So, you’re thinking of lending money to a friend or family member? That’s incredibly generous! Helping loved ones out is a wonderful thing, but mixing finances with personal relationships can sometimes get tricky. That’s where a friends and family loan agreement template comes in handy. It’s not about distrust; it’s about clarity, protection, and maintaining healthy relationships. Think of it as a roadmap that everyone agrees on upfront, outlining the terms of the loan and what happens if things don’t go exactly as planned.

Using a simple friends and family loan agreement template isn’t just for large sums of money either. Whether it’s a few hundred dollars to help with a bill or a more significant amount to start a small business, having a written agreement provides a clear understanding for everyone involved. It protects both the lender and the borrower, preventing misunderstandings and hard feelings down the road. It ensures everyone is on the same page regarding repayment schedules, interest rates (if any), and the consequences of late or missed payments.

In this article, we’ll explore why using a friends and family loan agreement template is a smart move, what essential elements it should include, and where you can find reliable templates to get started. We’ll break down the process into easy-to-understand steps so you can confidently navigate the world of informal lending and maintain strong relationships while doing it. It’s all about setting expectations and having a documented plan. Let’s dive in!

Why Formalize a Loan to Loved Ones?

You might be thinking, “Do I really need a formal agreement with my own family?” And it’s a fair question. After all, you trust these people. However, even with the strongest bonds, misunderstandings can arise, especially when money is involved. A written agreement isn’t about doubting their integrity; it’s about providing clarity and protecting everyone’s interests. It provides a framework that can prevent disagreements down the road.

Imagine this scenario: you lend your brother money to fix his car, verbally agreeing that he’ll pay you back “when he can.” Months pass, and you haven’t seen a penny. You’re hesitant to bring it up because you don’t want to strain the relationship, but resentment starts to build. This is precisely the kind of situation a friends and family loan agreement template can help avoid. By having a clear repayment schedule, interest rate (if applicable), and consequences for late payments, everyone knows what to expect.

Moreover, a written agreement provides legal protection should the unthinkable happen. While no one wants to imagine having to take legal action against a family member, it’s important to be prepared for all possibilities. If the borrower defaults on the loan, having a legally binding agreement allows you to pursue your options in a more structured and documented manner. It protects you and your assets.

Another crucial aspect to consider is how the loan might impact your family member’s financial situation. By discussing the terms of the loan openly and documenting them in an agreement, you’re encouraging responsible borrowing and lending. You’re helping them think through their ability to repay the loan and avoid taking on more debt than they can handle. It is an act of love and support, not mistrust.

In short, a friends and family loan agreement template isn’t just a formality; it’s an investment in the long-term health of your relationships. It promotes open communication, sets clear expectations, and provides a safety net for both the lender and the borrower. It’s about ensuring that a well-intentioned act of generosity doesn’t unintentionally damage valuable relationships.

Essential Elements of a Friends and Family Loan Agreement Template

So, you’re convinced that a friends and family loan agreement template is the way to go. Great! Now, let’s talk about what should be included in the agreement to make it comprehensive and effective. A well-drafted agreement will cover all the key aspects of the loan, leaving no room for ambiguity or misinterpretation.

