Ever found yourself tangled in the complexities of business ownership, especially when thinking about the future? What happens if a partner wants to leave, retires, or worse? That’s where a buy and sell agreement comes into play. Think of it as a prenuptial agreement for your business, outlining exactly what will happen to ownership interests under various circumstances. It provides a clear roadmap for transferring shares, protecting the business’s continuity and ensuring fair compensation for departing owners. It might seem daunting, but having this agreement in place can save you a lot of headaches and heartache down the road.

Imagine a scenario: two friends start a successful bakery. They’re both passionate and skilled, but they haven’t addressed what happens if one wants to pursue other interests. Without a buy and sell agreement, the remaining owner could face a legal battle to buy out the departing owner’s shares, potentially disrupting the business’s operations. A buy and sell agreement addresses these types of scenarios, offering a structured and agreed-upon process for handling ownership changes. This proactive approach ensures everyone is on the same page and minimizes potential conflict.

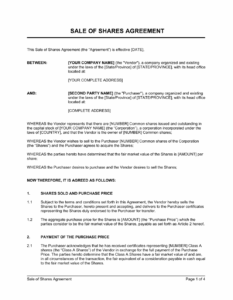

So, where do you start? Many business owners turn to a buy and sell agreement template to get the ball rolling. These templates offer a starting point, covering key considerations and clauses that are typically included in such agreements. However, it’s essential to remember that every business is unique. A template should be customized to reflect the specific circumstances of your company, your owners, and your long-term goals. Think of it as a customizable blueprint, not a one-size-fits-all solution. Consulting with legal and financial professionals is crucial to ensure that the agreement adequately protects your interests and complies with all applicable laws.

Why You Absolutely Need a Buy and Sell Agreement

The benefits of a buy and sell agreement extend far beyond simply having a document in place. It’s about securing the future of your business and providing peace of mind for all involved. Without a clear agreement, unforeseen events can trigger disputes, financial instability, and even the dissolution of the company. A well-crafted buy and sell agreement addresses these potential pitfalls head-on, offering a framework for navigating challenging situations with clarity and fairness.

Consider the impact on your employees. When ownership transitions are uncertain, employees may become anxious about their job security. This can lead to decreased morale and productivity. A buy and sell agreement provides stability and reassurance, demonstrating that the business has a plan in place to ensure its continued operation, regardless of changes in ownership. This fosters a sense of security among employees, allowing them to focus on their work and contribute to the company’s success.

Furthermore, a buy and sell agreement can facilitate smoother succession planning. If you envision passing the business on to family members or key employees, the agreement can outline the terms of the transfer, ensuring a seamless transition of ownership and leadership. This allows you to groom successors, gradually transferring responsibilities and expertise, while maintaining control over the business’s direction. Without a plan, you are leaving the future of your company to chance.

Beyond the practical benefits, a buy and sell agreement can also foster stronger relationships among business partners. By openly discussing and agreeing upon the terms of ownership transfer, partners can build trust and transparency. This proactive approach reduces the likelihood of misunderstandings and disputes, strengthening the foundation of the partnership. Knowing that a fair and equitable process is in place can lead to more open communication and collaboration among business owners.

Finally, securing funding or attracting investors often becomes easier with a buy and sell agreement. Lenders and investors want to see that the business has a plan for dealing with potential ownership changes. This demonstrates responsible governance and reduces the risk associated with investing in the company. A buy and sell agreement can be a valuable asset when seeking capital to fuel growth and expansion.

Key Considerations When Choosing a Buy and Sell Agreement Template

So, you’ve decided a buy and sell agreement is essential, and you’re considering using a template. Excellent choice! But before you download the first template you find, it’s important to understand the key considerations that will ensure it meets your specific needs. Remember, a generic template may not adequately address the unique circumstances of your business, so careful customization is crucial. You should consider the structure of your business and get advice from legal and financial experts.

First, consider the triggering events that will activate the buy and sell agreement. These events typically include death, disability, retirement, or the desire of an owner to sell their shares. Be as specific as possible when defining these events to avoid ambiguity and potential disputes. For example, clearly define what constitutes “disability” to ensure that the agreement is triggered appropriately. It’s important that all owners agree on these triggering events and that they are clearly documented in the agreement.

Next, determine the valuation method that will be used to determine the fair market value of the ownership interests. Common valuation methods include book value, agreed-upon value, appraisal, or a formula-based approach. Each method has its own advantages and disadvantages, so it’s important to choose one that is appropriate for your business and that is likely to result in a fair valuation. Consider the costs associated with each method, as well as the potential for disputes over the valuation.

Another critical aspect to consider is the funding mechanism that will be used to finance the buyout. Common funding options include life insurance, installment payments, or a combination of both. Life insurance can provide immediate liquidity to fund the buyout in the event of an owner’s death, while installment payments allow the remaining owners to spread the cost of the buyout over time. Carefully consider the financial implications of each funding mechanism and choose one that is sustainable for the business.

Finally, be sure to address any restrictions on the transfer of ownership interests. The buy and sell agreement may include provisions that restrict owners from selling their shares to outside parties without the consent of the other owners. This can help to maintain control over the business and prevent unwanted ownership changes. Additionally, the agreement may include a right of first refusal, which gives the remaining owners the option to purchase the shares before they are offered to outside parties. All owners must agree to restrictions.

Remember, finding a suitable buy and sell agreement template is just the first step. Customizing it to fit your specific business needs and consulting with legal and financial professionals are essential to ensure that the agreement is comprehensive, legally sound, and effectively protects your interests. While a buy and sell agreement template offers a great starting point for protecting your business, be sure to seek legal advice to customize the buy and sell agreement template to your specific needs.

Navigating the world of business ownership can sometimes feel like charting unknown waters, but having the right tools can make all the difference. Planning ahead is key to a sustainable and thriving business, and a little effort now can pay off handsomely in the future by protecting your investment, your partners, and your employees.

Taking proactive steps to protect your business is crucial for ensuring its longevity and stability. Remember, it’s not just about the legalities; it’s about fostering trust and transparency among all stakeholders. By investing in proper planning, you’re not just safeguarding your business; you’re investing in its future success.