Ever feel like you’re carrying the weight of the world on your shoulders, especially when it comes to debt? Sometimes, circumstances change, and someone else might be willing to take on that financial responsibility. That’s where an assumption of debt agreement comes in handy. It’s a legally binding document that transfers the obligation of a debt from one party to another. Think of it like passing the baton in a relay race, but instead of a baton, it’s a debt!

But navigating the world of legal documents can be daunting. Understanding the ins and outs of an assumption of debt agreement, and knowing where to find a reliable template, can save you a lot of headaches and potential legal troubles down the line. It’s not something you want to just wing it on, trust me! Getting it right is crucial for both the person transferring the debt and the person taking it on.

In this article, we’ll break down what an assumption of debt agreement is all about, why you might need one, and how to find the right template to fit your specific situation. We’ll also touch on some key considerations to keep in mind before signing on the dotted line. So, let’s dive in and demystify the world of debt assumption!

Understanding Assumption of Debt Agreements: A Comprehensive Guide

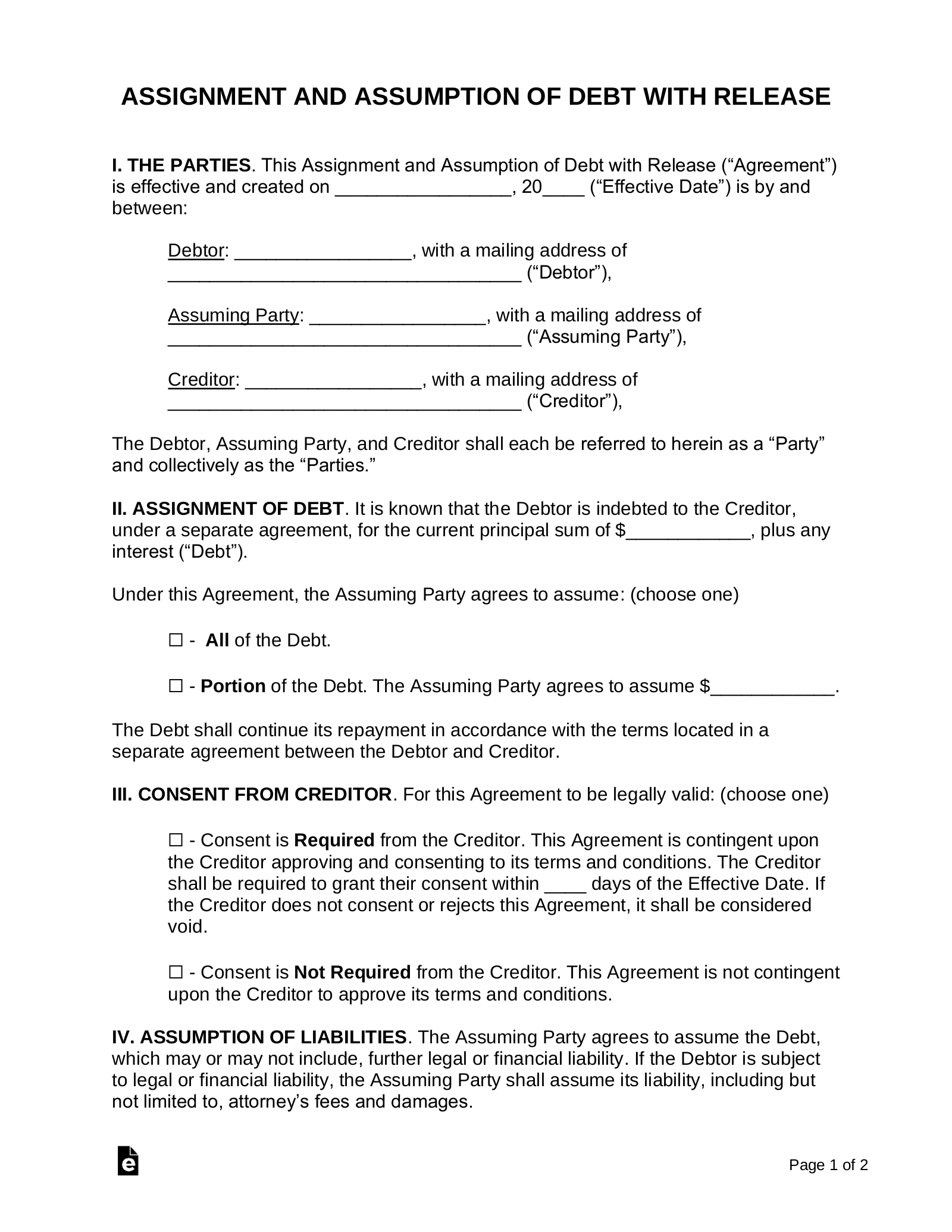

An assumption of debt agreement, at its core, is a contract. It’s an agreement between three parties: the original debtor (the person initially responsible for the debt), the new debtor (the person assuming the debt), and the creditor (the lender or entity to whom the debt is owed). This agreement essentially transfers the legal responsibility for repaying the debt from the original debtor to the new debtor. It’s more than just a casual agreement; it’s a formal, legally recognized transfer of financial obligation.

