So, you’re thinking about setting up a line of credit? Smart move! Whether you’re a business owner looking to manage cash flow, or an individual wanting some financial flexibility, a line of credit can be a lifesaver. But before you dive in, you’ll need a solid line of credit loan agreement. Think of it as the rulebook for your borrowing relationship. It outlines everything from the amount of credit available to the interest rates and repayment terms. Creating this agreement from scratch can be daunting, that’s where a template comes in handy.

A line of credit loan agreement template offers a framework, ensuring you cover all the essential aspects of the loan. It’s like having a blueprint for a successful lending arrangement. These templates can save you time and legal fees, because who wants to spend hours drafting legal documents when you could be focusing on growing your business or achieving your personal goals? It’s essential to customize it to fit your specific needs, of course, but it’s a great starting point.

Choosing the right line of credit loan agreement template is crucial. Look for templates that are clear, comprehensive, and easy to understand. A well-written template will help prevent misunderstandings and disputes down the line. It’s also a good idea to consult with a legal professional to review the document before finalizing it, just to be absolutely sure you’ve covered all your bases and that it’s compliant with the laws and regulations in your jurisdiction. Nobody wants unexpected legal trouble down the road!

Understanding the Essentials of a Line of Credit Loan Agreement

A line of credit loan agreement isn’t just a piece of paper; it’s a legally binding contract that outlines the rights and responsibilities of both the lender and the borrower. It’s crucial to understand the key elements included in this document to ensure a smooth and transparent borrowing experience. Let’s break down some of the most important aspects.

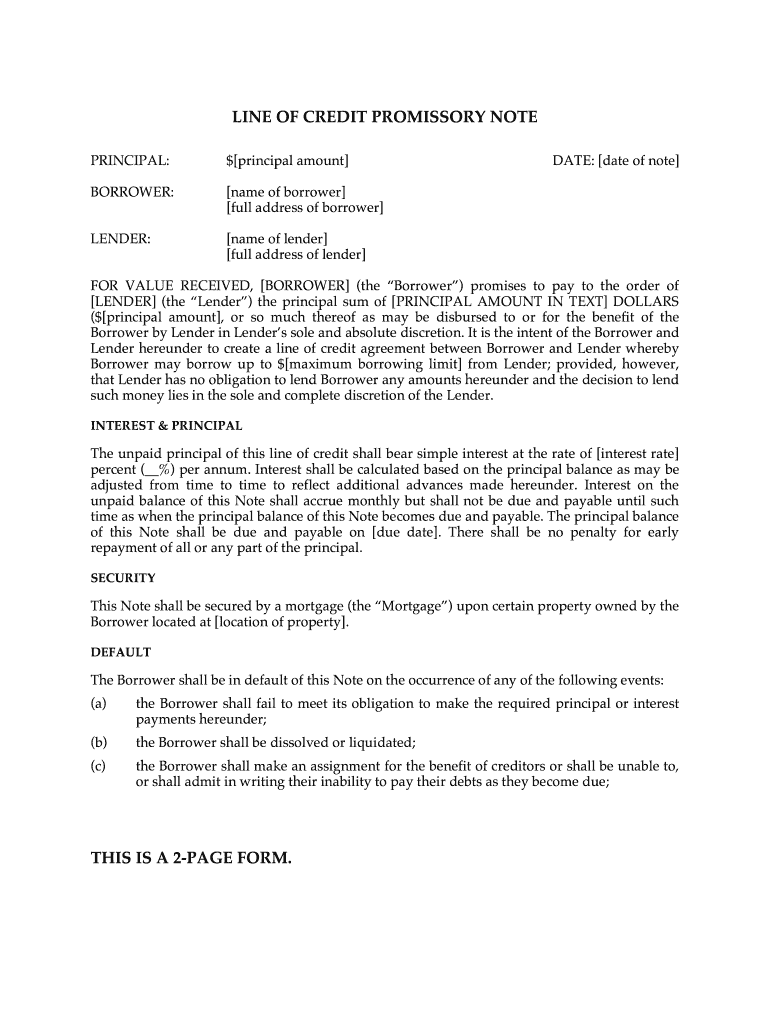

Firstly, the agreement will clearly state the amount of credit being offered. This is the maximum amount of money the borrower can draw upon. It also specifies how the borrower can access these funds, whether it’s through checks, online transfers, or other methods. This section provides clarity on the availability and accessibility of the credit line.

Next, the agreement will detail the interest rate that applies to the borrowed funds. This could be a fixed rate, which remains constant throughout the term, or a variable rate, which fluctuates based on a benchmark interest rate, such as the prime rate. The agreement should also clearly explain how interest is calculated and when it is charged. Understanding the interest rate is crucial for budgeting and managing your repayments.

Repayment terms are another vital component. The agreement will specify the minimum payment amount, the payment frequency (e.g., monthly, quarterly), and the due date. It will also outline any penalties for late payments or defaults. It’s crucial to understand these terms to avoid late fees and protect your credit score.

Finally, the agreement will include clauses addressing default, termination, and legal jurisdiction. These clauses outline what happens if the borrower fails to meet their obligations, the conditions under which the lender can terminate the agreement, and the legal jurisdiction that governs the agreement. Understanding these clauses can help you navigate any potential issues that may arise during the term of the line of credit.

Key Considerations When Choosing a Line of Credit Loan Agreement Template

Not all templates are created equal, so it’s essential to choose wisely. Selecting the right line of credit loan agreement template can save you time, money, and potential headaches down the road. Here are some key considerations to keep in mind during your selection process.

First and foremost, ensure the template is comprehensive. It should cover all the essential elements discussed above, including the credit limit, interest rate, repayment terms, default provisions, and legal jurisdiction. A complete template leaves less room for ambiguity and misunderstandings, reducing the risk of disputes.

Next, look for a template that is clear and easy to understand. Legal jargon can be confusing, so choose a template that uses plain language and avoids overly technical terms. A well-written template should be accessible to both the lender and the borrower, regardless of their legal expertise.

Consider the source of the template. Opt for templates from reputable sources, such as legal websites, financial institutions, or professional legal services. These sources are more likely to provide accurate and up-to-date information. Be wary of free templates from unknown sources, as they may not be legally sound or tailored to your specific needs.

Customization is key. While a template provides a solid foundation, it’s important to customize it to reflect the specific terms of your line of credit agreement. Add or modify clauses as needed to ensure the template accurately reflects the unique circumstances of your loan. Consulting with a legal professional is highly recommended to ensure your customizations are legally sound.

Finally, ensure the template is compliant with the laws and regulations in your jurisdiction. Lending laws vary by state and country, so it’s crucial to choose a template that complies with the applicable laws in your area. This can help prevent legal challenges and ensure the enforceability of the agreement.

Ultimately, a well-structured line of credit loan agreement can foster a transparent and mutually beneficial lending relationship. Taking the time to understand the agreement and choosing the right template are investments in your financial well-being.