Ever felt like you’re navigating a financial maze, especially when dealing with loans? The world of lending can seem complex, filled with jargon and legal documents that leave you scratching your head. One such document, the loan agreement, outlines the terms and conditions of a loan. But what happens when the lender wants to transfer their rights to someone else? That’s where the assignment of a loan agreement comes into play. It’s essentially like passing the baton in a relay race, but instead of a stick, it’s a loan!

The assignment of a loan agreement isn’t something that happens every day, but when it does, it’s crucial to understand what it entails. It’s a legal process where the original lender (the assignor) transfers their rights and obligations under the loan agreement to a third party (the assignee). This means the new lender now has the right to receive payments, enforce the terms of the agreement, and generally step into the shoes of the original lender. For borrowers, this might seem daunting, but don’t worry; we’re here to break it down.

Think of it this way: you borrow money from Bank A. Later, Bank A decides they want to focus on other investments and sells your loan to Bank B. Suddenly, you’re making payments to Bank B instead of Bank A. That’s assignment in action! While the process might seem complicated, the goal of this article is to demystify the assignment of loan agreements, explain its implications, and guide you through the process, including how to utilize an assignment of loan agreement template.

Understanding Loan Agreement Assignments: A Detailed Overview

At its core, an assignment of a loan agreement is a legal mechanism that allows the lender to transfer their rights and obligations under a loan agreement to another party. This process doesn’t extinguish the underlying loan; it simply changes who holds the right to receive payments and enforce the agreement’s terms. The borrower’s obligations remain the same; they still owe the same amount of money and must adhere to the original terms of the loan. However, their new point of contact for all loan-related matters becomes the assignee, the new lender. The original lender, also known as the assignor, steps out of the picture, at least in terms of actively managing the loan.

Why do lenders assign loan agreements? There are several reasons. Sometimes, it’s a strategic decision to reduce their portfolio risk. A bank might want to get rid of certain types of loans, such as those with higher risk profiles, to improve its overall financial health. Other times, it’s a matter of liquidity. A lender might need to raise cash quickly and selling off a portion of their loan portfolio can be an effective way to do so. Mergers and acquisitions can also lead to loan assignments. When one financial institution acquires another, the acquiring institution typically assumes control of the acquired institution’s loan portfolio, which involves assigning the existing loan agreements.

It’s important to distinguish between an assignment and a novation. While both involve transferring rights and obligations, they differ in a crucial way. In an assignment, the borrower’s consent is generally not required (though the loan agreement might stipulate otherwise). The lender can unilaterally assign the agreement. In a novation, however, the borrower’s consent *is* required. A novation essentially creates a brand new agreement, with the assignee stepping fully into the shoes of the assignor, and the original agreement being extinguished. An assignment of loan agreement template simplifies this process for all parties involved.

