Loaning money to family can be a delicate dance. You want to help out, but you also don’t want to jeopardize your relationship over financial misunderstandings. A simple handshake agreement might seem sufficient, especially with loved ones, but memories fade, and circumstances change. This is where a loan agreement template for family comes in handy. It provides a clear record of the terms, protecting both the lender and the borrower.

Think of a loan agreement template for family as a roadmap. It lays out the loan amount, the interest rate (if any), the repayment schedule, and what happens if payments are missed. It’s not about distrust; it’s about open communication and setting realistic expectations. Having everything in writing prevents future disputes and ensures everyone is on the same page. It can actually strengthen family bonds by removing ambiguity and fostering financial responsibility.

Using a loan agreement template for family isn’t just about protecting your money; it’s about protecting your relationships. It establishes a professional, yet personal, framework for the transaction. This structure can make it easier to discuss potentially uncomfortable topics like late payments or changing financial circumstances. Plus, in the unlikely event of a serious disagreement, the agreement provides a legally sound reference point.

Why Use a Loan Agreement Template For Family?

Let’s face it, mixing family and finances can be tricky. You might feel awkward asking your brother to sign a contract, or your daughter might think you don’t trust her if you suggest putting things in writing. However, remember that a loan agreement isn’t a sign of distrust, but rather a sign of respect. It respects the importance of the financial transaction and the importance of the family relationship.

A formal agreement brings clarity. It explicitly states the terms of the loan, leaving no room for misinterpretations. How much is being loaned? What’s the agreed-upon interest rate? When are the payments due? What are the consequences of late payments? Answering these questions upfront prevents misunderstandings down the road. This is far more preferable to a verbal agreement, which can easily be forgotten or misinterpreted.

Consider the tax implications. Depending on the amount and the interest rate, the loan might have tax consequences for both the lender and the borrower. Having a written agreement demonstrates to tax authorities that this is a legitimate loan, not a gift, which can affect your tax liabilities. This is especially important for larger loans.

More than just taxes, a written agreement documents how the loan should be repaid. This provides structure for the borrower to follow. Without a written agreement, there is a chance that repayment can be sporadic or simply forgotten. This can create issues for both the lender and borrower.

Finally, a loan agreement template for family can provide peace of mind. Knowing that you have a legally sound document in place can alleviate stress and anxiety related to the loan. It gives you a clear course of action if things don’t go as planned, and it protects your financial interests in a responsible and professional manner.

