Navigating the world of insurance can feel like trekking through a dense jungle. You need someone who knows the terrain, speaks the language, and can guide you safely to the best possible outcome. That’s where an insurance broker comes in. They act as your advocate, shopping around for the right coverage at the right price. But before you embark on this insurance journey together, it’s crucial to establish a clear understanding of how they’ll be compensated. That’s where an insurance broker fee agreement template becomes your trusty map and compass.

Think of it as a prenuptial agreement for your insurance relationship. It outlines the terms and conditions of the service, ensuring transparency and preventing any potential misunderstandings down the line. No one wants to be surprised by hidden fees or unexpected charges, and a well-crafted agreement ensures everyone is on the same page from the outset. This document clarifies exactly what services the broker will provide and how they will be paid for those services.

This article will serve as your guide to understanding and creating an effective insurance broker fee agreement template. We will explore the key components, discuss best practices, and provide insights to help you navigate this important aspect of securing the right insurance coverage. Let’s demystify the process and empower you to approach your insurance needs with confidence.

Understanding the Importance of an Insurance Broker Fee Agreement

So, why is an insurance broker fee agreement so vital? It’s all about clarity and transparency. Without a formal agreement, assumptions can lead to disagreements, and those disagreements can sour the relationship and even result in legal disputes. The agreement protects both the broker and the client by clearly defining the scope of services, the method of compensation, and the responsibilities of each party. Think of it as a foundation built on trust and mutual understanding.

A good agreement will detail the specific services the broker will provide. This could include analyzing your current insurance needs, researching available policies, negotiating with insurance companies, presenting you with options, assisting with policy renewals, and providing ongoing support throughout the policy term. By clearly outlining these responsibilities, you know exactly what to expect from your broker.

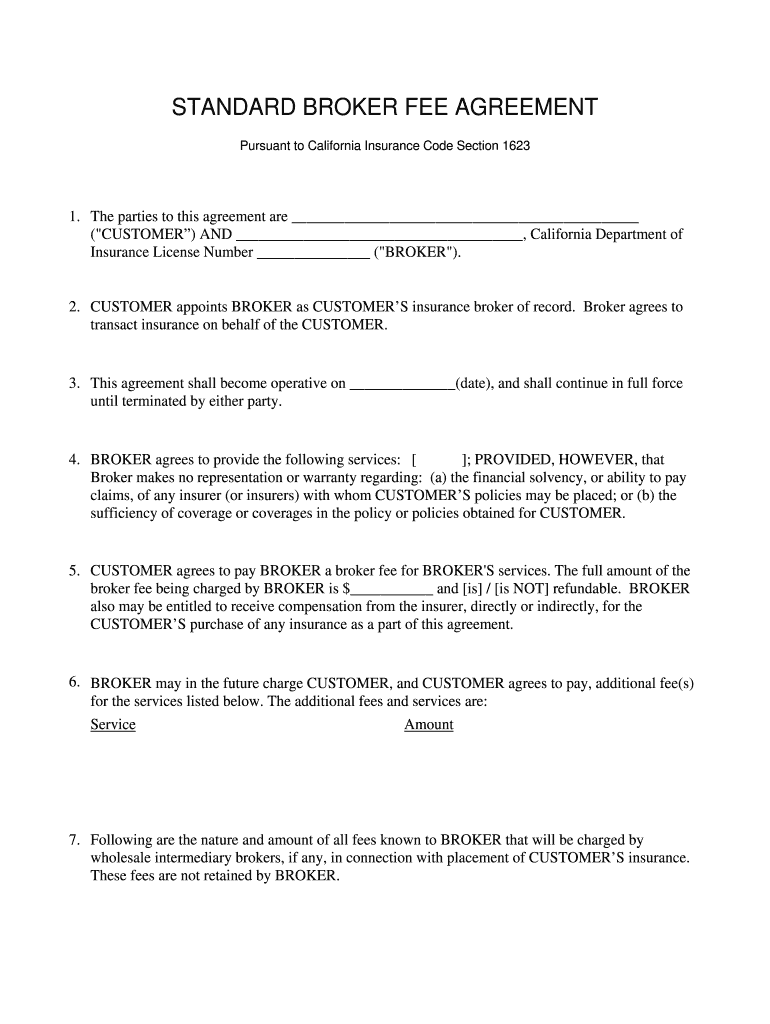

Furthermore, the agreement clearly lays out how the broker will be compensated. This is a crucial element. Brokers typically earn commissions from insurance companies, but in some cases, they may also charge a direct fee to the client, especially for complex or specialized services. The agreement should specify whether the broker is receiving commission, charging a fee, or a combination of both. It should also detail the amount of the fee, when it is due, and how it will be calculated.

Consider this scenario: you need specialized liability insurance for your small business. The broker spends considerable time researching unique coverage options and negotiating with multiple insurers. A direct fee might be justified in this case, compensating the broker for their specialized expertise and time. Without a clear agreement, you might be surprised by this fee, leading to dissatisfaction. An insurance broker fee agreement template prevents this from happening.

Finally, a well-drafted agreement should also address potential conflicts of interest. Brokers have a duty to act in your best interest, but sometimes, their own financial incentives might be at odds with your needs. The agreement should disclose any potential conflicts and explain how the broker will manage them fairly and ethically.

Key Components of an Insurance Broker Fee Agreement Template

Now that we understand the importance of the agreement, let’s break down its key components. Every agreement will vary based on the specific circumstances, but there are certain elements that should always be included.

First, you’ll need to clearly identify the parties involved: the insurance broker or brokerage and the client. Include their full legal names and addresses. This seems obvious, but it’s a foundational element for any legally sound document.

Next, define the scope of services. As mentioned earlier, this section should detail exactly what the broker will do for you. Be specific. For example, instead of saying “provide insurance advice,” say “analyze the client’s property, auto, and liability insurance needs, research available policies from at least three different insurance providers, and present the client with written recommendations and premium quotes.”

The compensation section is perhaps the most critical. Clearly state how the broker will be paid. Will they receive a commission from the insurance company? If so, disclose the average commission percentage they typically receive. Will they charge a direct fee? If so, specify the amount of the fee, how it will be calculated (e.g., hourly rate, percentage of premium), and when it is due. If both commission and a fee are involved, clearly explain how each will be applied.

The agreement should also include a termination clause. This outlines the conditions under which either party can terminate the agreement and what happens to any outstanding fees or commissions upon termination. For example, the agreement might state that either party can terminate the agreement with 30 days’ written notice.

Finally, consider adding a dispute resolution clause. This outlines the process for resolving any disagreements that may arise. This could involve mediation or arbitration, which are often less expensive and time-consuming than litigation. Include an “Entire Agreement” clause, which states that the written agreement constitutes the complete understanding between the parties. This prevents either party from later claiming that there were other agreements or understandings not included in the document. Using an insurance broker fee agreement template can ensure all these vital aspects are included.

Securing insurance coverage can be simplified when you understand the purpose of each element of this agreement. It is a crucial tool for establishing a strong working relationship with your broker.

By taking the time to create a comprehensive agreement, you can ensure that everyone is on the same page, leading to a smoother and more successful insurance experience.