Ever found yourself in a situation where you need to redirect money coming your way to someone else? Maybe you’re expecting a large sum from a settlement, a sale, or even an inheritance, but you want to ensure those funds go directly to a creditor, a family member, or a business partner. That’s where an assignment of proceeds agreement comes in handy. It’s a legally binding document that allows you to transfer your right to receive those future proceeds to another party.

Think of it as a formal “IOU” with extra security. Instead of just promising to pay someone back later, you’re essentially saying, “Hey, when this money comes in, it goes straight to them.” This can be a really useful tool for securing loans, settling debts, or even just simplifying financial transactions. It provides clarity and assurance to everyone involved, ensuring that the intended recipient receives the funds directly.

The process can seem a bit daunting at first, navigating the legal jargon and understanding the implications. But don’t worry, it doesn’t have to be complicated. An assignment of proceeds agreement template can make the process much smoother. In this article, we will explore the ins and outs of using an assignment of proceeds agreement template, what to look for, and how to ensure it’s properly executed.

Understanding the Assignment of Proceeds Agreement

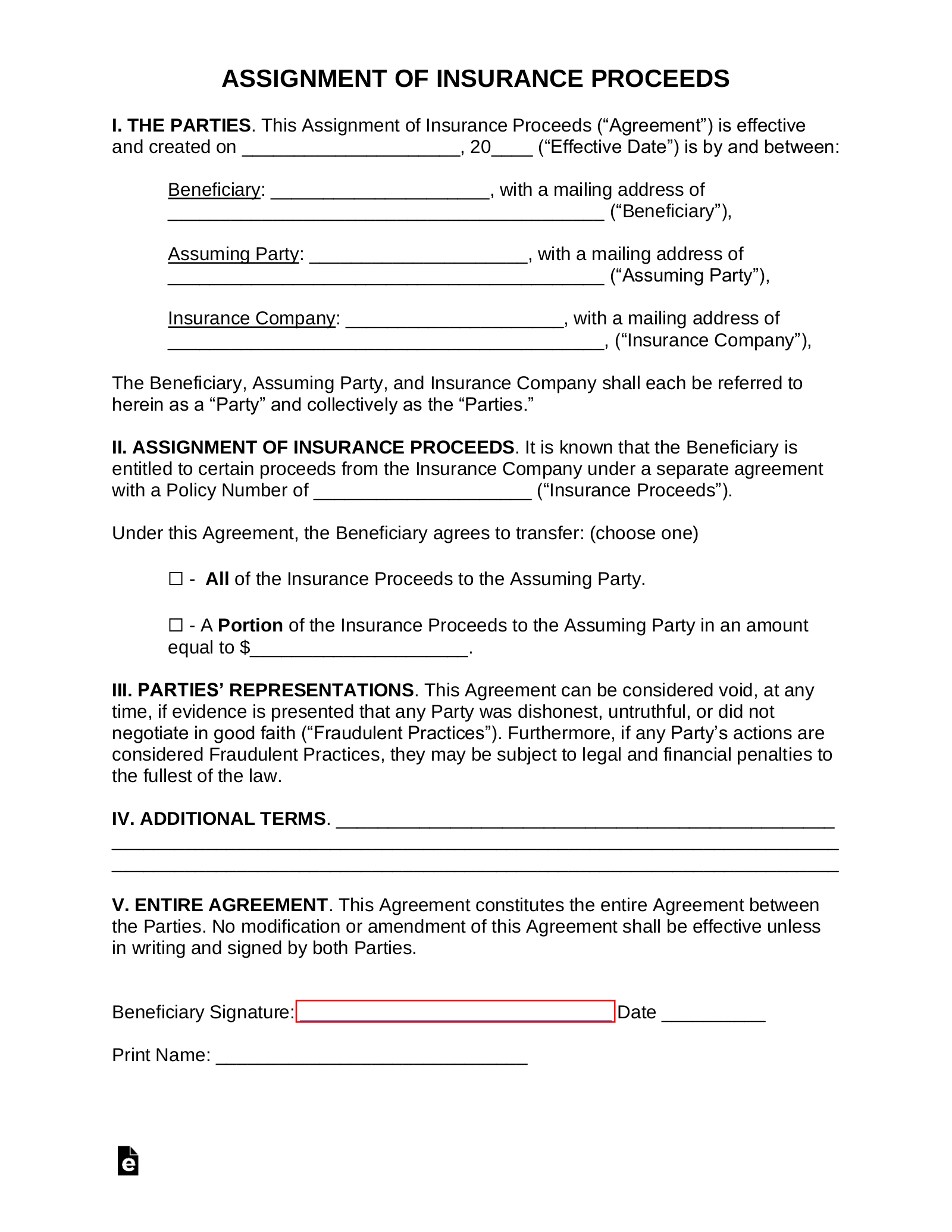

An assignment of proceeds agreement is a legal document that transfers the right to receive future payments or benefits from one party (the assignor) to another party (the assignee). This is a crucial distinction from a simple transfer of money. Instead of giving someone money you already have, you’re assigning them the right to receive money that you will receive in the future. This future payment could be anything from the proceeds of a sale, insurance payouts, settlement funds, or even rental income.

