So, you’ve got an LLC, which is fantastic! You’ve navigated the paperwork, chosen a name, and hopefully, drafted an operating agreement. This document is like the constitution for your business, outlining how things are run, who does what, and what happens if someone wants out. But business evolves, partnerships change, and life throws curveballs. That’s where an amendment to LLC operating agreement template comes in handy. It allows you to adapt your agreement to reflect the new realities of your business without having to scrap the whole thing and start from scratch.

Think of it this way: your initial operating agreement was a snapshot of your business intentions at a particular moment in time. As time goes on, you might want to bring in a new member, change profit distribution percentages, or alter management responsibilities. An amendment is the tool that allows you to officially and legally record these changes. Without a proper amendment, you risk disputes, misunderstandings, and even potential legal challenges down the road. It ensures everyone is on the same page and that your business operations are clearly defined.

The beauty of using an amendment to LLC operating agreement template is that it provides a structured way to make these changes. It guides you through the necessary steps, ensuring you don’t miss any crucial details. It also serves as a documented record of the changes, which is essential for transparency and legal compliance. Instead of feeling overwhelmed by legal jargon, you can confidently update your operating agreement and keep your business running smoothly.

Why You Might Need an Amendment to Your LLC Operating Agreement

Life, and business, are rarely static. What worked perfectly when you first formed your LLC might not be the best approach a few years down the line. Several situations commonly prompt the need for an amendment to your operating agreement. Understanding these scenarios can help you proactively address them and keep your business on track. Failing to update your operating agreement can lead to disagreements among members and even legal battles, so it’s crucial to be aware of when an amendment is necessary.

One of the most frequent reasons for amending an LLC operating agreement is a change in membership. Perhaps a new member is joining the company, an existing member is leaving, or a member’s ownership percentage is changing. Each of these scenarios requires a formal amendment that outlines the details of the transition, including the new member’s rights and responsibilities, the terms of the departing member’s departure, or the revised ownership percentages. Without a written amendment, you could find yourself in a sticky situation when it comes to voting rights, profit distributions, and other key business decisions.

Another common trigger for an amendment is a change in the business’s management structure. Initially, you might have designated all members as managers, but as the business grows, you may want to appoint a managing member or hire a professional manager. An amendment to the operating agreement is necessary to clearly define the roles and responsibilities of the new management structure, including their authority to make decisions on behalf of the company. This ensures that everyone understands who is in charge and how decisions are made, minimizing potential conflicts.

Furthermore, changes to the business’s financial arrangements often necessitate an amendment. This could include altering the way profits and losses are distributed, changing the capital contribution requirements, or modifying the procedures for making distributions to members. For example, if you initially agreed to distribute profits equally but now want to base distributions on each member’s contribution to the business, you’ll need to amend the operating agreement to reflect this change. This helps to maintain fairness and transparency in the company’s financial operations.

Finally, a simple change in the business’s operating procedures can also warrant an amendment. This could include changes to voting procedures, meeting schedules, or the process for resolving disputes. While these changes might seem minor, they can have a significant impact on the day-to-day operations of the business. By formally documenting these changes in an amendment, you ensure that everyone is aware of the new procedures and that they are legally binding.

