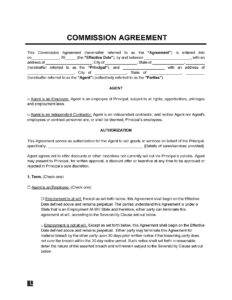

So, you’re looking for an independent contractor sales agreement template? You’ve come to the right place! Whether you’re a business owner onboarding a new salesperson or a talented individual ready to bring your A-game to selling someone else’s product or service, having a solid agreement in place is absolutely crucial. Think of it as the roadmap to a successful and mutually beneficial working relationship. It outlines the expectations, responsibilities, and compensation structure, ensuring everyone is on the same page from the get-go.

Without a well-defined contract, things can get messy fast. Imagine disagreements arising over commission rates, territories, or even who owns the leads generated. A clear agreement acts as a shield, protecting both the company and the independent contractor from potential misunderstandings and legal headaches down the road. It’s an investment in clarity and peace of mind.

This article will delve into the key components of an independent contractor sales agreement template, highlighting what you need to consider and include to create a document that truly works for your specific situation. We’ll break down the legalese and offer practical tips to ensure you’re armed with the knowledge to draft a robust and effective agreement. Let’s get started!

What Makes a Great Independent Contractor Sales Agreement Template?

A truly great independent contractor sales agreement template isn’t just a generic document filled with legal jargon. It’s a tailored roadmap that clearly defines the working relationship, minimizing potential conflicts and setting the stage for success. It must be comprehensive, covering all essential aspects of the agreement between the company and the independent contractor. The more detailed and specific the agreement, the better protected both parties will be.

