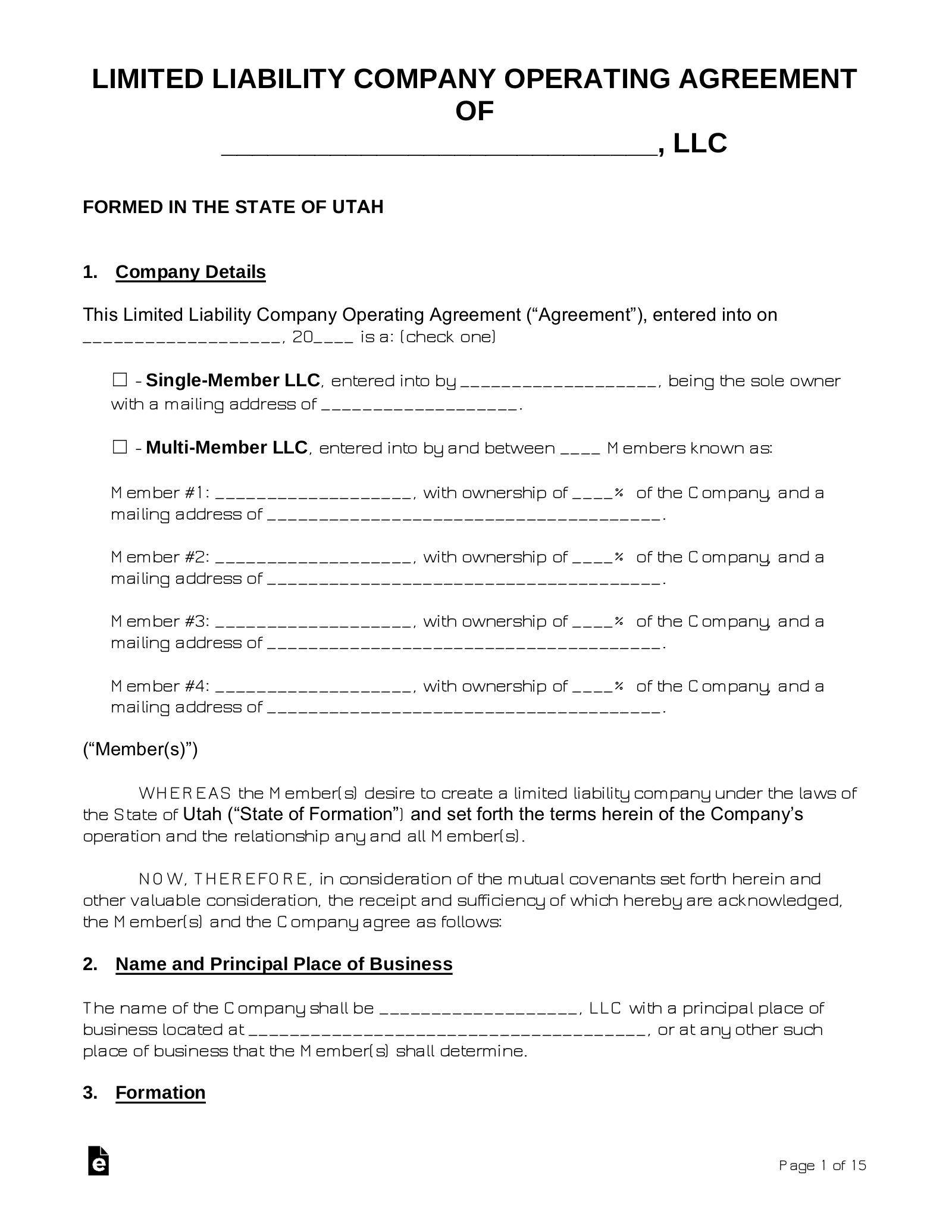

Starting a Limited Liability Company (LLC) in Utah is an exciting venture, but it’s also a process that requires careful attention to detail. One of the most crucial documents you’ll need is an operating agreement. Think of it as the blueprint for how your LLC will run, outlining the responsibilities of members, profit and loss distribution, and decision-making processes. It’s not legally required in Utah, but trust me, you absolutely want one.

Without an operating agreement, your LLC will be governed by Utah’s default LLC statutes. While these statutes provide a framework, they might not align with your specific business needs or the intentions of the members. A well-drafted operating agreement provides clarity, prevents potential disputes, and establishes a solid foundation for your business’s success. Many people search for a Utah LLC operating agreement template to get started.

