Navigating the California real estate market can feel like trying to solve a complex puzzle, especially when you’re dealing with the mountain of paperwork involved. One of the most crucial documents in this process is the California real estate purchase agreement. It’s essentially the blueprint for the entire transaction, outlining the terms and conditions that both the buyer and seller agree to. Without a solid understanding of this agreement, you might find yourself lost in the fine print, potentially leading to misunderstandings or even costly mistakes.

Think of the purchase agreement as the heart of your real estate deal. It’s where everything comes together – the price, the timeline, the responsibilities of each party, and what happens if things go south. Having access to a reliable California real estate purchase agreement template can be a lifesaver, providing a clear and structured framework to guide you through the negotiation and closing process. It ensures that all the essential details are covered, protecting your interests and ensuring a smoother transaction.

This article aims to demystify the California real estate purchase agreement. We’ll explore what it is, why it’s so important, and how to use a template effectively. Whether you’re a first-time homebuyer, a seasoned investor, or a seller looking to understand your obligations, this guide will provide you with valuable insights and resources to help you navigate the world of California real estate with confidence. You’ll discover how a well-crafted agreement can protect your investment and help you achieve your real estate goals.

Understanding the California Real Estate Purchase Agreement

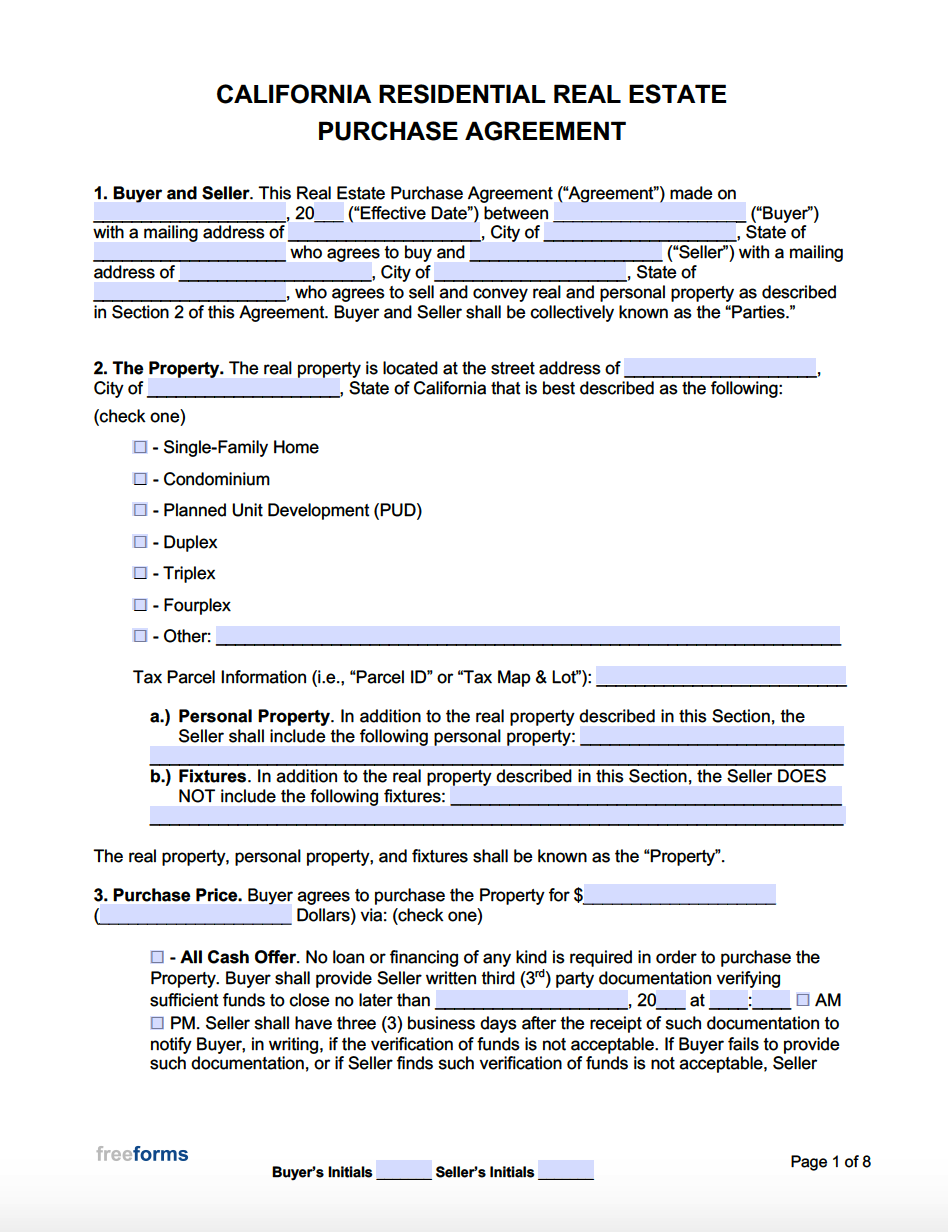

The California real estate purchase agreement is a legally binding contract between a buyer and a seller that outlines the terms and conditions for the sale of a property. It’s a comprehensive document that covers a wide range of details, from the basic information about the property and the parties involved to more complex clauses regarding financing, inspections, and contingencies. It’s crucial to understand that once signed by both parties, this agreement becomes a legally enforceable contract, so careful review and consideration are essential.

One of the most important sections of the agreement is the purchase price and financing terms. This section specifies the agreed-upon price for the property, the amount of any down payment, and how the buyer intends to finance the purchase. It might include details about a mortgage loan, including the loan amount, interest rate, and loan term. It’s also common to find clauses outlining the buyer’s obligation to obtain financing and any contingencies related to financing approval. If the buyer cannot secure financing within a specified timeframe, they may be able to terminate the agreement without penalty, depending on the terms of the financing contingency.

Another critical aspect of the California real estate purchase agreement is the section dealing with disclosures and inspections. California law requires sellers to disclose any known material defects or issues with the property, such as structural problems, environmental hazards, or pest infestations. The purchase agreement typically includes a list of required disclosures, and the buyer has the right to conduct inspections to further evaluate the property’s condition. These inspections can cover a wide range of areas, including the structural integrity of the building, the condition of the plumbing and electrical systems, and the presence of hazardous materials like asbestos or lead paint.

