Navigating the aftermath of an auto accident can feel overwhelming, especially when dealing with insurance companies and trying to reach a fair settlement. It’s a stressful time, and you’re likely juggling medical appointments, vehicle repairs, and potential lost wages. One crucial step in resolving your claim is creating or obtaining an auto accident settlement agreement template. This document formalizes the terms you and the other party (or their insurance company) agree upon, ensuring everyone is on the same page and preventing future disputes. Having a well-drafted agreement is your shield, your peace of mind, and your guarantee that the agreed-upon compensation will be delivered.

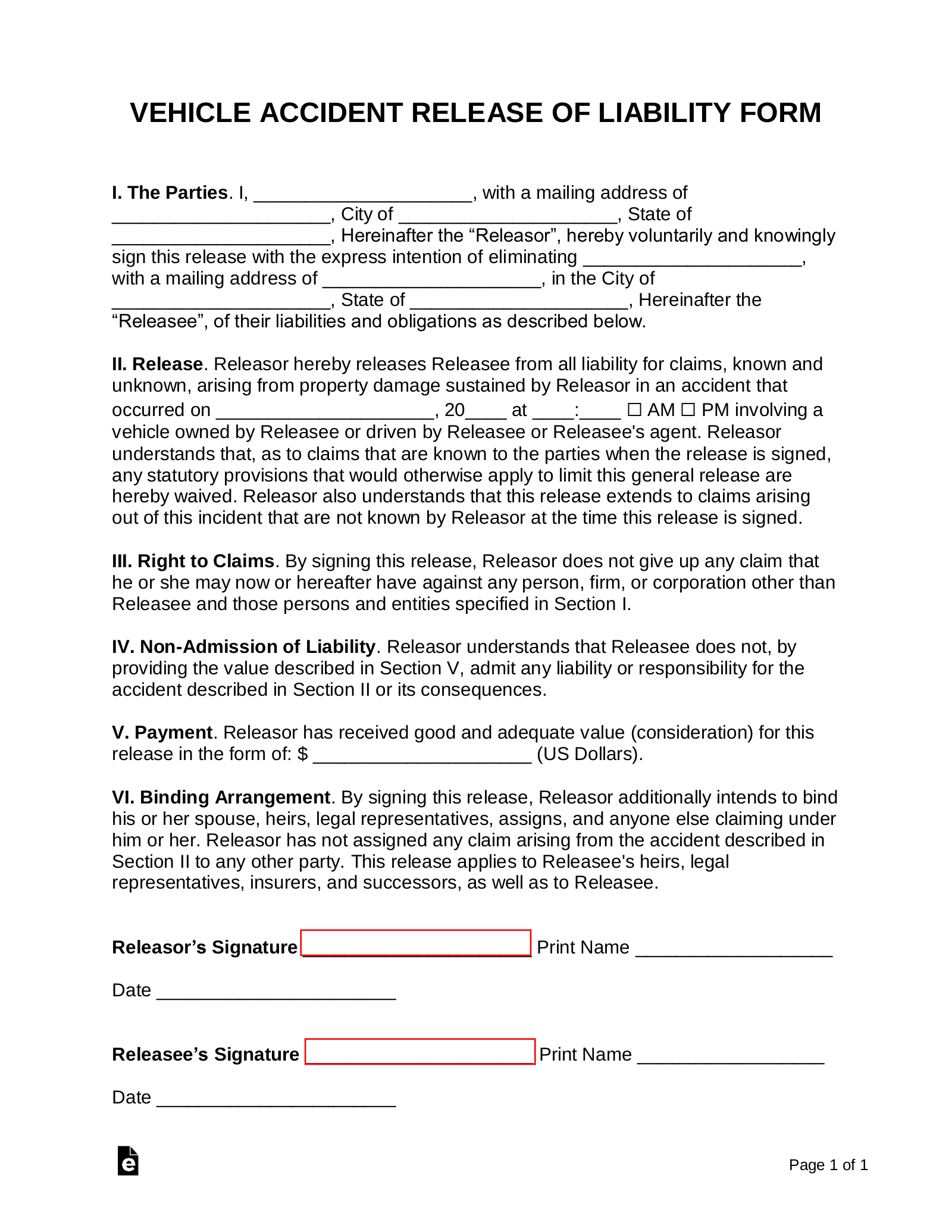

Think of an auto accident settlement agreement template as a contract. It outlines the specifics of the accident, the injuries sustained, the damages incurred, and most importantly, the amount of money you’ll receive in exchange for releasing the other party from further liability. A clear and comprehensive agreement protects both parties, solidifying the understanding and preventing the potential for costly legal battles down the road. This document needs to be clear, concise, and legally sound.

While templates can be a good starting point, it’s vital to understand what information needs to be included and how to tailor the document to your specific situation. Every accident is unique, and a generic form may not adequately address all the nuances of your case. Therefore, understanding the essential components and potential pitfalls of settlement agreements is crucial for ensuring a fair and equitable resolution. If you feel out of your depth, consulting with an attorney is always a wise decision to ensure your rights are fully protected and the agreement accurately reflects your damages and losses.

