breach of other covenants (promises) in the agreement, or the borrower becoming insolvent. The agreement specifies the lender’s remedies in the event of default, which may include accelerating the loan (demanding immediate repayment of the entire outstanding balance), repossessing the collateral, and pursuing legal action to recover the debt.

Finally, a well-drafted agreement will include miscellaneous provisions covering matters such as governing law (which jurisdiction’s laws will apply), notices (how communications between the parties will be delivered), and amendment procedures (how the agreement can be modified). These seemingly minor provisions can have significant implications in the event of a dispute, so it’s important to pay close attention to them.

Benefits of Using a Loan and Security Agreement Template

While a loan and security agreement template isn’t a substitute for legal advice, it offers several compelling benefits, especially for small businesses and individuals. The most obvious advantage is the time and cost savings. Hiring an attorney to draft a custom agreement from scratch can be expensive. A template provides a pre-built framework that you can adapt to your specific circumstances, potentially saving you hundreds or even thousands of dollars in legal fees.

Another benefit is that templates offer a structured approach to drafting the agreement. They ensure that you cover all the essential elements, reducing the risk of overlooking critical provisions. A good template will typically include clauses addressing the loan amount, interest rate, repayment schedule, collateral description, events of default, and remedies. By following the template, you can create a more comprehensive and legally sound agreement.

Furthermore, using a template can improve your understanding of the loan process. By reviewing the different clauses and provisions, you’ll gain a better grasp of your rights and obligations as a borrower or a lender. This increased understanding can empower you to negotiate more effectively and make informed decisions.

However, it’s crucial to remember that a loan and security agreement template is just a starting point. It’s not a one-size-fits-all solution. You need to carefully review the template and customize it to reflect the unique circumstances of your transaction. This may involve adding or deleting clauses, modifying existing provisions, and ensuring that the template complies with applicable laws and regulations.

Before using any loan and security agreement template, it’s always a good idea to consult with an attorney to ensure that it meets your specific needs and that it’s legally compliant. An attorney can help you identify any potential risks or issues and make necessary adjustments to the template. They can also provide valuable guidance on negotiating the terms of the agreement and protecting your interests.

Ultimately, a loan and security agreement serves as a critical tool for managing risk and protecting the interests of both lenders and borrowers. Understanding its key components and utilizing resources like templates can streamline the process and contribute to a more secure and predictable financial arrangement. Taking the time to properly document the agreement provides peace of mind for all parties involved.

The importance of a comprehensive and well-executed loan document cannot be overstated, safeguarding all parties involved and ensuring clarity throughout the loan’s lifecycle. Remember, this document provides protection for both the lender and the borrower, so ensure you understand everything before signing.