This article will guide you through why you need a Utah LLC operating agreement template, what to include, and where to find reliable resources to help you create one that perfectly suits your business. We will explore the essential components and provide insights into tailoring it to your specific circumstances. Let’s dive in and ensure your Utah LLC is set up for success from the start.

Why Your Utah LLC Needs an Operating Agreement

Okay, so you might be thinking, “Do I really need an operating agreement if Utah doesn’t require it?”. The short answer is a resounding yes. Imagine you and your business partner have a disagreement about how to distribute profits. Without an operating agreement, you’re relying on the state’s default rules, which may not reflect your agreed-upon arrangement. An operating agreement acts as a binding contract between members, preventing misunderstandings and potential legal battles down the road. It essentially puts everyone on the same page and safeguards your personal assets.

Beyond preventing disputes, an operating agreement enhances your LLC’s credibility. Banks and other financial institutions often require an operating agreement when you apply for loans or open business bank accounts. It demonstrates that your LLC is a legitimate and well-organized entity. Furthermore, it can protect your personal liability by reinforcing the separation between you and your business. This separation is one of the main reasons people choose to form an LLC in the first place, and an operating agreement strengthens that shield.

Consider this: Utah’s default rules might dictate that profits are distributed equally among members, regardless of their individual contributions. What if one member invested significantly more capital or dedicates more time to the business? An operating agreement allows you to customize profit distribution based on specific contributions, ensuring fairness and reflecting the unique circumstances of your LLC.

Another crucial aspect is the transfer of ownership. What happens if a member wants to leave the LLC or sell their interest? An operating agreement outlines the procedures for transferring membership interests, preventing potential conflicts and ensuring a smooth transition. It might specify buy-sell provisions, giving existing members the right of first refusal to purchase the departing member’s interest.

In essence, an operating agreement provides control and flexibility. It allows you to customize the structure and operations of your LLC to align with your vision and goals. It’s a proactive step that can save you time, money, and headaches in the long run.

Essential Components of a Utah LLC Operating Agreement

A comprehensive operating agreement covers various aspects of your LLC’s operations. Let’s break down some of the essential components you should include:

Basic Information

This section should clearly state the name of your LLC, its registered agent (the person or entity responsible for receiving legal notices), and its principal place of business. You should also specify the purpose of your LLC, which can be as broad as “to engage in any lawful business activity” or more specific depending on your industry.

Membership Details

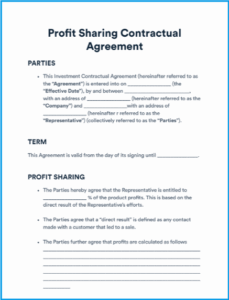

This section identifies all the members of the LLC, their names, addresses, and their initial contributions (cash, property, or services). It also specifies each member’s percentage ownership interest in the LLC. If the LLC has only one member, then you would create a Single-Member LLC operating agreement.

Management Structure

Decide how your LLC will be managed. Will it be member-managed, where all members actively participate in decision-making, or manager-managed, where one or more designated managers are responsible for the day-to-day operations? Clearly define the roles and responsibilities of managers if applicable. This would require further description in your Utah LLC operating agreement template.

Profit and Loss Allocation

This is a crucial section that outlines how profits and losses will be distributed among the members. As mentioned earlier, you can customize this to reflect each member’s contributions or choose an equal distribution. Be specific and avoid vague language.

Meetings and Voting

Establish procedures for holding meetings, including notice requirements, quorum requirements (the minimum number of members needed to be present for a meeting to be valid), and voting rights. Specify how decisions will be made, whether by majority vote or unanimous consent.

Transfer of Ownership

As discussed earlier, this section outlines the process for transferring membership interests. Include buy-sell provisions, restrictions on transfers, and procedures for admitting new members.

Dissolution

Define the circumstances under which the LLC will be dissolved, such as the death or withdrawal of a member, or a predetermined termination date. Specify the procedures for winding up the LLC’s affairs and distributing its assets.

Remember, this is not an exhaustive list, and you may need to include additional provisions based on your specific business needs. It’s always a good idea to consult with an attorney or legal professional to ensure your operating agreement is comprehensive and legally sound.

Creating a solid operating agreement, possibly from a Utah LLC operating agreement template, will serve you well.

By prioritizing a well-crafted operating agreement, you lay a robust foundation for your Utah LLC’s future. This document isn’t just paperwork; it’s a proactive measure that empowers you to shape the direction of your business and mitigate potential risks.