So, you’re thinking about leasing a car in the UK? Smart move! Leasing can be a fantastic way to get behind the wheel of a new vehicle without the long-term commitment and hefty depreciation costs associated with buying. But before you sign on the dotted line, you’ll need to understand the car lease agreement. It’s a legally binding document outlining the terms and conditions of your lease, and it’s crucial to get it right.

Think of a car lease agreement as a detailed roadmap for your leasing journey. It covers everything from the monthly payments and mileage allowance to the responsibilities for maintenance and what happens if you want to end the lease early. Don’t be intimidated by the legal jargon! We’re here to break it down and help you navigate the process with confidence. A good starting point is often a solid car lease agreement template uk that you can adapt to your specific needs.

In this article, we’ll explore what a car lease agreement template uk typically includes, highlighting the key clauses you should pay close attention to. We’ll also offer some helpful tips on how to use a template effectively and what to watch out for before finalizing your lease. So, buckle up and let’s get started!

Understanding the Key Components of a Car Lease Agreement

A car lease agreement might seem overwhelming at first glance, but it’s really just a collection of clauses designed to protect both the lessor (the leasing company) and the lessee (you, the person leasing the car). Each section plays a vital role in defining your responsibilities and rights throughout the lease period.

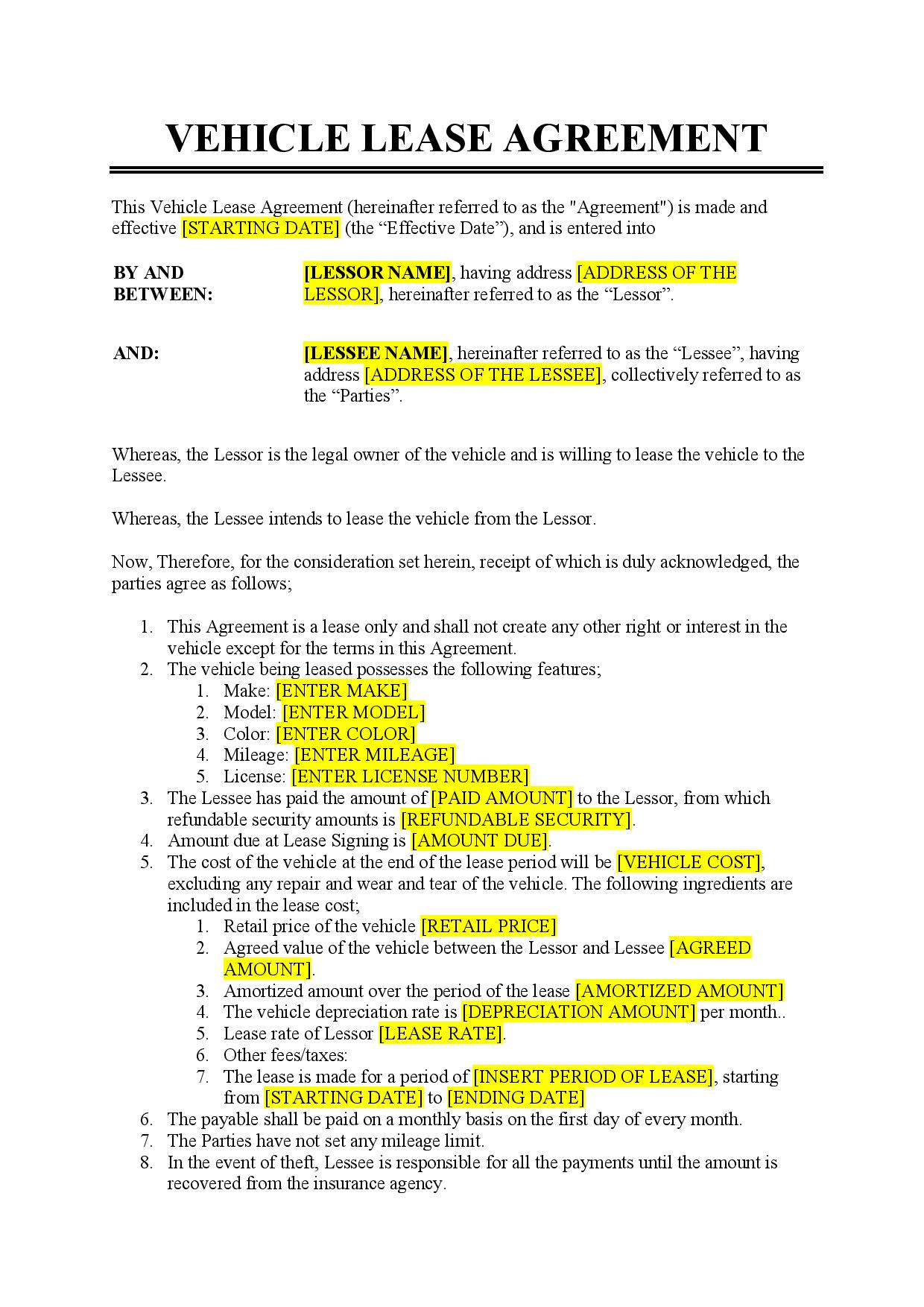

Let’s start with the basics. The agreement will clearly identify the parties involved – the leasing company and yourself. It will also provide a detailed description of the vehicle, including its make, model, VIN (Vehicle Identification Number), and registration number. This ensures there’s no confusion about the specific car you’re leasing.

Next up are the financial details. This section is crucial, as it outlines your monthly payments, the initial deposit (if any), and the total cost of the lease. Pay close attention to the interest rate (often called the “money factor”) and any associated fees, such as documentation fees or acquisition fees. Make sure you understand exactly what you’re paying for and whether there are any hidden costs.

Mileage allowance is another critical factor. The agreement will specify the number of miles you’re allowed to drive per year (or over the entire lease term). Exceeding this mileage limit will result in per-mile charges, which can add up quickly. Carefully estimate your annual mileage needs to avoid unexpected costs. It’s often better to overestimate slightly, as you can typically negotiate a higher mileage allowance upfront.