Understanding the Essential Components of an Auto Accident Settlement Agreement Template

An auto accident settlement agreement template isn’t just a formality; it’s a legally binding contract that outlines the terms of your agreement with the at-fault party or their insurance company. A comprehensive and well-drafted agreement will protect your interests and ensure that you receive the compensation you deserve. Several key components must be included to make the agreement valid and enforceable. Let’s delve into what makes up an effective settlement document.

First and foremost, the agreement should clearly identify all parties involved. This includes your name, the name of the at-fault driver, and the name of the insurance company (if applicable). Be sure to include accurate contact information for each party. The document should also describe the accident itself, including the date, time, and location of the incident. A brief narrative of how the accident occurred can also be helpful, although avoid placing blame or admitting fault beyond what has already been established.

Next, the agreement needs to detail the injuries and damages you sustained as a result of the accident. This includes medical expenses (both past and future), lost wages, property damage, and pain and suffering. Be as specific as possible when listing your damages. For example, instead of simply stating “medical expenses,” list the specific healthcare providers you saw, the dates of treatment, and the amounts you paid. Include supporting documentation, such as medical bills, pay stubs, and repair estimates, as attachments to the agreement. Clearly articulating the financial impact of the accident is crucial for justifying the settlement amount.

The core of the agreement is the settlement amount itself. This is the total sum of money the at-fault party or their insurance company will pay you in exchange for releasing them from further liability. The agreement should explicitly state the settlement amount and the method of payment (e.g., check, electronic transfer). It should also specify the date by which the payment will be made. Once you sign the agreement, you are bound by its terms, so ensure the settlement amount adequately covers all your damages and losses.

Finally, a crucial clause is the release of liability. This provision states that by accepting the settlement amount, you are releasing the other party from any further claims or lawsuits related to the accident. Read this clause carefully to ensure you understand the full extent of the release. Consider whether there are any potential future medical expenses or other unforeseen damages that might arise after signing the agreement. It’s generally advisable to consult with an attorney to ensure that the release language is fair and does not unduly limit your rights. If you are not happy with the offer you can always negotiate a better settlement.

Key Considerations Before Signing an Auto Accident Settlement Agreement

Before you put pen to paper and sign an auto accident settlement agreement, it’s crucial to pause and carefully consider several key factors. Signing the agreement means you’re essentially closing the door on any further claims related to the accident, so it’s vital to ensure that the settlement adequately compensates you for all your damages and losses. Rushing into an agreement without proper consideration can lead to regret and financial hardship down the road. Here are some important aspects to evaluate before making a final decision.

One of the most important considerations is the full extent of your injuries. Are you fully recovered, or are you still undergoing treatment? It’s essential to have a clear understanding of your long-term prognosis before signing a settlement agreement. Some injuries may not manifest fully until months or even years after the accident. If you’re unsure about your future medical needs, consult with your doctor or other healthcare professionals. Delay signing an agreement until you have a clear picture of your potential future medical expenses. Settling too early might leave you responsible for covering unexpected healthcare costs that arise later. The insurance company will likely push you to settle quickly, but don’t allow them to pressure you into a premature decision.

Another crucial aspect to consider is the amount of lost wages you’ve incurred and may incur in the future. If your injuries have prevented you from working, be sure to include lost income in your settlement demand. Gather documentation such as pay stubs, tax returns, and letters from your employer to support your claim. If your injuries will prevent you from returning to work in the same capacity, consider the potential for lost earning capacity in the future. An attorney can help you assess the long-term financial impact of your injuries and ensure that the settlement adequately compensates you for your lost income and earning potential.

Think about other damages that are relevant. Beyond medical bills and lost wages, consider other damages such as property damage to your vehicle, rental car expenses, and any other out-of-pocket costs you’ve incurred as a result of the accident. Document all your expenses and keep receipts to support your claim. In some cases, you may also be entitled to compensation for pain and suffering, emotional distress, and loss of enjoyment of life. These non-economic damages can be more difficult to quantify, but they are a legitimate part of your claim.

Finally, it’s always advisable to consult with an attorney before signing an auto accident settlement agreement template. An attorney can review the agreement to ensure it’s fair and protects your rights. They can also negotiate with the insurance company on your behalf to maximize your settlement amount. While hiring an attorney may involve upfront costs, the potential benefits of securing a fair settlement far outweigh the expense. An experienced attorney can help you navigate the complexities of the legal process and ensure that you receive the compensation you deserve.

Reaching a settlement can bring much-needed closure and financial relief after an auto accident. However, never rush the process or feel pressured to sign anything you don’t fully understand.

Careful consideration of all aspects of your claim, including your injuries, lost wages, and other damages, is essential for ensuring a fair and equitable resolution. Consulting with an attorney is a wise investment that can protect your rights and help you obtain the compensation you deserve.