Why would someone use this type of agreement? There are several reasons. One common scenario is securing a loan. A borrower might assign the proceeds of a future sale to a lender as collateral. This provides the lender with a stronger guarantee of repayment. Another scenario is settling a debt. Instead of making regular payments, a debtor might assign the proceeds of a future inheritance to their creditor. This allows them to settle the debt in a lump sum.

The agreement itself needs to be carefully drafted to clearly outline the terms of the assignment. It should specify the exact source of the proceeds, the amount being assigned, and the conditions under which the assignment is valid. Ambiguity can lead to disputes later on, so clarity is key. Furthermore, it is important to consider the rights and obligations of all parties involved. The assignor needs to understand that they are relinquishing their right to receive the proceeds, and the assignee needs to understand their rights to collect those proceeds.

Beyond the basics, the agreement should also address potential contingencies. What happens if the proceeds are less than expected? What happens if the proceeds never materialize? The agreement should outline these scenarios and provide a clear course of action. This can prevent misunderstandings and protect the interests of all parties involved. For example, an assignment of proceeds agreement template might include clauses addressing the possibility of bankruptcy or other unforeseen circumstances.

Ultimately, an assignment of proceeds agreement provides a legally sound way to transfer future financial benefits. It can be a valuable tool for securing loans, settling debts, and simplifying financial transactions. However, it is essential to understand the implications of the agreement and to ensure that it is properly drafted to protect the interests of all parties involved. Before signing anything, it’s always wise to seek legal advice to make sure you fully understand your rights and obligations.

Key Considerations When Using an Assignment of Proceeds Agreement Template

Using an assignment of proceeds agreement template can simplify the process, but it’s crucial to remember that templates are not one-size-fits-all solutions. Each situation is unique, and the template should be carefully reviewed and adapted to fit the specific circumstances. Simply downloading a template and filling in the blanks without a thorough understanding of the clauses and legal implications can lead to problems down the road.

One of the most important considerations is clearly defining the source of the proceeds. The agreement should specify exactly where the money is coming from. Is it from a specific insurance policy? A particular sale of property? A specific legal settlement? The more detail you provide, the less room there is for ambiguity. For example, instead of simply stating “proceeds from a lawsuit,” specify the name of the lawsuit, the court where it’s being heard, and any relevant case numbers. This leaves no room for doubt about the source of the funds.

Another crucial element is specifying the amount being assigned. Is it the entire amount of the proceeds, or only a portion? If it’s a portion, the agreement should clearly state the exact amount or percentage being assigned. It should also address how any excess funds will be handled. For instance, if the assignee is owed $10,000 and the proceeds amount to $12,000, the agreement should specify who is entitled to the remaining $2,000.

Beyond the specifics of the proceeds, it’s also important to consider the legal jurisdiction. Laws regarding assignments vary from state to state, so you need to ensure that the agreement complies with the laws of the relevant jurisdiction. This may require consulting with an attorney to review the template and make any necessary adjustments. An assignment of proceeds agreement template may have been created for use in a different state, so it is essential to verify its suitability for your particular location.

Finally, remember that an assignment of proceeds agreement should be a clear and concise document that is easily understood by all parties involved. Avoid using overly complex legal jargon or ambiguous language. The goal is to create a document that accurately reflects the intentions of the parties and minimizes the potential for disputes. When using an assignment of proceeds agreement template, think of it as a starting point, not the finished product. Take the time to review, adapt, and customize the template to ensure that it accurately reflects the specific circumstances of your situation. The assignment of proceeds agreement template can be a useful tool, but its effectiveness depends on careful consideration and attention to detail.

By carefully considering these factors and seeking legal advice when needed, you can ensure that the assignment of proceeds agreement is properly executed and protects the interests of all parties involved.

Using an assignment of proceeds agreement template can be straightforward if you take your time and pay attention to all the details. Doing it right protects everyone involved.

Remember that this isn’t legal advice. Consulting with a qualified attorney is always recommended to ensure your specific situation is handled appropriately and to create a legally sound agreement.