Finally, the agreement will cover your responsibilities for maintaining the vehicle. This usually includes regular servicing, oil changes, and tire rotations, as specified by the manufacturer. You’ll typically be responsible for any damage to the vehicle beyond normal wear and tear. The agreement will also outline the procedures for reporting accidents and making insurance claims. Understanding these maintenance requirements is vital to avoid potential penalties at the end of the lease.

Essential Clauses and Considerations in a Car Lease Agreement

Beyond the basic components, a car lease agreement contains several key clauses that warrant careful consideration. These clauses outline specific scenarios and consequences, so it’s important to understand them thoroughly before signing.

One crucial clause deals with early termination. Life happens, and sometimes you might need to end the lease before the agreed-upon term. However, early termination usually comes with significant penalties. These penalties can include paying the remaining lease payments, plus additional fees. Carefully review the early termination clause to understand the potential costs if you need to break the lease.

Another important clause addresses wear and tear. At the end of the lease, the vehicle will be inspected for excessive wear and tear. This includes damage beyond normal use, such as dents, scratches, stained upholstery, or damaged tires. You’ll be responsible for paying for any repairs needed to bring the vehicle back to acceptable condition. It’s a good idea to familiarize yourself with the leasing company’s definition of “normal wear and tear” to avoid surprises.

The insurance requirements are also clearly stated in the agreement. You’ll typically be required to maintain comprehensive and collision insurance coverage throughout the lease term. The agreement will specify the minimum coverage limits required by the leasing company. Ensure you have adequate insurance coverage to protect yourself and the vehicle.

Furthermore, pay attention to any clauses regarding modifications or alterations to the vehicle. Most lease agreements prohibit making any permanent modifications without the leasing company’s permission. This includes things like adding aftermarket accessories, changing the paint color, or installing a new sound system. Violating this clause could result in penalties.

Finally, take a close look at the purchase option clause. This clause outlines your option to purchase the vehicle at the end of the lease term. The purchase price will be specified in the agreement or determined based on the vehicle’s fair market value at the time. If you’re considering purchasing the car at the end of the lease, this clause is particularly relevant.

Navigating a car lease doesn’t have to be a daunting task. Armed with the right knowledge and a clear understanding of the car lease agreement template uk, you can confidently make informed decisions and enjoy the benefits of driving a new car without the long-term commitment of ownership.

Take your time, read the fine print, and don’t hesitate to ask questions. A well-informed decision is always the best decision.