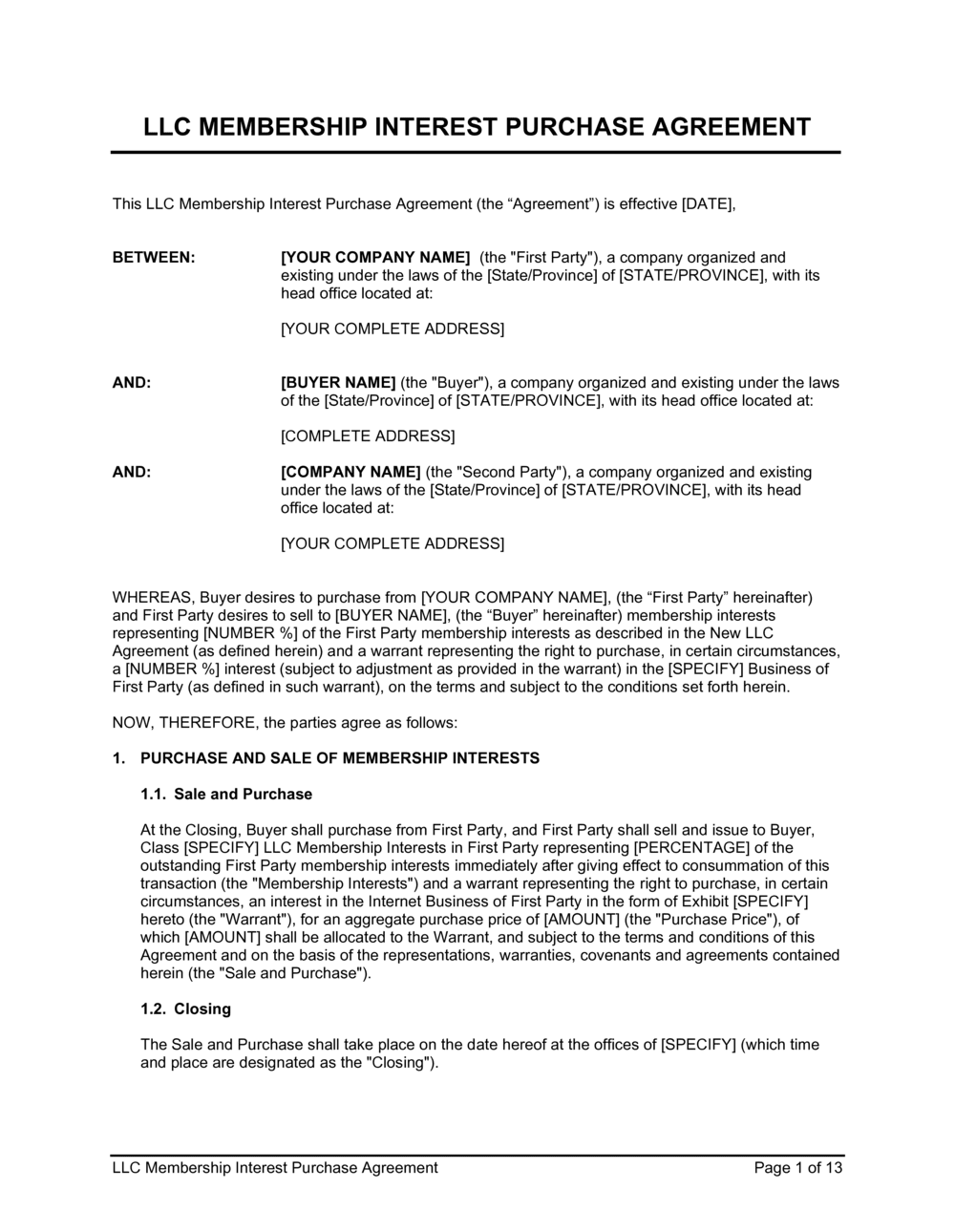

Llc Membership Interest Purchase Agreement Template

So, you’re diving into the world of LLCs and need to transfer ownership? Specifically, you’re looking for an LLC membership interest purchase agreement template? You’ve come to the right place! Buying or selling a piece of an LLC is a significant transaction, and it’s absolutely crucial to have the paperwork in order. Think of it as laying the groundwork for a smooth transition and preventing potential headaches down the road. This agreement lays out all the nitty-gritty details, ensuring everyone is on the same page.

Why is a solid agreement so important? Well, it’s more than just a formality. It’s a legally binding document that protects both the buyer and the seller. It spells out exactly what’s being sold, for how much, and under what conditions. Without a clear agreement, things can quickly get messy. Imagine disagreements arising later about the valuation of the interest, or the responsibilities of the buyer. A well-drafted agreement nips those potential issues in the bud.

Throughout this guide, we will explore the key elements of an LLC membership interest purchase agreement template, why it’s essential, and what you should consider when using one. We’ll break down the jargon and provide practical insights to help you navigate this process with confidence. Remember, this isn’t legal advice, but it’s designed to empower you with the knowledge to make informed decisions.