Why would someone want to assume another person’s debt? There are several reasons. Perhaps the original debtor is selling a business, and the debt is tied to the business’s assets. Or maybe it’s part of a divorce settlement, where one spouse agrees to take on certain debts. Sometimes, a family member might assume a debt to help out a loved one. Whatever the reason, it’s crucial to have a well-drafted assumption of debt agreement to protect all parties involved. A clear and concise agreement spells out everyone’s rights and responsibilities, minimizing the risk of misunderstandings or disputes later on.

The agreement typically outlines the specific debt being assumed, the terms of repayment (interest rate, payment schedule, etc.), and any warranties or representations made by either party. It’s also important to address what happens if the new debtor defaults on the debt. Will the original debtor still be liable? What remedies does the creditor have? These are all important questions to answer in the agreement. Furthermore, a proper assumption of debt agreement usually requires the creditor’s consent. This ensures that the creditor is aware of and agrees to the change in debtor.

Using an assumption of debt agreement template is a great starting point. It provides a framework for the agreement and ensures that you cover all the essential elements. However, it’s crucial to customize the template to fit your specific circumstances. Don’t just blindly fill in the blanks! Read each section carefully and make sure it accurately reflects the terms of your agreement. And when in doubt, seek legal advice. A qualified attorney can review the agreement and ensure that it protects your interests.

There are many places where you can find an assumption of debt agreement template. Law firms often offer them on their websites, or you can search online legal document providers. Just be sure to choose a reputable source and carefully review the template before using it. Remember, this is a legally binding document, so accuracy and clarity are paramount. Protect yourself by understanding every aspect of the agreement before signing it.

Key Considerations Before Using an Assumption of Debt Agreement Template

Before diving headfirst into using an assumption of debt agreement template, it’s vital to pause and consider some crucial factors. This isn’t a decision to take lightly, as it involves significant financial and legal ramifications for all parties involved. First and foremost, ensure that all parties are fully aware of the implications of the agreement. The original debtor needs to understand they are transferring their debt obligation, and the new debtor needs to comprehend the full extent of the financial burden they are taking on. Transparency and open communication are key to a smooth and successful debt assumption.

Another critical consideration is the creditor’s consent. As mentioned earlier, most debt agreements require the creditor’s approval before the debt can be transferred. The creditor needs to be confident that the new debtor is capable of repaying the debt. They may require financial statements, credit reports, or other documentation to assess the new debtor’s creditworthiness. Without the creditor’s consent, the assumption of debt agreement may not be valid or enforceable.

Furthermore, carefully review the original debt agreement. Understand the terms of repayment, interest rates, and any potential penalties for late payments or default. Make sure the assumption of debt agreement accurately reflects these terms. It’s also wise to consider the overall financial health of both the original debtor and the new debtor. The original debtor should ensure they are no longer legally liable for the debt after the assumption is complete, and the new debtor should assess their ability to comfortably manage the debt repayment.

Don’t underestimate the importance of legal counsel. While an assumption of debt agreement template can be a useful tool, it’s not a substitute for professional legal advice. An attorney can review the agreement, identify any potential risks or loopholes, and ensure that your interests are protected. They can also advise you on the legal requirements in your specific jurisdiction. Investing in legal advice upfront can save you a lot of headaches and potential legal battles down the road.

Finally, remember that an assumption of debt agreement is a legally binding contract. Once it’s signed, it’s very difficult to undo. So, take your time, do your due diligence, and make sure you fully understand the terms before committing. The future of your financial well-being could depend on it. Take the time to shop around for an assumption of debt agreement template that suits you.

Navigating debt can be stressful, but understanding the options available, such as an assumption of debt agreement, empowers you to make informed decisions. Whether you’re looking to transfer a debt or assume one, knowing the process and having the right resources can make all the difference.

Ultimately, remember that seeking professional advice from a legal expert is always recommended when dealing with complex financial matters like debt assumption. An attorney can provide tailored guidance and ensure your rights are protected throughout the process.