Ever found yourself in a situation where you needed to transfer the right to receive payment from someone else? Maybe you’re a business owner selling off some of your receivables, or perhaps you’re just simplifying your personal finances. Whatever the reason, understanding how to properly assign a debt agreement is crucial. That’s where an assignment of debt agreement template comes in handy. It’s a legal document that outlines the terms and conditions of transferring that debt, ensuring everyone involved is on the same page. Think of it as the official “hand-off” of the right to collect a debt.

The beauty of using a template is that it provides a solid framework, saving you time and legal fees. Instead of starting from scratch, you can customize a pre-existing document to fit your specific needs. But remember, while a template is a great starting point, it’s not a one-size-fits-all solution. You might need to tweak it to ensure it complies with local laws and accurately reflects the details of your agreement. It’s always a good idea to have a legal professional review the document, especially if you’re dealing with a significant amount of money or complex financial arrangements.

So, whether you’re a seasoned business professional or just navigating the world of personal finance, understanding how an assignment of debt agreement works can save you a lot of headaches. It’s a practical tool for managing your assets and ensuring that financial transactions are handled legally and ethically. Let’s dive into what makes a good template and how you can use one to your advantage.

Understanding the Elements of an Effective Assignment of Debt Agreement Template

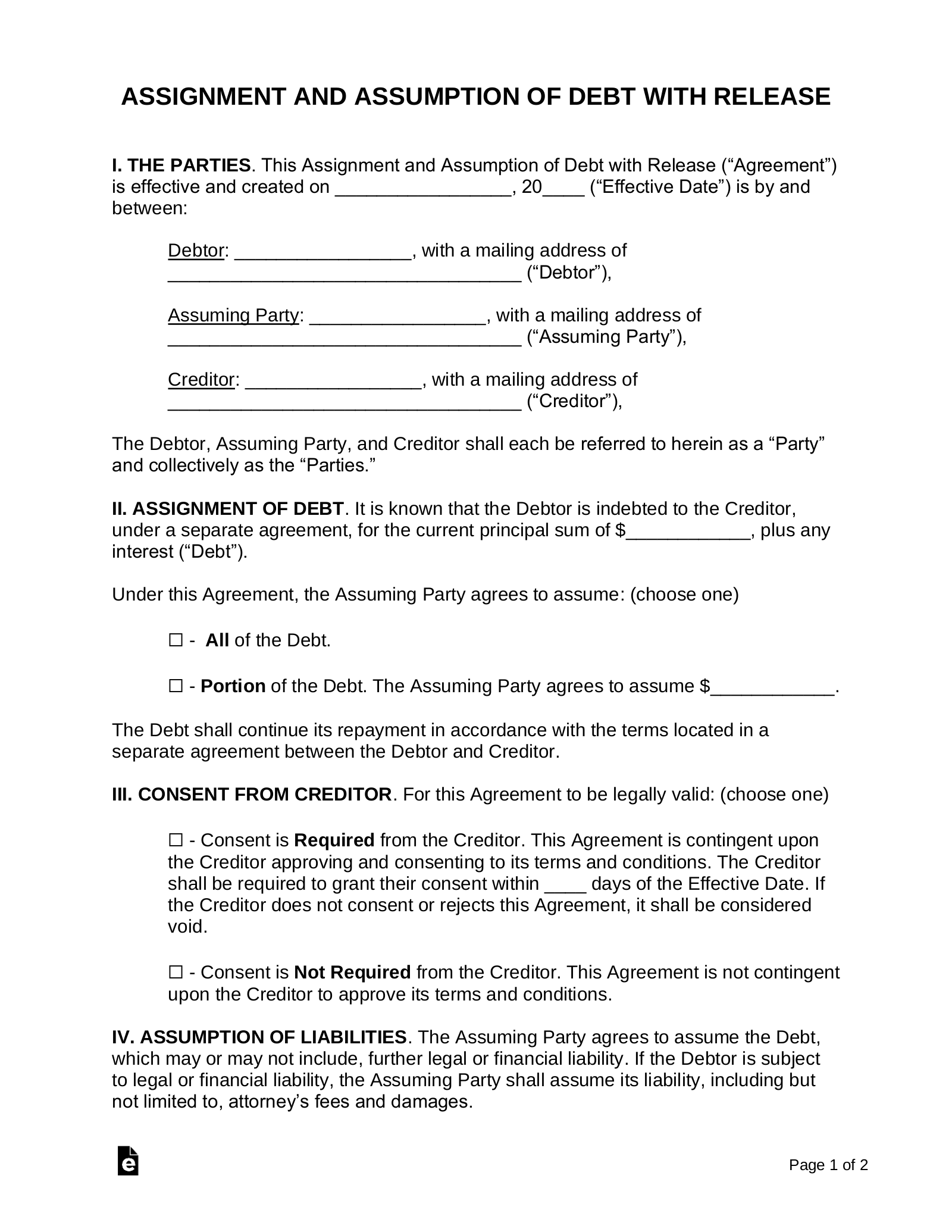

A solid assignment of debt agreement template should cover several key areas to ensure clarity and protect the interests of all parties involved. First and foremost, it needs to clearly identify the parties: the assignor (the person transferring the debt), the assignee (the person receiving the debt), and the debtor (the person who owes the original debt). Full legal names and addresses should be included to avoid any confusion later on. This establishes who is responsible for what in the transaction.

The agreement must also provide a detailed description of the debt being assigned. This includes the original debt agreement (if applicable), the outstanding balance, interest rates, and any other relevant terms. The more specific you are, the better. Attaching a copy of the original debt agreement as an exhibit can be a smart move. This eliminates any ambiguity about the exact nature of the debt being transferred.

Furthermore, the template should outline the terms of the assignment itself. This includes the effective date of the assignment, the consideration being paid for the assignment (if any), and any warranties or representations made by the assignor. For instance, the assignor might warrant that they have the legal right to assign the debt and that the debt is valid and enforceable. These warranties provide the assignee with some level of protection in case there are issues with the debt later on.

Another critical element is the notice to the debtor. The debtor needs to be informed that the debt has been assigned and that they are now required to make payments to the assignee. The template should include a section outlining the process for notifying the debtor, as well as the debtor’s rights and obligations after the assignment. This is essential for ensuring that the debtor understands where to send their payments and who to contact with any questions.

