Ever find yourself in a situation where you’re worried about potential liabilities? Maybe you’re hiring a contractor, organizing an event, or even just letting someone borrow your equipment. That’s where an insurance hold harmless agreement template comes in handy. It’s a legal document designed to protect you from financial responsibility if something goes wrong. Think of it as a safety net, ensuring that you’re not left footing the bill for accidents or damages that aren’t directly your fault.

Essentially, this agreement shifts the burden of responsibility to another party. It’s a common practice in many industries, from construction to entertainment, and it’s all about mitigating risk and providing peace of mind. Without a clear understanding of who is responsible for what, you could be opening yourself up to significant financial risk. These agreements clarify those responsibilities and define the boundaries of liability.

Now, you might be thinking, “Do I really need one of these?” Well, consider the potential consequences of not having one. Imagine a contractor getting injured on your property or a participant at your event tripping and falling. Without a hold harmless agreement, you could be held liable for their medical expenses, lost wages, and even legal fees. That’s why having a solid insurance hold harmless agreement template is crucial for protecting your assets and ensuring a smooth and secure transaction or event.

Understanding the Nuances of Hold Harmless Agreements

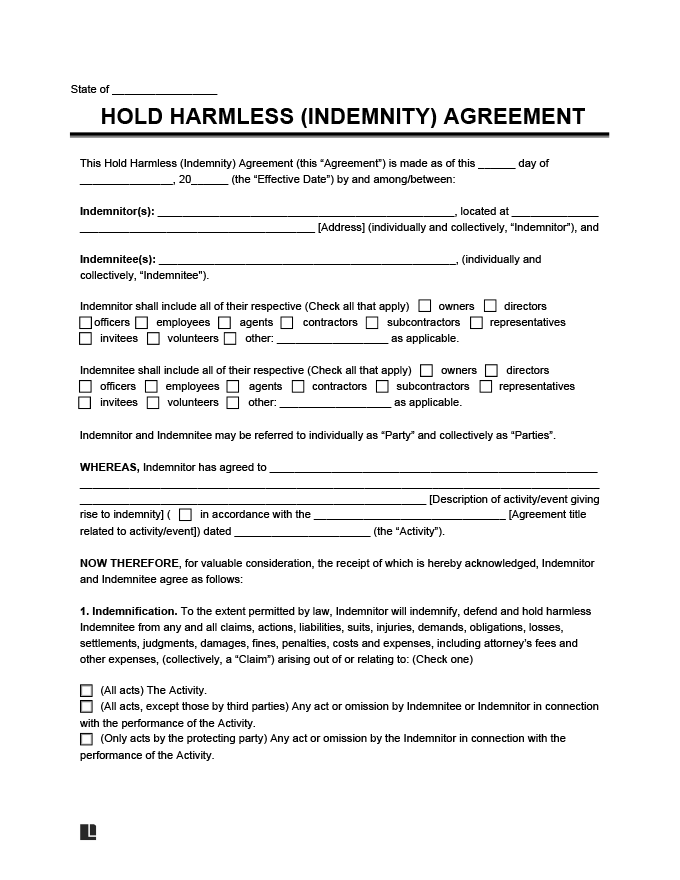

Hold harmless agreements, also known as indemnity agreements, are powerful tools that can significantly impact your financial well-being. They are essentially contracts where one party agrees not to hold another party responsible for any losses, damages, or liabilities that may arise from a particular activity or situation. This transfer of risk is at the heart of the agreement, and understanding how it works is essential before signing anything. The key is to have a clear and comprehensive document that accurately reflects the intentions of all parties involved.

These agreements come in various forms, each tailored to specific circumstances. A “broad form” hold harmless agreement offers the most protection, shifting nearly all risk to the indemnifying party. A “limited form” agreement, on the other hand, only covers liabilities caused by the indemnifying party’s own negligence. There’s also an “intermediate form” which attempts to split the liability, which can be more complex to define and enforce. Choosing the right type of agreement depends on the specific situation and the level of risk involved.