Contingencies play a significant role in protecting both the buyer and the seller. A contingency is a condition that must be met before the sale can proceed. Common contingencies include financing contingencies, inspection contingencies, and appraisal contingencies. For example, an inspection contingency allows the buyer to back out of the deal if they are not satisfied with the results of the inspections. An appraisal contingency protects the buyer if the property appraises for less than the purchase price. These contingencies provide a safety net, allowing either party to terminate the agreement under certain circumstances without breaching the contract.

Finally, the agreement also outlines the closing process, including the date of closing, the responsibilities of each party at closing, and the allocation of closing costs. Closing costs can include things like title insurance, escrow fees, recording fees, and transfer taxes. The purchase agreement will specify who is responsible for paying these costs, which can vary depending on local customs and negotiations between the buyer and seller. It is important to review this section carefully to understand your financial obligations at closing.

Utilizing a California Real Estate Purchase Agreement Template Effectively

Using a California real estate purchase agreement template can significantly simplify the process of drafting a purchase agreement. However, it’s crucial to remember that a template is just a starting point. You’ll need to carefully review and customize the template to fit the specific circumstances of your transaction. Simply filling in the blanks without understanding the legal implications can lead to problems down the road.

The first step in using a template effectively is to ensure that you’re using a reputable and up-to-date template. California real estate laws and regulations can change, so it’s essential to have a template that reflects the current legal landscape. Several organizations, such as the California Association of Realtors, provide standardized purchase agreement forms that are widely used in the industry. These forms are regularly updated to comply with the latest laws and regulations.

Once you have a reliable template, take the time to read through it carefully and understand each section. Pay particular attention to the clauses related to financing, disclosures, inspections, and contingencies. These are often the most complex and critical parts of the agreement. If you’re unsure about the meaning of any clause, don’t hesitate to seek clarification from a real estate attorney or a qualified real estate professional.

When customizing the template, be sure to accurately reflect all the agreed-upon terms and conditions. Don’t leave any blanks or rely on assumptions. For example, if you’ve negotiated a specific repair credit with the seller, make sure that’s clearly documented in the agreement. Similarly, if you’re including any special conditions or addenda, attach them to the agreement and reference them in the appropriate sections.

Finally, before signing the agreement, have it reviewed by a real estate attorney. An attorney can identify any potential issues or ambiguities in the agreement and provide you with legal advice to protect your interests. While it may seem like an added expense, the cost of legal review is typically minimal compared to the potential financial consequences of signing an agreement that isn’t in your best interest. A properly reviewed and customized California real estate purchase agreement template is an invaluable tool in ensuring a smooth and successful real estate transaction.

The intricacies of a real estate deal require careful attention to detail and a comprehensive understanding of the legal documents involved. A California real estate purchase agreement template serves as a framework, but its effective use hinges on proper customization and professional guidance.

Whether buying or selling, a well-executed agreement, potentially starting from a California real estate purchase agreement template, lays the groundwork for a successful transaction and protects all parties involved, so take your time and ask questions when necessary.