Finally, the agreement should include standard legal clauses such as governing law, dispute resolution, and severability. The governing law clause specifies which jurisdiction’s laws will govern the agreement. The dispute resolution clause outlines how any disputes will be resolved, whether through mediation, arbitration, or litigation. The severability clause states that if one part of the agreement is found to be unenforceable, the rest of the agreement will still remain in effect. These clauses help to ensure that the agreement is legally sound and enforceable.

Key Considerations When Using an Assignment of Debt Agreement Template

Before you jump in and use an assignment of debt agreement template, there are several crucial considerations to keep in mind. First and foremost, understand the legal implications of assigning a debt. Depending on your jurisdiction, there might be specific laws and regulations governing debt assignments. Make sure you’re familiar with these laws before you proceed. For example, some jurisdictions might require you to obtain the debtor’s consent before assigning the debt. Failing to comply with these requirements could render the assignment invalid.

Another important consideration is the due diligence process. As the assignee, you need to carefully evaluate the debt before you agree to accept the assignment. This includes verifying the validity of the debt, assessing the debtor’s ability to pay, and reviewing the original debt agreement. You might also want to conduct a credit check on the debtor to get a better sense of their financial situation. The more information you have, the better equipped you’ll be to make an informed decision about whether to accept the assignment.

Think about the tax implications as well. Assigning a debt can have tax consequences for both the assignor and the assignee. It’s always a good idea to consult with a tax advisor to understand how the assignment will affect your tax liability. For example, the assignor might be able to deduct the loss on the sale of the debt, while the assignee might have to recognize income when the debt is repaid.

Remember to tailor the template to your specific circumstances. A generic template might not cover all the unique aspects of your situation. Take the time to carefully review the template and make any necessary modifications. This might include adding additional clauses to address specific risks or concerns, or deleting clauses that are not relevant to your transaction. The goal is to create a document that accurately reflects the terms of your agreement and protects your interests.

Finally, consider seeking professional legal advice. While an assignment of debt agreement template can be a helpful tool, it’s not a substitute for legal counsel. An attorney can review the template, advise you on the legal implications of the assignment, and help you negotiate the terms of the agreement. This can be particularly important if you’re dealing with a complex or high-value debt. Investing in legal advice upfront can save you a lot of headaches down the road.

It’s a great way to streamline financial transactions, whether you’re selling receivables or simplifying your personal finances. It provides a framework for clearly defining the transfer of debt, ensuring everyone involved understands their rights and obligations.

Ultimately, the key to a successful assignment of debt is clear communication and a well-drafted agreement. By understanding the elements of a good template and taking the time to tailor it to your specific needs, you can ensure that your financial transactions are handled smoothly and legally.