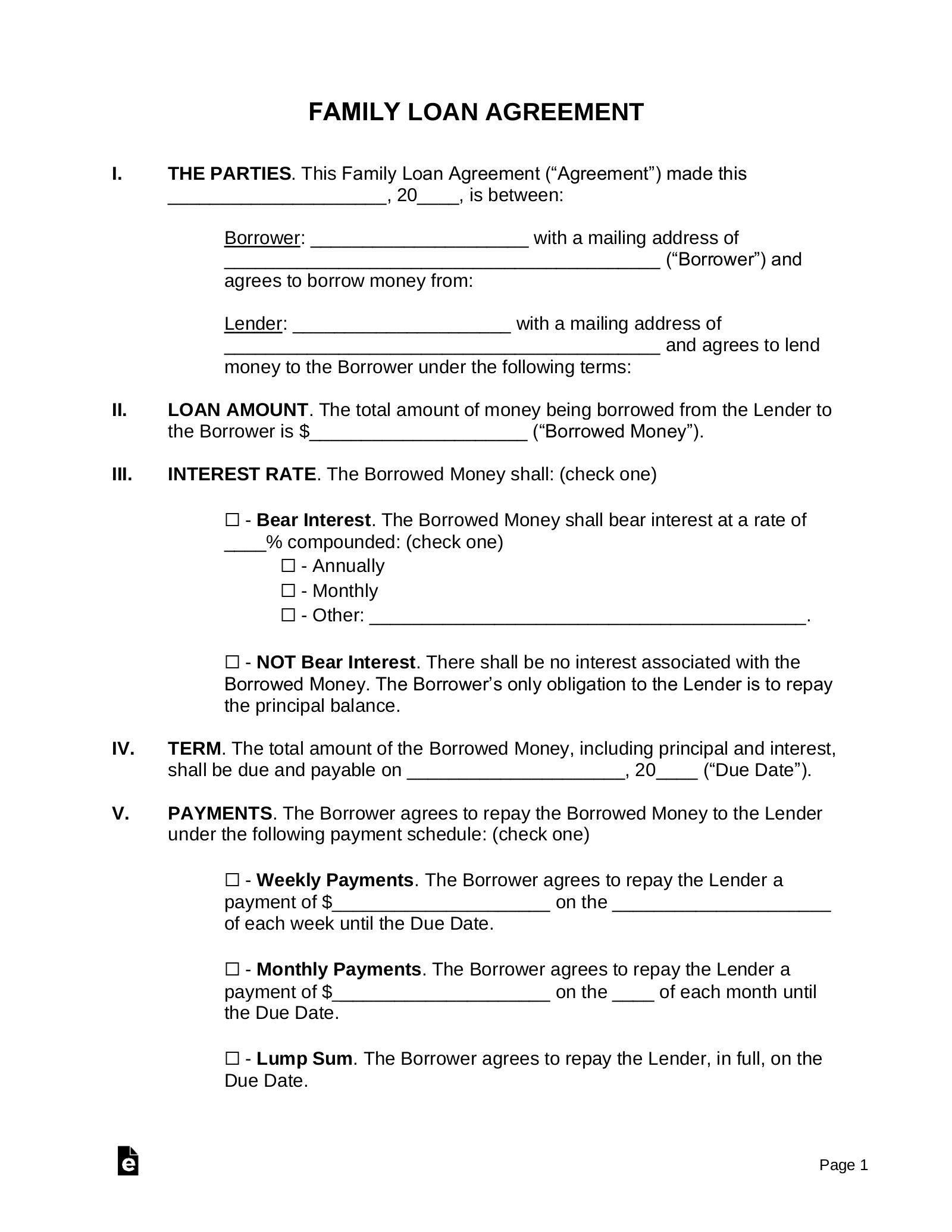

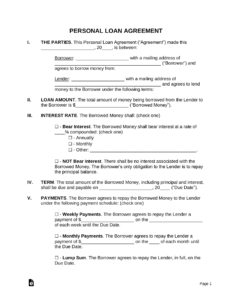

First and foremost, the agreement should clearly identify the lender and the borrower by their full legal names and addresses. This might seem obvious, but it’s important for legal clarity. Next, state the principal amount of the loan – that is, the total amount of money being lent. Be specific and avoid vague language. Write out the amount in both numbers and words (e.g., $5,000.00, Five Thousand US Dollars).

The repayment schedule is another crucial element. Specify how often payments will be made (e.g., monthly, weekly), the amount of each payment, and the date the first payment is due. If you’re charging interest, clearly state the interest rate and how it will be calculated. It’s also important to outline any penalties for late payments, such as late fees or increased interest rates.

Consider including a section on what happens if the borrower defaults on the loan. Defaulting means failing to make payments as agreed. This section should outline the lender’s recourse in the event of default, such as the right to demand immediate repayment of the entire loan balance or to pursue legal action. It can be uncomfortable to think about, but it’s essential to have a plan in place.

Finally, be sure to include a section for signatures. Both the lender and the borrower should sign and date the agreement in the presence of a witness or notary public. Having the signatures notarized adds an extra layer of legal validity. Remember, this document is intended to provide clarity and protection for everyone involved, so take the time to ensure it’s comprehensive and legally sound. Using a friends and family loan agreement template is the smartest way to do it. Seek legal advise if necessary.

Lending money to a loved one can be a rewarding experience, but it’s essential to approach it with careful planning and open communication. A well-drafted agreement ensures that everyone is on the same page and protects your relationship from potential financial misunderstandings.

Taking the time to create a friends and family loan agreement template doesn’t mean you don’t trust your loved one; it means you value your relationship and want to protect it. It’s a sign of respect and a commitment to open communication, ensuring that both parties understand their rights and responsibilities.