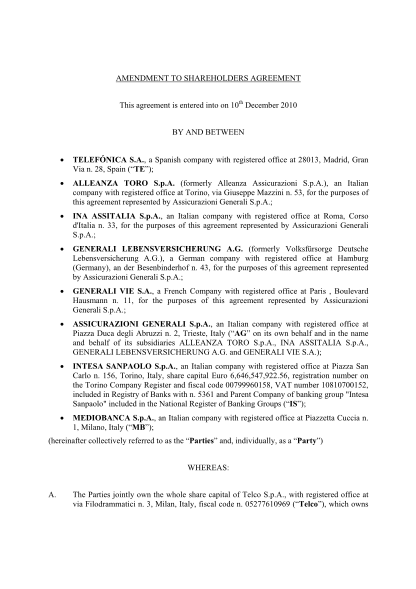

So, your company’s been around for a while, and that initial shareholders agreement you all signed way back when? Well, it might not quite fit anymore. Businesses evolve, circumstances change, and that perfectly crafted document from the early days might need a little tweaking. That’s where an amendment to shareholders agreement template comes in handy. Think of it as updating your company’s operating manual to reflect its current reality. It’s a crucial step in ensuring everyone’s on the same page and that the business continues to run smoothly.

Shareholders agreements are designed to protect the interests of everyone involved, from the founders to the early investors. They outline rights, responsibilities, and what happens when things don’t go according to plan. But life, as they say, happens. Maybe a key shareholder wants to sell their shares, or perhaps the company is bringing in a new investor with different expectations. These situations require adjustments to the original agreement, and a well-structured amendment is the best way to handle them.

Trying to wing it without a proper amendment can lead to misunderstandings, disputes, and even legal battles down the road. That’s why using an amendment to shareholders agreement template is so important. It provides a framework for addressing changes in a clear, legally sound manner, protecting all parties involved and ensuring the long-term stability of the business. So, let’s dive into what makes a good amendment and how to use one effectively.

Why Amend Your Shareholders Agreement?

Think of your shareholders agreement as a living document. It’s not something you create once and then forget about. As your company grows and evolves, the agreement needs to adapt to reflect the new realities. There are a multitude of reasons why an amendment might be necessary. Perhaps you are bringing in a new investor, or maybe an existing shareholder wants to transfer their shares to someone else. Perhaps a shareholder has passed away, necessitating a change in ownership. These are just a few examples, but they highlight the need for a flexible and adaptable agreement.

Another common reason for amending a shareholders agreement is to update the terms regarding shareholder rights and responsibilities. Maybe the original agreement didn’t adequately address certain issues, such as voting rights or dividend distribution. Or perhaps the shareholders have decided to change the way decisions are made within the company. An amendment allows you to clarify these points and ensure that everyone understands their roles and obligations.

Furthermore, legal and regulatory changes can also necessitate amendments. Laws change, and what was once a perfectly valid agreement may no longer comply with current regulations. It’s important to review your shareholders agreement periodically to ensure that it remains compliant with all applicable laws. Failure to do so could expose the company and its shareholders to legal risks.

Beyond legal compliance, an amendment can also be used to address unforeseen circumstances or resolve disputes among shareholders. Maybe a disagreement has arisen over the direction of the company, or perhaps there’s a conflict of interest that needs to be addressed. An amendment can provide a mechanism for resolving these issues and ensuring that the company can continue to operate smoothly.

The key takeaway here is that an amendment to shareholders agreement template isn’t just a formality; it’s a critical tool for managing the ongoing relationships between shareholders and ensuring the long-term success of the business. Failing to address necessary changes can lead to serious problems down the line, so it’s important to stay proactive and keep your agreement up to date.

Key Components of an Amendment

When crafting an amendment to your shareholders agreement, there are several key components to keep in mind. First and foremost, it’s crucial to clearly identify the original agreement that is being amended. This ensures that there’s no confusion about which document is being changed. You should include the date of the original agreement and any other relevant identifying information.

Next, you need to specifically state which sections of the original agreement are being amended. Don’t leave anything open to interpretation. Clearly identify the specific clauses or provisions that are being changed, added, or deleted. Use precise language to avoid any ambiguity. For each change, clearly articulate the new terms that will be in effect. This is where you spell out exactly how the original agreement is being modified.

Another important component is a statement of the reasons for the amendment. While not always legally required, including a brief explanation of why the amendment is being made can help to provide context and prevent future misunderstandings. This can be especially helpful if the amendment is addressing a specific issue or resolving a dispute.

Finally, the amendment must be signed by all parties to the original agreement, or their authorized representatives. This ensures that everyone is in agreement with the changes and that the amendment is legally binding. It’s also a good idea to have the signatures notarized, especially if the amendment involves significant changes to the original agreement. Including a severability clause is also recommended. This ensures that if one part of the amendment is deemed unenforceable, the rest of the agreement remains valid.

Remember, an amendment is only effective if it’s properly drafted and executed. Using an amendment to shareholders agreement template can help you ensure that you’re covering all the necessary bases and that your amendment is legally sound. Consulting with legal counsel is always a good idea to ensure that the amendment is tailored to your specific circumstances and complies with all applicable laws.

As businesses evolve, the need to amend existing legal frameworks becomes inevitable. Taking the time to update these documents, like the shareholders agreement, is paramount.

Adjusting the agreement allows for clear communication and alignment among shareholders, fostering a more stable and productive environment for the company’s future.