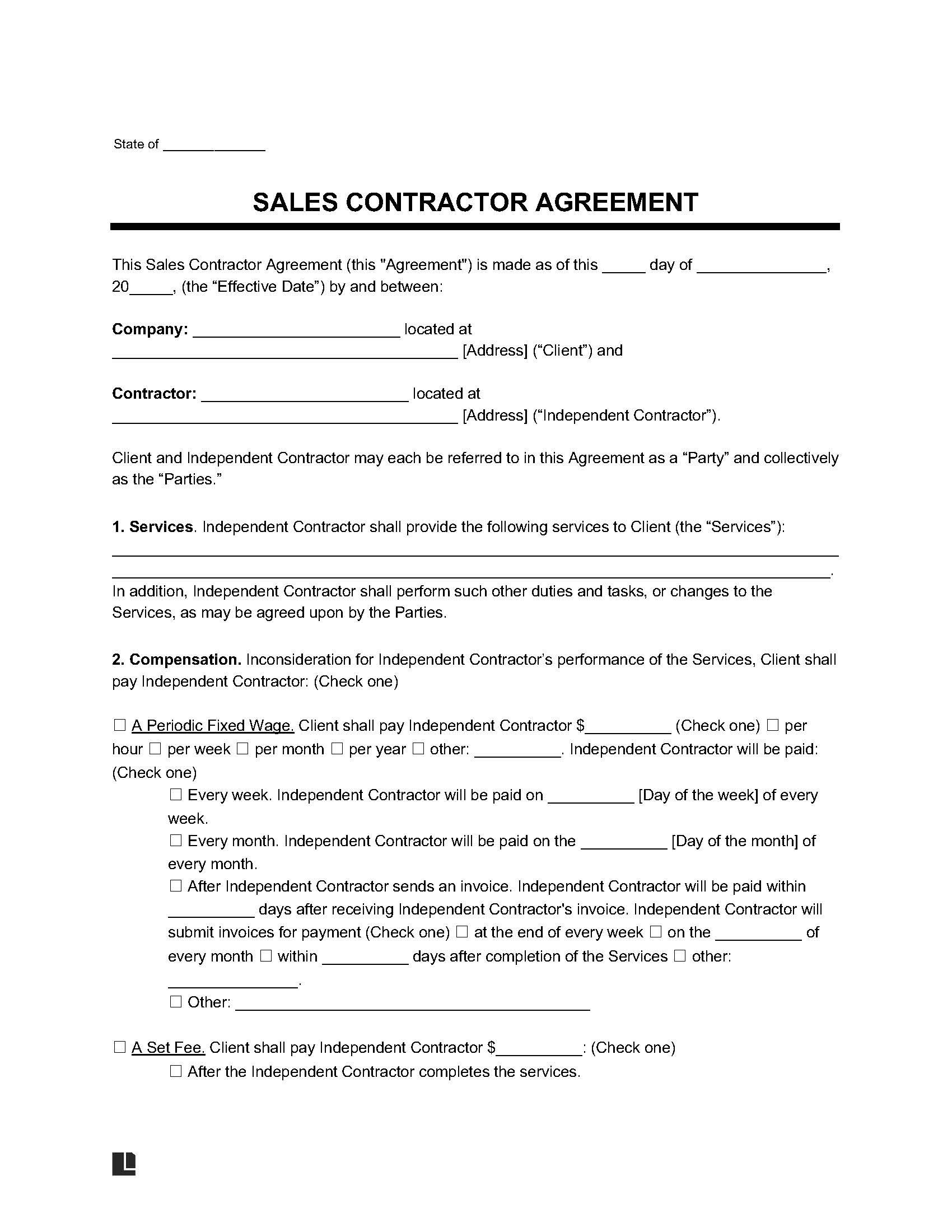

One crucial aspect is clearly defining the scope of work. What exactly is the independent contractor responsible for selling? What territories are they allowed to operate in? Are there any restrictions on the types of clients they can target? The more precise you are with these details, the less room there is for misinterpretation or disputes later on. For example, specifying the exact product lines or services the contractor is authorized to sell is essential.

Compensation, of course, is another critical area. The agreement should clearly outline the commission structure, including the percentage or amount paid per sale, the timing of payments, and any bonuses or incentives. It should also address expenses. Who is responsible for covering travel costs, marketing materials, or other business-related expenses? Clarity on these financial aspects is vital for a harmonious working relationship. In addition, be sure to detail how sales are tracked and verified for accurate commission calculations.

The agreement should also address the issue of intellectual property. Who owns the leads generated by the independent contractor? What about any marketing materials they create? The agreement needs to clearly define ownership and usage rights to avoid disputes down the line. For instance, stating that all leads generated during the term of the agreement are the property of the company provides important protection.

Finally, the agreement should include provisions for termination. Under what circumstances can either party terminate the agreement? What notice period is required? What happens to outstanding commissions upon termination? Addressing these scenarios upfront can prevent unpleasant surprises and legal battles should the relationship end. A well-defined termination clause ensures a smooth and professional exit for both parties.

Key Clauses to Include in Your Independent Contractor Sales Agreement Template

Beyond the general structure, certain key clauses are essential for a robust independent contractor sales agreement template. These clauses address specific potential issues and provide crucial legal protection for both the company and the independent contractor. Omitting these clauses can leave you vulnerable to disputes and legal challenges.

One vital clause is the “Independent Contractor” clause. This clause explicitly states that the contractor is an independent contractor and not an employee. It clarifies that the contractor is responsible for their own taxes, benefits, and insurance. This clause is essential for avoiding misclassification issues, which can have significant financial and legal consequences. It often includes statements about the contractor’s freedom to control their work methods and the fact that they are not subject to the company’s direct supervision.

A confidentiality clause is also paramount, especially if the independent contractor will have access to sensitive company information, such as customer lists, pricing strategies, or trade secrets. This clause prohibits the contractor from disclosing or using this confidential information for their own benefit or the benefit of a competitor. It should clearly define what constitutes confidential information and the duration of the confidentiality obligation, which may extend beyond the termination of the agreement.

Another important clause is a non-compete or non-solicitation clause. This clause restricts the contractor from competing with the company or soliciting its clients or employees for a certain period after the termination of the agreement. The enforceability of these clauses varies by jurisdiction, so it’s essential to consult with an attorney to ensure they are reasonable and legally compliant in your area. The scope of the restriction (geographic area, duration, and type of activity) must be carefully considered to ensure it’s not overly broad.

A dispute resolution clause is also highly recommended. This clause outlines the process for resolving any disputes that may arise between the company and the independent contractor. It may specify mediation, arbitration, or litigation as the preferred method of dispute resolution. Having a clear dispute resolution clause can save time and money by providing a streamlined process for resolving disagreements outside of court.

Finally, a governing law clause specifies which state’s laws will govern the interpretation and enforcement of the agreement. This is particularly important if the company and the independent contractor are located in different states. Choosing the governing law upfront can prevent confusion and ensure that the agreement is interpreted consistently.

Crafting the right agreement might feel like a daunting task, but taking the time to do it right will pay dividends. It minimizes potential conflict and sets the stage for a productive and profitable relationship.

With a carefully considered agreement in place, both parties can focus on what matters most: driving sales and achieving success. This contributes to a stronger, more resilient business.