One crucial element of a valid hold harmless agreement is clear and unambiguous language. Vague or confusing wording can lead to disputes and make the agreement difficult to enforce in court. The agreement should specifically identify the parties involved, the activities or situations covered, and the types of losses or damages that are being indemnified. It should also clearly state that the indemnifying party agrees to defend, indemnify, and hold harmless the other party from any claims, lawsuits, or expenses that may arise.

Insurance plays a vital role in conjunction with hold harmless agreements. Often, the indemnifying party will be required to maintain insurance coverage that specifically covers the risks associated with the agreement. This provides an additional layer of protection for the indemnitee, ensuring that there are sufficient funds available to cover any losses or damages. It’s important to carefully review the insurance requirements outlined in the agreement and ensure that the indemnifying party has adequate coverage.

Before entering into a hold harmless agreement, it’s always advisable to seek legal counsel. An attorney can review the agreement, explain the potential risks and liabilities, and ensure that the agreement is enforceable under the laws of your jurisdiction. They can also help you negotiate the terms of the agreement to protect your best interests. Remember, a well-drafted and carefully considered hold harmless agreement can provide valuable protection and peace of mind, while a poorly drafted one can create more problems than it solves. That’s where using an insurance hold harmless agreement template is helpful as a starting point, but legal review is always recommended.

When to Consider Using an Insurance Hold Harmless Agreement Template

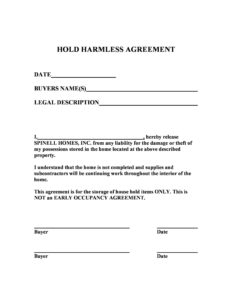

There are numerous situations where employing an insurance hold harmless agreement template is prudent and beneficial. Consider instances involving contractors working on your property. Construction work inherently carries risks, and having a hold harmless agreement in place protects you from liability if a worker is injured or if their work causes damage to your property or a neighbor’s. Similarly, if you’re hosting an event, a hold harmless agreement can protect you from lawsuits arising from injuries sustained by attendees.

Another common scenario involves rental agreements. Landlords often include hold harmless clauses in their leases to protect themselves from liability for injuries that occur on the property due to the tenant’s negligence. The same principle applies to equipment rentals. If you’re renting out equipment, you’ll want to ensure that the renter is responsible for any damage or injuries caused by its use. Even seemingly simple transactions, such as lending a friend your car or tools, can benefit from a hold harmless agreement.

Businesses frequently use these agreements in their dealings with vendors and suppliers. A hold harmless clause can protect a company from liability for defects in products or services provided by a third party. In the context of waivers, such as those used in recreational activities or gyms, a hold harmless agreement can prevent participants from suing for injuries sustained during the activity. However, it’s important to note that these waivers may not always be enforceable, particularly if the injury is caused by gross negligence or recklessness.

When drafting a hold harmless agreement, it’s crucial to tailor it to the specific circumstances. A generic template may not adequately address the unique risks and liabilities involved in your particular situation. Be sure to clearly identify the parties involved, the specific activities or situations covered, and the types of losses or damages that are being indemnified. It’s also important to consider the governing law and any applicable regulations.

Ultimately, the decision of whether or not to use an insurance hold harmless agreement template depends on the specific circumstances and the level of risk involved. However, in situations where there is a potential for liability, it’s always better to err on the side of caution and have a written agreement in place. Consulting with an attorney is highly recommended to ensure that the agreement is properly drafted and enforceable under the law.

These agreements are essential tools for managing risk and protecting your interests in various scenarios. Understanding their purpose and proper use can prevent potential financial losses and legal headaches down the road.

By carefully considering your specific circumstances and consulting with legal professionals, you can ensure that you’re adequately protected and minimizing your exposure to liability. It’s important to remember that using an insurance hold harmless agreement template can be a good starting point, but it should always be reviewed by an attorney to ensure it meets your specific needs.