Have you ever found yourself needing a quick influx of cash for your business, but your customers haven’t paid their invoices yet? It’s a common scenario for many businesses, especially small and medium-sized enterprises. An accounts receivable purchase agreement can be a useful tool in such cases. Essentially, it allows you to sell your outstanding invoices to a third party (the factor) at a discount, providing you with immediate working capital. This is much faster than waiting for your customers to pay, and it can help you cover immediate expenses or invest in growth opportunities.

Think of it like this: you’ve done the work, you’ve invoiced your clients, but the money is tied up in those invoices. Instead of waiting 30, 60, or even 90 days for payment, an accounts receivable purchase agreement template allows you to access that money now. The factoring company then takes on the responsibility of collecting those invoices from your customers. While there are costs involved, the benefits of immediate cash flow can often outweigh the expense, particularly when it comes to seizing opportunities or navigating short-term financial challenges.

Navigating the world of finance can feel overwhelming, but resources like an accounts receivable purchase agreement template can simplify the process. Using a template helps you ensure you’re covering all the necessary bases and understanding the terms involved. Remember, it’s always a good idea to consult with legal and financial professionals before entering into any financial agreement, to make sure it’s the right fit for your specific business needs.

Understanding Accounts Receivable Purchase Agreements

An accounts receivable purchase agreement, also known as a factoring agreement, is a legally binding contract between a business (the seller or client) and a factoring company (the factor). In this agreement, the business sells its accounts receivable (outstanding invoices) to the factor at a discounted price. The factor then assumes the responsibility for collecting payments on those invoices from the business’s customers. The difference between the face value of the invoices and the price the factor pays is the factor’s fee, which compensates them for the risk and administrative costs associated with collecting the receivables.

The purpose of such agreements is to provide businesses with immediate access to working capital. Instead of waiting for customers to pay their invoices, which can take weeks or even months, the business receives a significant portion of the invoice value upfront. This can be particularly helpful for businesses that are experiencing rapid growth, seasonal fluctuations in revenue, or unexpected expenses. This also assists businesses in continuing their business operations in a normal financial flow.

There are two main types of factoring agreements: recourse and non-recourse. In a recourse agreement, if the factor is unable to collect payment from the business’s customer, the business is responsible for repurchasing the invoice from the factor. This means the business bears the credit risk of its customers. In a non-recourse agreement, the factor assumes the credit risk. If the customer fails to pay due to insolvency or bankruptcy, the factor absorbs the loss. Non-recourse factoring is typically more expensive than recourse factoring, as the factor is taking on greater risk.

Before entering into an accounts receivable purchase agreement, it’s crucial to carefully review all the terms and conditions. Key aspects to consider include the factoring fee, the advance rate (the percentage of the invoice value the factor pays upfront), the recourse provisions, the term of the agreement, and any termination clauses. It’s also essential to understand the factor’s collection procedures and how they will interact with your customers. A well-drafted agreement protects both parties and ensures a smooth factoring relationship.

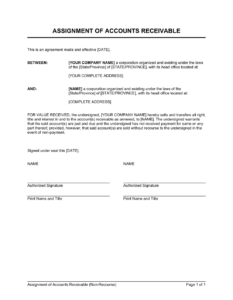

Using an accounts receivable purchase agreement template can be a great starting point for creating a factoring agreement. However, it’s important to customize the template to reflect the specific terms of your agreement and to seek legal advice to ensure the agreement is legally sound and meets your business’s specific needs. Remember that every business is different and needs its own customized terms.

Key Considerations When Using an Accounts Receivable Purchase Agreement Template

While an accounts receivable purchase agreement template can be a helpful resource, it’s important to approach it with a critical eye and understand its limitations. Templates are designed to provide a general framework, but they may not address all the specific nuances of your business or the particular transaction you’re undertaking. Therefore, customization and careful review are essential to ensure the agreement accurately reflects your intentions and protects your interests.

One of the primary considerations is the scope of the agreement. Will you be factoring all of your accounts receivable, or only a specific subset? Will the agreement cover all your customers, or only certain ones? Clearly defining the scope of the agreement is crucial to avoid confusion and potential disputes down the line. You should also define the payment terms from your customers clearly in the document.

Another critical aspect is the fee structure. Factoring fees can vary depending on factors such as the volume of receivables being factored, the creditworthiness of your customers, and the type of factoring agreement (recourse or non-recourse). It’s important to understand how the fees are calculated and what they cover. Are there any hidden fees or charges? What are the penalties for late payments or breaches of the agreement? Transparency in the fee structure is essential for building trust and maintaining a healthy factoring relationship.

You should also carefully examine the representations and warranties section of the template. These are statements you’re making about the validity and enforceability of your accounts receivable. You’re essentially guaranteeing that the invoices are legitimate and that your customers are obligated to pay them. If any of these representations are false, you could be held liable for damages. Therefore, it’s important to review this section carefully and ensure that all the representations are accurate and truthful.

Finally, don’t hesitate to seek professional advice before signing any accounts receivable purchase agreement. A qualified attorney can review the template, identify potential risks, and help you negotiate more favorable terms. They can also ensure that the agreement complies with all applicable laws and regulations. While using a template can save you time and money, it’s no substitute for sound legal guidance.

Using an accounts receivable purchase agreement can provide your business with a much needed injection of cash when it needs it most. It can be a real game changer when used in the right circumstances.

Ultimately, an accounts receivable purchase agreement is a tool that can significantly benefit a business if approached thoughtfully and with due diligence. Understanding the intricacies of the agreement, customizing the template to fit specific needs, and seeking professional advice are the keys to a successful and mutually beneficial factoring relationship.