Key Components of a Family Loan Agreement

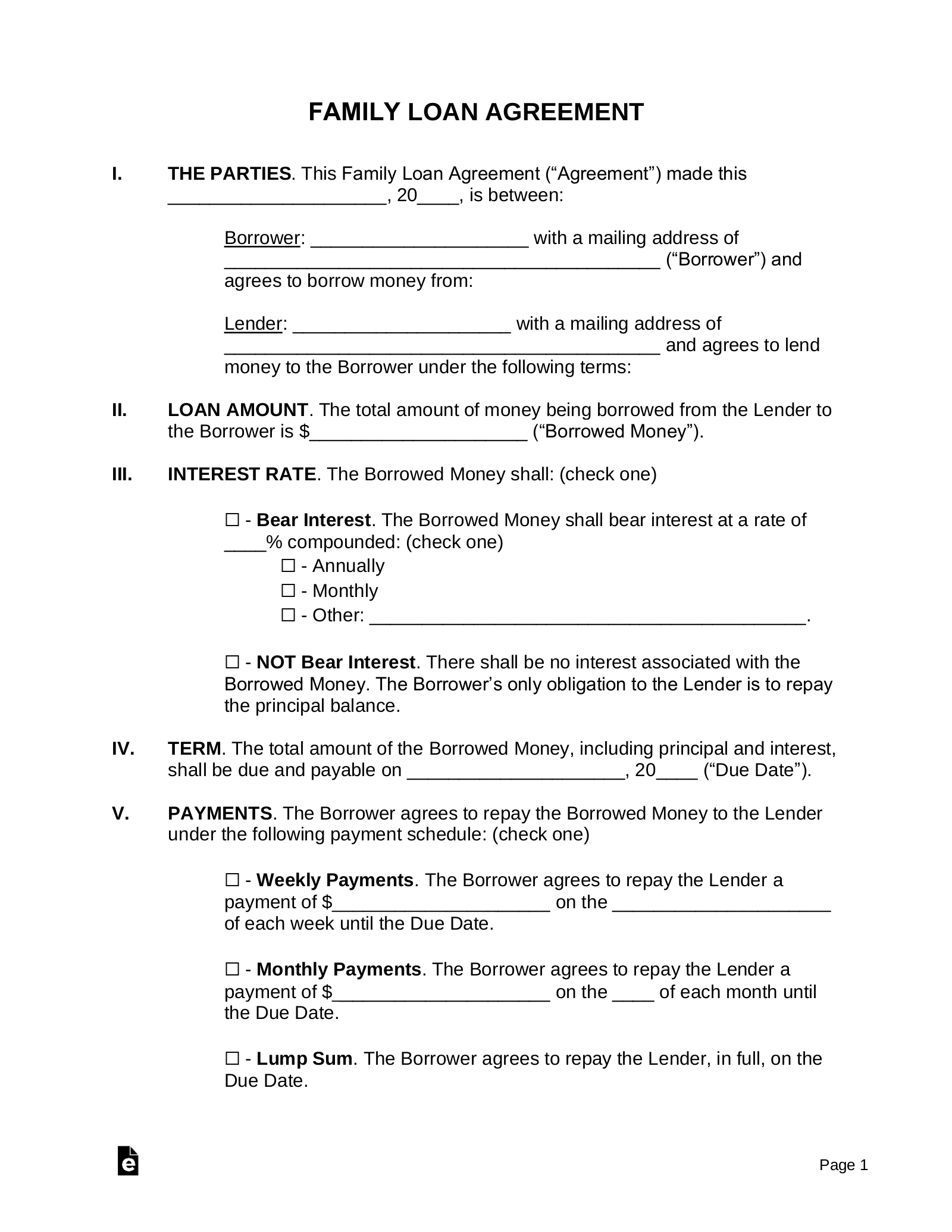

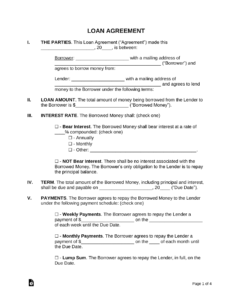

A good loan agreement template for family should include several key components to ensure it’s comprehensive and legally sound. First and foremost, it needs to clearly identify the lender and the borrower, including their full legal names and addresses. This may seem obvious, but it’s crucial for legal clarity.

The agreement must explicitly state the principal loan amount. This is the total sum of money being loaned. This amount needs to be clearly written in numerical form and spelled out in words to avoid any confusion. For example, you’d write “$10,000 (Ten Thousand Dollars)”.

Interest rates are often a sticking point in family loans. Whether you decide to charge interest or not, it’s essential to clearly state your decision in the agreement. If you are charging interest, specify the exact percentage rate and how it will be calculated (e.g., simple interest, compound interest). It’s wise to research the applicable federal and state interest rate laws to make sure your agreement is compliant.

The repayment schedule is another critical element. The agreement should outline the frequency of payments (e.g., weekly, monthly, quarterly), the amount of each payment, and the due date for each payment. It should also specify the method of payment (e.g., check, electronic transfer). If there’s a balloon payment at the end of the loan term, that needs to be clearly stated as well.

Finally, the agreement should address what happens in the event of default. This includes defining what constitutes a default (e.g., missing a certain number of payments), outlining the consequences of default (e.g., late fees, acceleration of the loan, legal action), and detailing any remedies available to the lender. Including these clauses helps prevent future issues if the loan is not being properly repaid.

Having a well-structured, professionally written loan agreement in place ensures that everyone involved knows their rights and responsibilities, fostering a better financial environment. With open communication and careful planning, lending to family can be a positive experience for all.