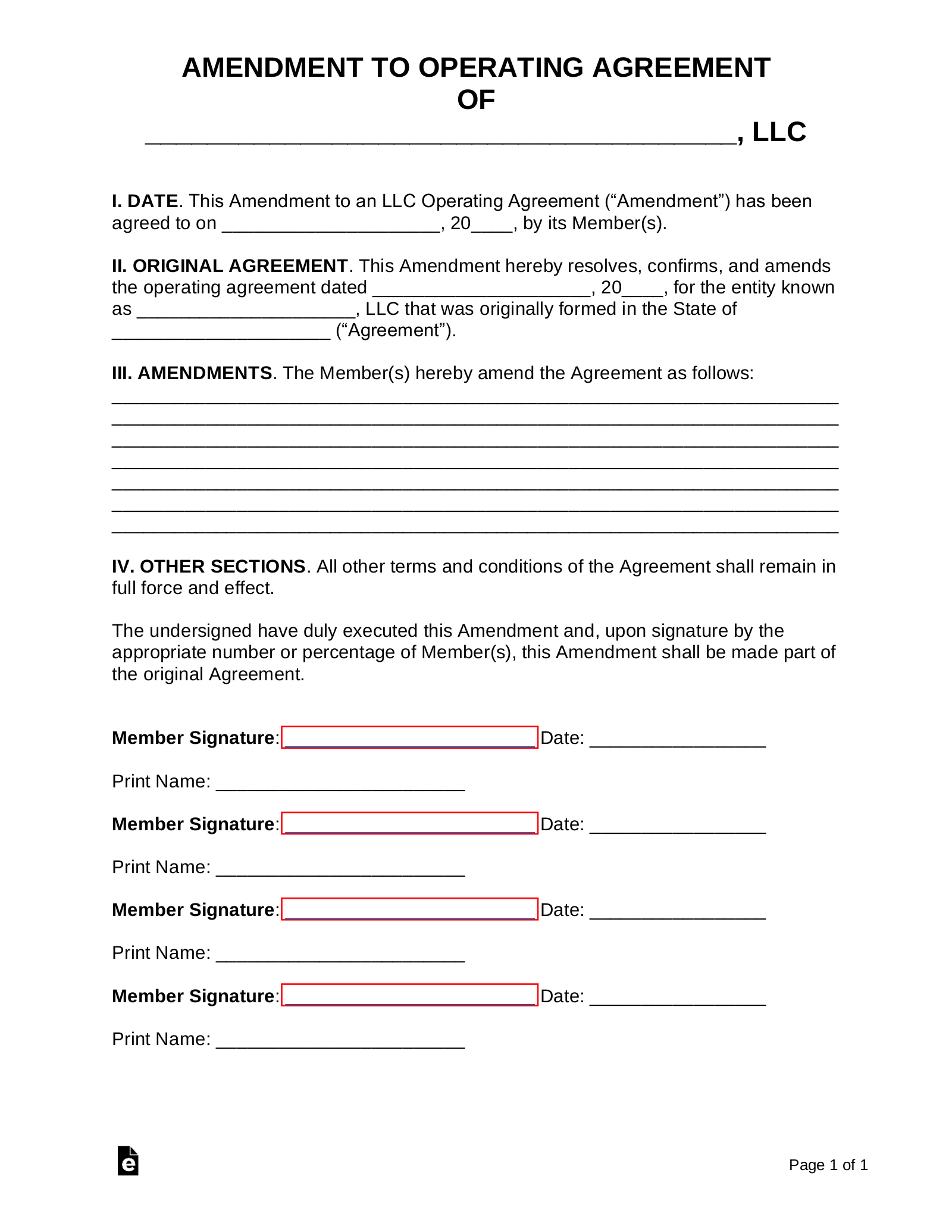

Key Elements of an Amendment to LLC Operating Agreement Template

When using an amendment to LLC operating agreement template, certain key elements are crucial to ensure it’s legally sound and effectively captures the intended changes. Think of these elements as the building blocks of your amendment, each playing a vital role in clarity and enforceability. Omitting or mishandling these elements can render the amendment ineffective and potentially lead to legal complications. Before signing anything, double-check that all these components are present and accurately reflect the agreement between the members.

First and foremost, the amendment must clearly identify the original operating agreement it intends to modify. This is typically done by referencing the date of the original agreement and the name of the LLC. This is paramount to avoid confusion and establish a clear link between the amendment and the document it’s updating. Without this connection, it would be difficult to prove which version of the operating agreement is currently in effect.

Next, the amendment should specifically state which sections of the original operating agreement are being changed. Vague or general statements can lead to misinterpretations and disputes. Instead, the amendment should clearly identify the exact sections being modified, deleted, or added. For example, “Section 4.2 regarding profit distributions is hereby amended to read as follows:” followed by the new language. This level of detail leaves no room for ambiguity.

The amendment must also include the new language that will replace or supplement the existing language in the operating agreement. This new language should be clear, concise, and unambiguous. It should accurately reflect the agreement between the members and address any potential issues or concerns. Consider seeking legal advice to ensure the new language is legally sound and achieves the desired outcome. It’s also vital to confirm that the new terms don’t contradict any other provisions within the operating agreement.

Finally, the amendment should include a signature block for each member of the LLC. Each member must sign and date the amendment to indicate their agreement to the changes. This is essential for demonstrating that all members have consented to the amendment and that it is legally binding. Some operating agreements may also require that the amendment be notarized for added security. Make sure you understand the requirements outlined in your original operating agreement.

Remember to keep a copy of the original operating agreement and all amendments together in a safe and accessible location. This creates a comprehensive record of your LLC’s governance and ensures that you can easily reference the most up-to-date version of the agreement. These documents are essential for resolving disputes, making business decisions, and complying with legal requirements.

Adapting your LLC operating agreement is a natural part of the business lifecycle. By proactively addressing changes and using an amendment to LLC operating agreement template, you can ensure that your business remains flexible, legally compliant, and well-positioned for success.

Keeping your operating agreement up-to-date with an amendment ensures everyone is on the same page and the business is prepared for whatever comes next.