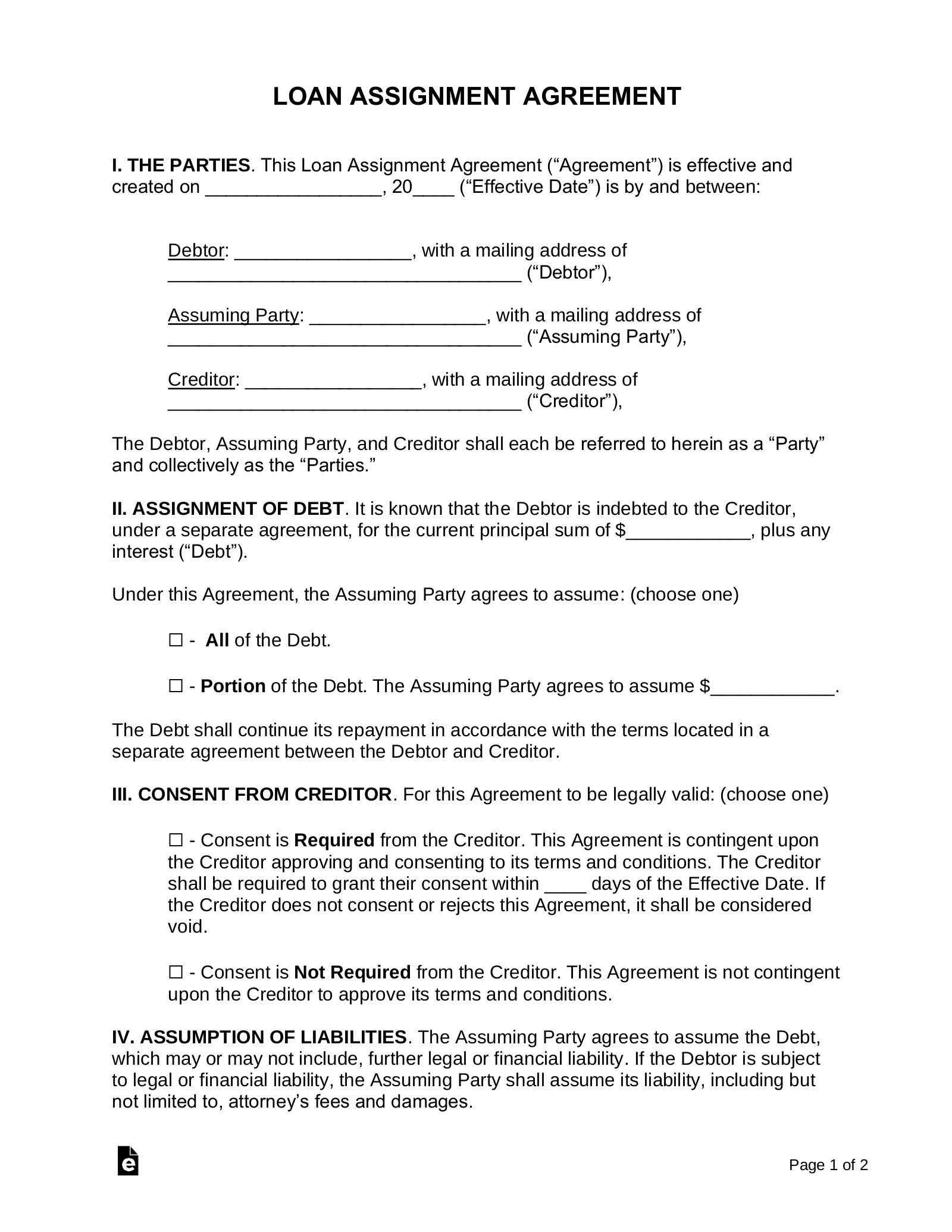

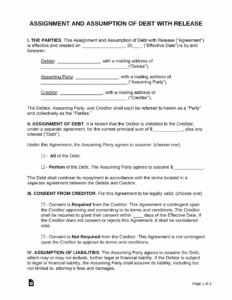

So, what does an assignment of loan agreement template typically include? At a minimum, you’ll find details of all the parties involved – the original lender (assignor), the new lender (assignee), and the borrower. There’s a clear identification of the original loan agreement, usually referencing the date it was signed, the original loan amount, and the borrower’s name. The document spells out that the assignor is transferring all its rights, title, and interest in the loan agreement to the assignee. It also often includes representations and warranties, where the assignor confirms that the loan agreement is valid and enforceable and that there are no outstanding disputes related to it. Finally, there’s usually a section dealing with notices, specifying how the borrower should be notified of the assignment and to whom future payments should be made.

From a borrower’s perspective, it’s essential to carefully review the loan agreement to understand the assignment provisions. Some agreements require the lender to notify the borrower of the assignment, while others don’t. Knowing your rights and obligations under the original loan agreement will help you navigate the assignment process smoothly and avoid any potential misunderstandings. Make sure you receive official written notice of the assignment, clearly identifying the assignee and providing contact information for all future loan-related inquiries. If you are unsure about anything, consulting with a legal professional is always a wise move.

Navigating the Assignment Process and Using a Template

The assignment process, while generally straightforward, involves a few key steps. First, the original lender (assignor) and the new lender (assignee) need to agree on the terms of the assignment. This involves negotiating the price of the loan portfolio being assigned and agreeing on any specific conditions related to the transfer. They then execute an assignment agreement, which is the legal document that formally transfers the rights and obligations. This is where an assignment of loan agreement template comes into play, providing a standardized framework for documenting the agreement.

The template typically includes clauses addressing the scope of the assignment, confirming that all rights, title, and interest in the loan are being transferred. It will also outline any representations and warranties being made by the assignor, such as confirming the validity and enforceability of the loan agreement and verifying that there are no existing defaults. Furthermore, the template will include a section detailing the consideration being paid for the assignment, essentially the price the assignee is paying to acquire the loan. It also usually includes provisions for governing law, specifying which jurisdiction’s laws will govern the interpretation and enforcement of the assignment agreement.

Once the assignment agreement is executed, the borrower needs to be notified. While the original loan agreement might not always require formal notification, it’s generally considered good practice to inform the borrower of the change in lender. This notification should include the identity of the new lender (assignee), their contact information, and instructions on where to make future loan payments. Failure to properly notify the borrower could lead to confusion and potential payment errors.

Before using an assignment of loan agreement template, it’s crucial to customize it to fit the specific circumstances of the transaction. A template provides a starting point, but it’s not a one-size-fits-all solution. You might need to add or modify clauses to address unique aspects of the loan agreement or the relationship between the assignor and assignee. For example, if the loan agreement includes specific covenants or restrictions, these should be explicitly addressed in the assignment agreement. It is always advisable to have legal counsel review the customized template before it is signed by the assignor and assignee.

In conclusion, the assignment of a loan agreement is a common practice in the lending industry. While it might seem complicated, understanding the basic principles and using an assignment of loan agreement template can help streamline the process. Remember to carefully review the original loan agreement, ensure proper notification to the borrower, and customize the template to fit the specific details of the transaction. Being informed and proactive will ensure a smooth and successful assignment for all parties involved.

The world of finance is complex, and understanding the ins and outs of loan agreements and their assignment can be daunting. However, with a little knowledge and the right tools, such as an assignment of loan agreement template, you can navigate this process with confidence.

Ultimately, being aware of your rights and responsibilities, whether you’re a lender or a borrower, is crucial in any financial transaction. The assignment of a loan agreement is no exception.