Understanding the Llc Membership Interest Purchase Agreement

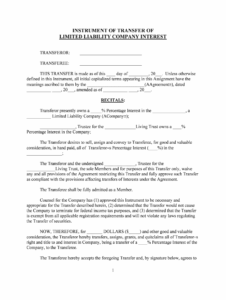

An LLC membership interest purchase agreement is essentially a contract that outlines the terms and conditions for the sale and transfer of a member’s ownership stake in a limited liability company (LLC). It’s a crucial document because it formally transfers the rights, responsibilities, and financial interests associated with that membership from the seller to the buyer. Without this agreement, the transfer might not be legally recognized, and it could lead to disputes among the LLC members.

The core purpose of the agreement is to clearly define the “who, what, when, where, and how” of the transaction. Who are the buyer and seller? What percentage of the LLC is being transferred? When will the transfer take place? Where is the LLC located and governed? How will the purchase be funded, and what are the payment terms? By addressing these questions explicitly, the agreement provides a roadmap for the transaction and minimizes the risk of misunderstandings.

Think of it like selling a car. You wouldn’t just hand over the keys without a bill of sale, right? The bill of sale outlines the details of the transaction, like the price, the make and model of the car, and the date of the sale. The LLC membership interest purchase agreement serves a similar purpose, but it’s tailored to the specific context of an LLC and its operating agreement. The operating agreement itself governs the rules and regulations of the LLC and often contains provisions relating to the transfer of membership interests.

Key elements you’ll find in an LLC membership interest purchase agreement template include: identification of the parties (buyer and seller), a detailed description of the membership interest being sold (percentage ownership, voting rights, etc.), the purchase price and payment terms (including any financing arrangements), representations and warranties from both parties (assurances about the accuracy of information provided), closing procedures (steps to finalize the transaction), governing law (the jurisdiction whose laws will govern the agreement), and provisions for dispute resolution (how disagreements will be handled).

Furthermore, it’s vital to ensure that the agreement complies with the LLC’s operating agreement and any applicable state laws. The operating agreement might impose restrictions on the transfer of membership interests, such as requiring the consent of other members. Failing to comply with these restrictions could invalidate the transfer. In short, having a solid and legally sound LLC membership interest purchase agreement template is a critical step in ensuring a successful and legally compliant transfer of ownership.

Specific Clauses to Consider

Beyond the basic elements, certain clauses deserve special attention. For example, clauses regarding indemnification (protecting a party from losses or damages), confidentiality (protecting sensitive information), and non-compete agreements (restricting the seller from competing with the LLC after the sale) can significantly impact the rights and obligations of the parties involved. Carefully review and understand the implications of each clause before signing the agreement. It might be useful to seek legal advice on these complex clauses.

Essential Considerations When Using an Llc Membership Interest Purchase Agreement Template

While an LLC membership interest purchase agreement template provides a solid starting point, it’s crucial to remember that it’s not a one-size-fits-all solution. Every LLC and every transaction is unique, so it’s essential to tailor the template to your specific circumstances. Blindly using a generic template without careful consideration can lead to problems down the road.

One key aspect to consider is the valuation of the membership interest. How did you arrive at the purchase price? Was it based on a formal appraisal, or was it a negotiated amount between the buyer and seller? The agreement should clearly document the basis for the valuation to avoid potential disputes. Factors to consider when determining the value of the membership interest include the LLC’s assets, liabilities, revenues, and future prospects. Consulting with a business valuation expert can be beneficial, especially for larger or more complex transactions.

Another important consideration is the impact of the transfer on the other LLC members. Does the operating agreement require their consent? Are they entitled to a right of first refusal, meaning they have the first opportunity to purchase the membership interest? It’s essential to respect the rights of the other members and ensure that the transfer complies with the terms of the operating agreement.

Tax implications are also a critical consideration. The sale of an LLC membership interest can have significant tax consequences for both the buyer and the seller. It’s essential to consult with a tax advisor to understand the tax implications of the transaction and to structure the agreement in a way that minimizes tax liabilities. For instance, the sale could be taxed as capital gains or as ordinary income, depending on the specific circumstances.

Finally, it’s always a good idea to have an attorney review the agreement before it’s signed. An attorney can help you identify any potential risks or loopholes and ensure that the agreement adequately protects your interests. Legal counsel can also assist with negotiating the terms of the agreement and ensuring that it complies with all applicable laws. While using an LLC membership interest purchase agreement template can save time and money, seeking professional legal advice is always a wise investment.

Navigating the complexities of LLC membership interest transfers can be challenging, but with careful planning and the right tools, you can ensure a smooth and successful transaction. Remember, a well-drafted agreement is your best defense against potential disputes and misunderstandings.

Understanding the nuances of your specific LLC, including its operating agreement and state regulations, is paramount. Seeking professional guidance from legal and financial experts will further solidify your position and safeguard your interests.